High price reached $1679.70

The price of spot gold has surged over $30 or 1.83%. The price high just reached $1679.70. That’s the highest level since February 6, 2013.

The price of spot gold has surged over $30 or 1.83%. The price high just reached $1679.70. That’s the highest level since February 6, 2013.

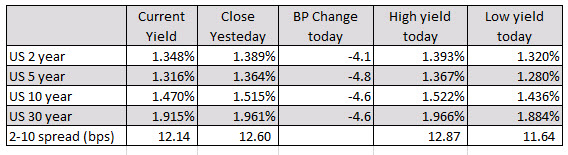

The headline of the day is that the 30 year yield traded to a new all time low of 1.8843%. That took out the August 2019 low yield of 1.9039% and although the yield is closing above that old low, the closing level will be the lowest on record.

Helping the yields move lower is the:

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

The major stock indices are ending the day lower with the NASDAQ falling by -1.79%. In a week where the NASDAQ and S&P index made new all-time highs, selling on Thursday and Friday have taken those gains away. The major indices are ending the week lower.

Citi’s currency strategist, Adam Pickett, says that “consensus expectations have not yet fully adjusted to the reality of weaker Chinese growth that will result from efforts to contain COVID-19”.

The major European indices are now close for the day and indices are closing lower but well off the lows for the day. The provisional closes are showing:

In other markets:

In other markets:

How many different ways can you say “Record close for the US indices?” It is like a broken record.

Some of the oversize winners today include:

3 scenarios for Coronavirus and its FX implications.

“Coronavirus was unknown to asset markets two months ago, may disappear as a factor within a few months, but may also evolve into a major global supply shock if it spreads and intensifies. We lay out the alternative scenarios on how the disease could evolve and what the short-medium term FX responses might be. Our subjective assessment is that current asset market pricing probably lies somewhat closer to the static than good scenarios,” SC notes.

“FX winners (W) and losers (L) under our good scenario where the disease abates:

• W: CAD, CNY, MXN, KRW, IDR, RUB

• L: USD, CHF, JPY

FX winners (W) and losers (L) under our static scenario of neither major intensification nor elimination:

• W: USD, JPY, CHF, MXN

• L: KRW, TWD, THB, SGD, MYR, AUD, NZD, EUR, CNY, CAD

FX winners (W) and losers (L) under our bad scenario where the disease intensifies and spreads:

• W: JPY, USD

• L: KRW, TWD, THB, SGD, MYR, IDR, INR, AUD, NZD, EUR, CNY, CAD,”