Moody’s cuts the United Kingdom

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

2. Keep Losses Small. It is vitally important to keep losses small as most all of large losses began as small ones, and large losses can put an end to your trading career.

3. Adjust Stops. When a trade is working move your stop loss up in order to lock in gains.

4. Keep Commissions Low. There is a cost to trading but there is no reason to overpay brokerage fees. A discount brokerage is just as good as a premium brand name one.

5. Amateurs at the Open, Pros at the Close. The best time to enter trades are after lunch when the professionals are looking to get in at a better price than one provided in the morning.

6. Know the General Market Trend. When trading individual stocks make sure you trade with the general market trend or condition, not against it.

7. Write Down Every Trade. Doing this will allow you to learn what is working and what is not. It will also help you determine what types of trades work best for your personality.

8. Never Average Down a Losing Position. It is a loser’s game when you add to a loser. You add to winning positions because they are winners and are proving themselves to be such.

9. Never Overtrade. Overtrading is a direct result of not following a well thought out plan, deciding it is best to trade off emotion instead. This will do nothing but cause frustration and a loss of money.

10. Give 10 Percent Away. Money works the fastest when it is divided. When we share we prime the economic pump of the universe.

Trading is a game of rules. We either make the decision to abide by them or we break them. We do the latter at our own peril.

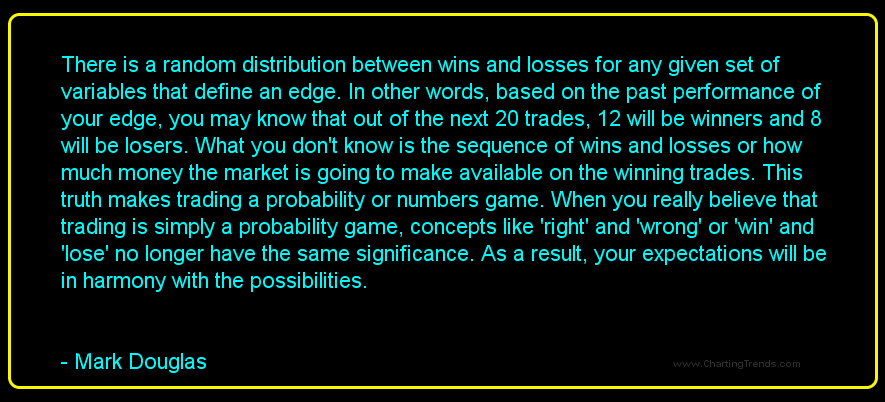

Perceptions are a normal part of daily life. It is normal to have a perception of someone, something or a situation, but this perception is often judgmental. One tends to allow feelings, emotions and looks to affect the perception. Despite being a normal and inherent part of human psychology, perceptions can be highly problematic if left uncontrolled in the case of traders.

Perceptions are a normal part of daily life. It is normal to have a perception of someone, something or a situation, but this perception is often judgmental. One tends to allow feelings, emotions and looks to affect the perception. Despite being a normal and inherent part of human psychology, perceptions can be highly problematic if left uncontrolled in the case of traders.

A trader cannot allow perceptions to cloud his/her judgement and decisions. Perceptions can be deceiving and they thus need to be kept in check as they could lead to erroneous decisions.

In a perfect world, a trader will manage to be completely rational. He/she would be able to assess all facts so as to base decisions and choices on sound information and data. Such a perfect scenario would not allow emotions, perceptions and feelings to come into the picture. As a result the decision making process and the resultant decisions should be ideal. However this is an unreal scenario as we all know that this is not possible in a real world. This is what makes trading psychology so interesting, and yet so complicated and complex. However one should consider this in a positive way as it after all lies at the foundation of why the market and the life of a trader is so challenging and exciting.

The basic idea is to try to keep perceptions under control as much as possible. Despite all efforts though, even seasoned traders may find it hard to be veyr rational at times. One cannot forget that there is tension, pressure, emotion and various other aspects which come into play while a trader is trying to make up his/her mind about the best and the safest course of action. (more…)

In my opinion, this is the ultimate goal for all traders: Get to the point where you can make confident decisions on your own and trade with complete independence. While I tremendously respect the opinion of my colleagues, I DO NOT rely on them. I can turn off Blue Channels, and all communication to the outside world…and still be fine with making my own decisions and letting THE MARKET tell me if I’m right or wrong. I apologize if this sounds cocky, but it’s simply the truth.

