Russian economy ministry issues revised forecasts

- 2021 GDP growth forecast up to 3.8% from 2.9%

- lifts Urals oil price forecast to $65.9/bbl from $60.3/bbl

- 2021 inflation forecast to 5% from 4.3%

- 2021 capital investment growth forecast to 4.5% from 3.3%

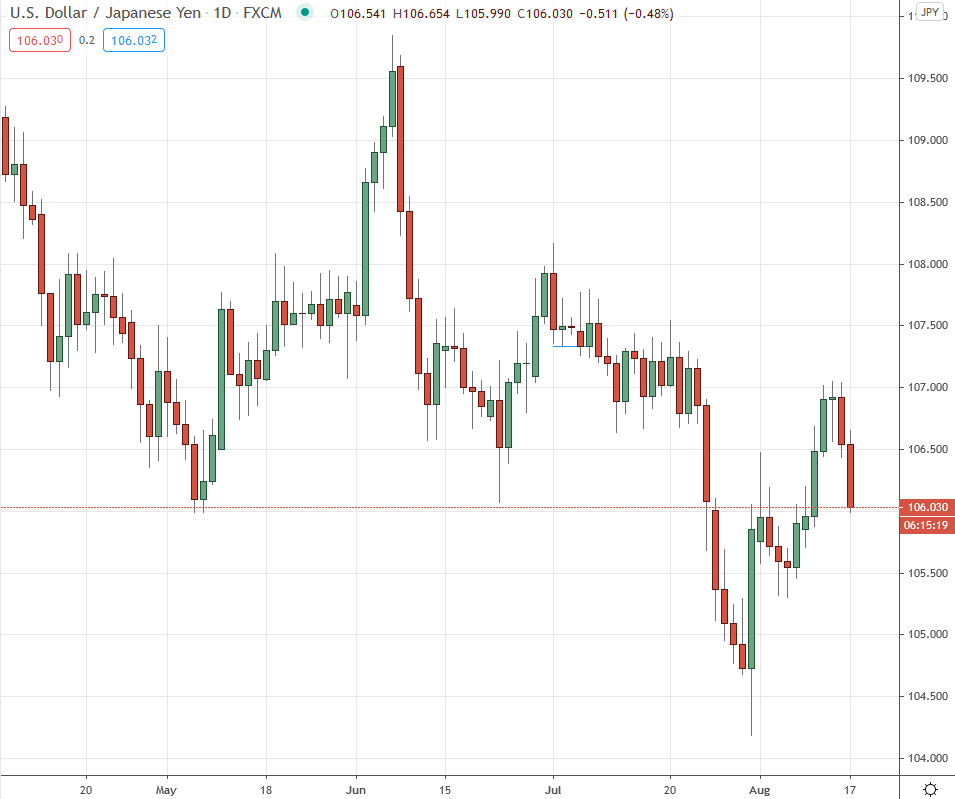

- 2021 average dollar/rouble rate to 72.8 from 73.3 seen in April

The ministry comments on the higher forecasts:

- We see the economy is recovering faster than we had expected

- Our experts say the economic recovery potential is not exhausted yet

- We all realise that the rouble price should be different at oil prices of $75 per barrel

- current rouble weakness blamed on sanction risks, OPEC+ uncertainty around global oil output.