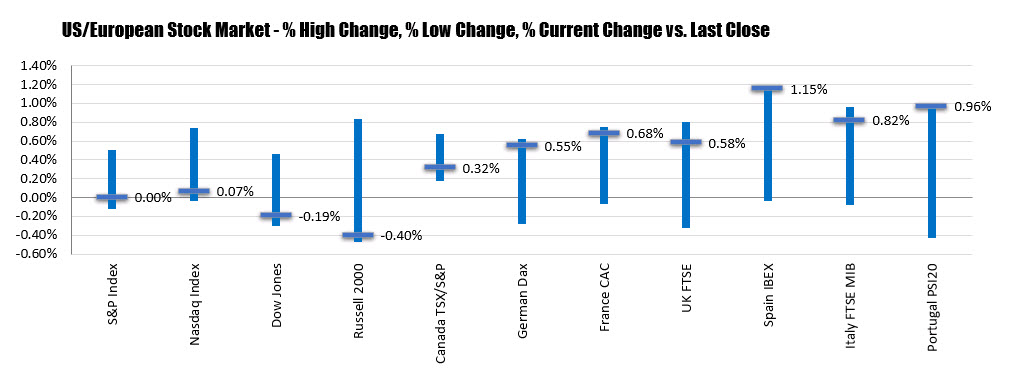

Early declines still holding the lows

- The S&P index fell -13.22 points or -0.45% at 2938.79. The high reached 2959.75. The low extended to 2935.68

- The NASDAQ index fell -26.181 points or -0.33% at 7956.29. The high reached 8013.316. The low extended to 7942.08

- The down industrial average fell -95.70 points or -0.36% at 26478. The high reached 26655.84. The low extended to 26424.54

The NASDAQ index closed below its 100 day moving average at 7967.39. The index close back above that MA on Friday. Failure to keep the momentum to the upside going is a disappointment for the bulls.