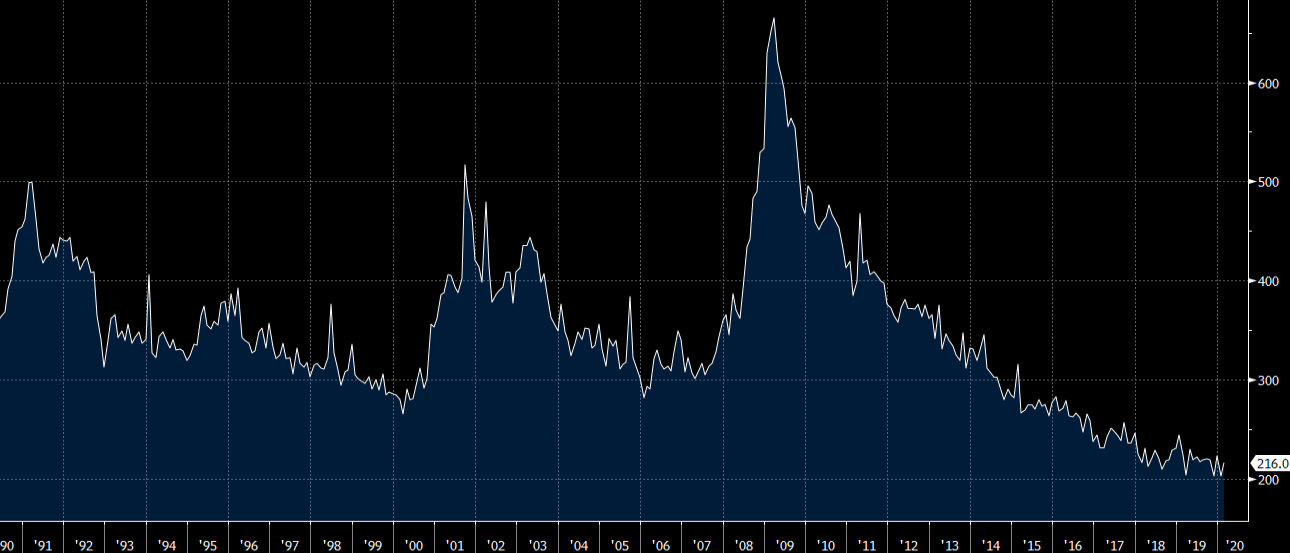

The dollar rallied strongly from March 9 through March 20 or the start of last week on March 23. It has subsequently sold off and done so in dramatic fashion. It is not clear the trigger of the stunning reversal. Some observers attribute it to the Fed’s currency swap lines, which were offered daily (seven-day operations) to a handful of large central banks.

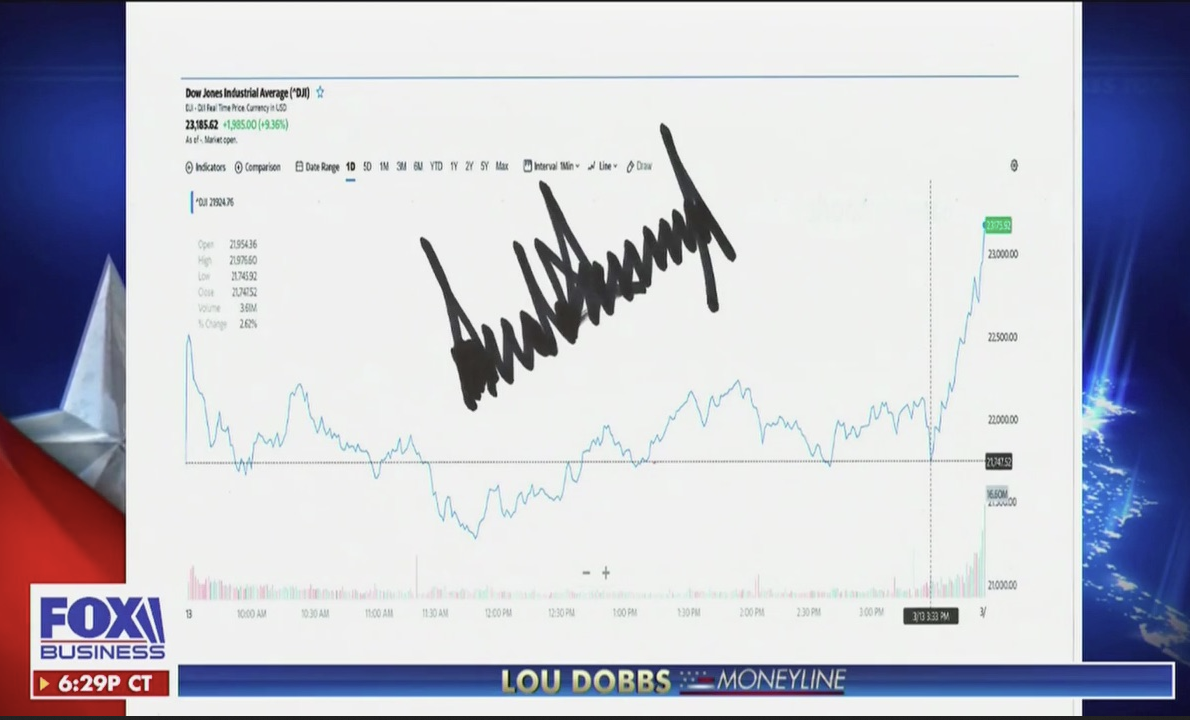

Others link it to the better risk appetites reflected in meaningful bounces in equity markets, but nothing as striking as the 17% rally in the Nikkei. Even with a 915-point tumble in the Dow and a 3.3% drop in the S&P 500 before the weekend, both ended with double-digit gains on the week. Gold’s 8.6% rally will not sit well with those who view it as a safe haven. The 30- and 60-day rolling correlations on the percent change of gold and the S&P 500 are positive for the first time since the middle of last year and October 2018, respectively.

The technical indicators that we monitor, the MACD and Slow Stochastic, have turned down for the dollar against all the major currencies. The poor technical condition suggests the dollar’s weakness is more than a function of month- and quarter- and fiscal year-end flows, but was technically over-extended. We will use Fibonacci retracement and moving averages to identify potential price targets and relative strength.

To read more enter password and Unlock more engaging content