AUD/USD falls to its lowest level since 24 June

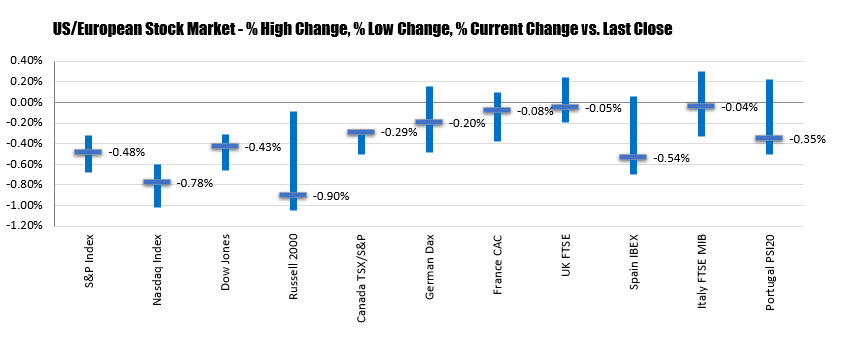

The final numbers are showing:

There are only three types of traders, they are defined by how well they execute their trading plan (rules applied to strategy).

A trader that performs worst than their trading plan. These traders often have a weak understanding and belief in their trading plan. How they feel is more or as important as making money. They fail to see past the current trade.

A trader that performs the same as their trading plan. These traders have a strong understanding and belief in their trading plan. They get a majority of their satisfaction from making money. They can see past the current trading day.

Those that perform better than their trading plan. These traders have spent time in the previous two groups so they not only understand and believe their trading plan, they have 100’s or thousands of experiences that “prove” it to them. The only satisfaction is following their plan and knowing that the money will follow. They can see past the current trading year. They find areas and times to be aggressive and times to hold back.

The purpose of trading is to at least perform as well as your trading plan. Any trader will tell you that he has spent time in all three and is always susceptible to be in any of the categories. Each category is filled with important lessons, the lesson is often that I do not want to end up back there.

Those that under perform their trading plan are usually not honest with themselves about their level of belief in said trading plan.

(1) Any strategy you build will be determined by your beliefs about the market and the objectives you’re trying to achieve. Therefore, your beliefs and objectives are the starting point of the system design and build process and it’s from these you will determine your Key Idea.

(2) Therefore, your Key Idea is your working hypothesis or your explanation of what the foundations of your system are and how it will work.

(3) One of the most famous Key Idea’s was declared by the Turtle Traders, specifically Richard Dennis. Being trend traders they acknowledged that every trend, without fail, was preceded by a breakout.

(4) From that start point they used a standard channel breakout to enter and they also had what they called a ‘fail safe’ breakout entry which absolutely guaranteed they’d capture every new trend.

(5) The Key Idea of Warren Buffett is that you should buy a great company at a cheap price. From this Key Idea he built specific rules and guidelines about how to actually go about doing that.

(6) The Beliefs of many of the worlds great traders can be found in various texts, such as the Market Wizards series by Jack Schwager. Examples: – Markets only trends 30% of the time – The big money is made in the big trends – Buying value is a safe strategy – Stops get hunted

(7) Your objectives are also very important in the design process. In many instances I often hear, “I want to make as much money as possible”. Well, we all do, but that’s a very one dimensional view of the world and of the process of designing a trading system.

(8) Indeed, there is much research to suggest extremely successful traders view profits as a by-product and not the main goal. Many successful traders are passionate about the markets and it’s that passion, not the want of profits, that enable them to succeed.

(9) Taking a more holistic view, objectives encompass many other dimensions, such as your personal risk tolerance and your lifestyle factors. If you’re a family man & has system that requires you to sit in front of a screen for 15-hours a day, it’s probably not a realistic goal.

(10) So your objectives must be broader than just profitability. They must be aligned with your Beliefs. They must be aligned with realistic expectations and they must be aligned with your lifestyle.

The federal minimum wage of $7.25 has not risen in a decade. The price of most essentials like housing, clothing, and food has. As a measure of how little the minimum wage covers when gauged against a yardstick of housing costs nationally, people whose incomes are at the minimum level would have to work 127 hours week, every week, to afford a two-bedroom apartment.

New research by the National Low Income Housing Coalition measured housing costs against the minimum wage in all 50 states, and several large cities. The current survey is the 30th annual installment of the analysis.

The report is unusually comprehensive and runs 285 pages. It shows that the pool of low-income housing in the U.S. is shrinking. Its authors note that to afford a two-income apartment based on the national average rent means people would need to work three full-time jobs at the minimum wage. The stark bottom line conclusion of the report is that “In no state, metropolitan area, or county in the U.S. can a worker earning the federal or prevailing state minimum wage afford a modest two-bedroom rental home at fair market rent by working a standard 40-hour work week.”

Renters with the lowest wages in America range from 20% of Black households to 16% of Hispanic households, to 6% of Whites. The difference in racial makeup, the researcher report is “because of historical and persisting wage disparities and barriers to homeownership.”

The ability for minimum wage workers to afford two-apartment rental costs varies sharply by state and city. The states where the ratios are most disadvantageous are Hawaii, where a family would need to make $36.82 an hour to afford an apartment that size and New York were the figure is $34.69 to, at the low end, Arkansas at $14.26 and West Virginia at $14.27. Even at the low end, the affordability of rent against a $7.25 wage is stark.

In several cities, the figures are much worse for low-income renters. In San Francisco, a family would need to make $60.96 an hour. In nearly San Jose, the number is $54.60. The two cities are at the very top of most lists in terms of housing expenses. Several of the zip codes in these cities are among the most expensive zip codes in the U.S.

The conclusion of the reports is depressing. “Low wages, wage inequality, racial inequities and a severe shortage of affordable rental homes leave too many vulnerable people unable to afford their housing” And, all of the data in the report show that the trend worsens year after years.