The U.S. slapped fresh tariffs on Chinese goods on Sunday to bring the average to more than 20%, comparable with levels seen during the protectionist era preceding World War II.

At 12:01 a.m. EDT, the U.S. imposed additional tariffs of 15% on about $110 billion in imports from China, covering 3,243 items. Consumer goods account for about half — far more than the 20%-plus of the previous round last September, which included such products as furniture. China’s corresponding tariffs against U.S. products took effect at the same time.

U.S. President Donald Trump postponed tariffs on 555 items on the original list — including smartphones — until Dec. 15 to soften the impact on the year-end shopping season. More than 80% of American imports of these goods come from China, and finding alternative sources is difficult. Higher tariffs are likely to lead to price increases, which risk weighing on consumer spending and thus the broader economy.

Digital consumer devices such as smartwatches are among the largest import categories by value affected by Sunday’s tariffs. More than half of all apparel is taxed as well.

China is retaliating with additional duties of 5% to 10% on $75 billion in imports from the U.S. The first tranche covers 1,717 goods including soybeans and crude oil, while the second set being implemented Dec. 15 will cover 3,361 items including autos.

But all told, fewer than 1,800 of these items — only about 35%, including crude oil — are new additions. Most have already been hit by previous rounds of tit-for-tat tariffs.

Beijing has already imposed tariffs on about 70% of its imports from the U.S. by value, and after these rounds, the only items left untouched will be those that it would be disadvantageous to domestic industry to tax, such as large aircraft. Previous tariff rounds have already led to sharp declines in imports of affected goods, and further hikes are unlikely to have much of an effect.

With the September duties, the average American tariff on Chinese goods rises to slightly above 21%, up from about 3% before the trade war, according to Chad Bown of the Peterson Institute for International Economics. China’s average tariff on imports from the U.S. climbs to nearly 22%. (more…)

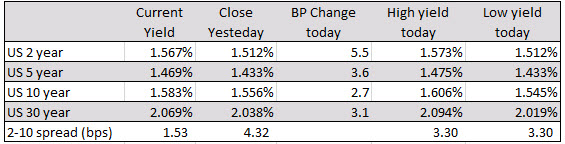

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

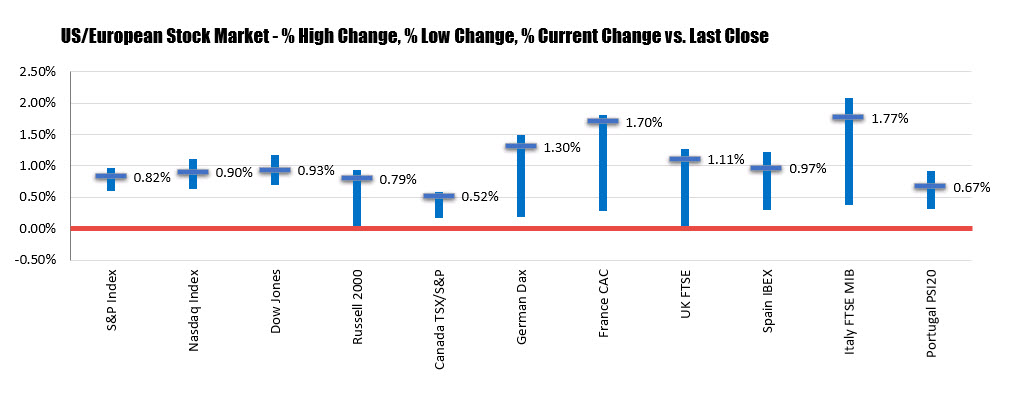

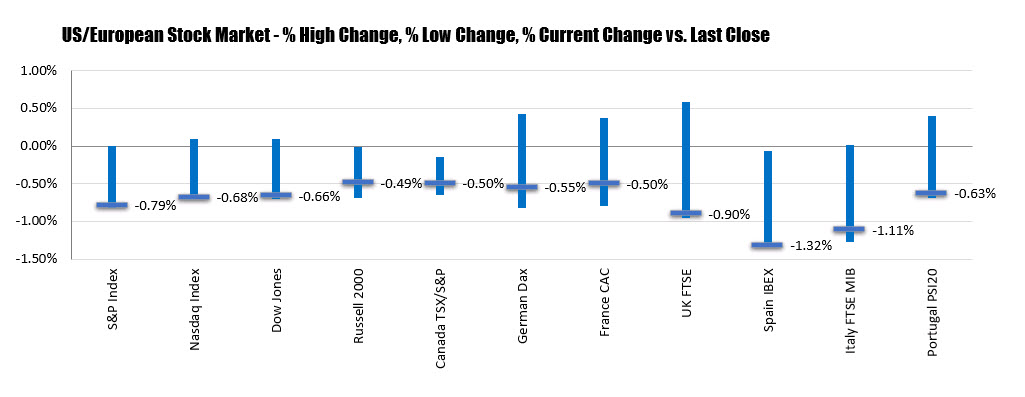

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.