“Central banks have made a $6t commitment to prop up financial markets via asset purchases. That might not limit the collapse in EPS, but it might limit the collapse in share prices,” Citi says.

“Central banks have made a $6t commitment to prop up financial markets via asset purchases. That might not limit the collapse in EPS, but it might limit the collapse in share prices,” Citi says.

The major European shares are ending the session with sharp declines. For the year, the major European indices are also in the red. A look at the provisional closes are showing:

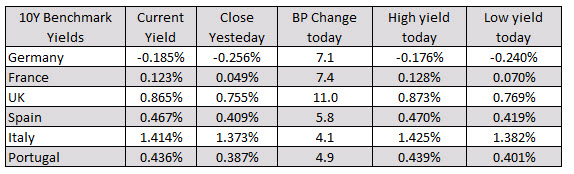

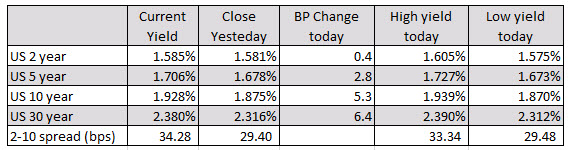

In other markets as European traders exit:

In other markets as European traders exit:US yields are also higher with the yield curve steepening. The 2 – 10 year spread has widened out to 34.28 basis points from 29.4 basis points on Friday.

Citi discusses the Fed policy trajectory in light of yesterday’s FOMC minutes from the October meeting.

“Minutes from the October 30th FOMC released overnight are broadly consistent with Citi analysts expectations for disagreement regarding the need to cut, but agreement that on leaving policy rates on-hold. On USD supply to year end (the more interesting part of the Minutes), Fed officials continue to look for ways to make sure funding pressures in the overnight lending market don’t cause a problem again with a “standing repo” seen as the preferred option that would likely provide substantial assurance of control over the federal funds rate (and USD supply). However, Citi analysts do not expect a final decision until H1 2020. ,” Citi notes.

“The Citi analyst view remains for the Fed to stay on hold in December and through 2020 though muted inflation makes hikes in the next year very unlikely. Cuts are possible should domestic activity data indicate a slowdown,” Citi adds.