How do you get to this point? Make decisions and learn from them! I openly admit that I have made TONS of mistakes in the market, and I still make mistakes EVERY DAY. The key is I’ve learned from them and now try my best to minimize those mistakes. As Tony Robbins says: “Good decisions come from experience, and experience comes from bad decisions.” The key is to MAKE a decision without worrying that you might be wrong. As long as you learn from it, you can correct it the next time. Again, just make the decision! Who knows, it might end up being a good one

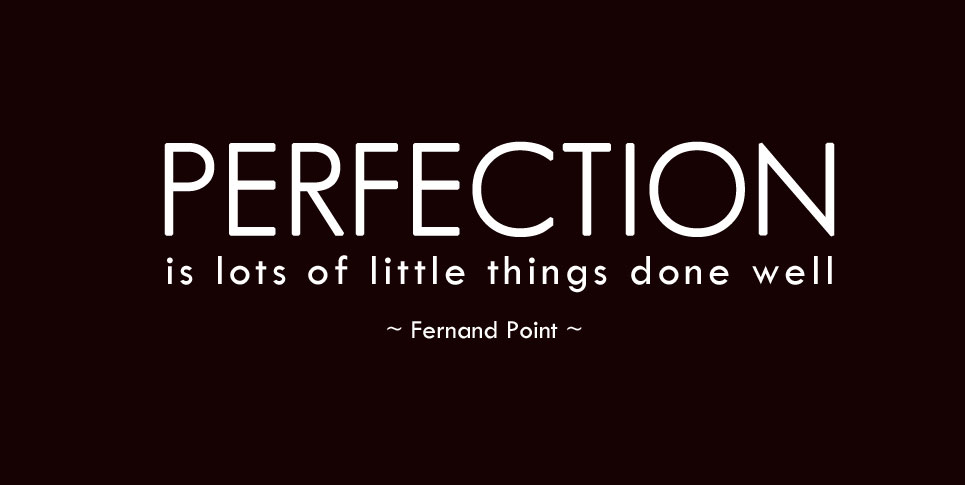

Being perfect is certainly not easy. Perfection is debatable, and needless to say, as challenging as can be. Matters become increasingly difficult when this is attributed to a trading environment or situation. Many traders end up setting their trades by focusing on what they want the results to be. They focus on the outcome of the trade, and do not give a lot of attention to the actual execution of that trade. This is in fact one of the main reasons why trading is so difficult. A trader can never hope to be perfect in his or her decisions. And, one can never hope for a perfect scenario, where any decision that is made results in a favorable result. Therefore the general rule of thumb that traders need to appreciate and get used to is that they need to perfect the decision making process and the execution of the trade, rather than hoping to make the results perfect. The choices, research, knowledge and information discerned are the steps that need to be perfected in the hope of perfecting the results of the trade in question.

Being perfect is certainly not easy. Perfection is debatable, and needless to say, as challenging as can be. Matters become increasingly difficult when this is attributed to a trading environment or situation. Many traders end up setting their trades by focusing on what they want the results to be. They focus on the outcome of the trade, and do not give a lot of attention to the actual execution of that trade. This is in fact one of the main reasons why trading is so difficult. A trader can never hope to be perfect in his or her decisions. And, one can never hope for a perfect scenario, where any decision that is made results in a favorable result. Therefore the general rule of thumb that traders need to appreciate and get used to is that they need to perfect the decision making process and the execution of the trade, rather than hoping to make the results perfect. The choices, research, knowledge and information discerned are the steps that need to be perfected in the hope of perfecting the results of the trade in question.

Perfection also revolves around another issue in trading. The vast majority of traders worry a great deal about the outcome of their trading decisions. They experience a fear of losing out, and they do not want to risk a lot of their money either. They realize that in trading it is practically impossible to be perfect, and no matter how many years pass, and how many trades they do, they are still going to end up being imperfect.

Moreover, especially in the case of novice traders, it is normal to think that being a trader is a somewhat simple way to make money. They see the future as being rewarding and profitable – typically, a perfect way to become rich. Yet, they tend to underestimate the risks involved in trading and the various issues that revolve around making sound trading decisions and choices. (more…)

Think of an answer before reading further.

Think of an answer before reading further.

Now. You have the choice of definitely losing RS 25000 or flipping a coin with a 50/50 chance of losing Rs 50000. Which option do you take?

If you answered both questions the same way, congratulations, you have a rational attitude toward gains and losses. That’s good news if you’re a trader.

Studies show that most people will pick receiving Rs 25000 while opting to take the chance of losing Rs 50000 or nothing. It’s called loss aversion and it’s because negative reactions to loss impact our psyches twice as hard as the rush of making gains does.

Master that psychological part of trading and you’re one step closer to being the trader you want to be.

1. Greed could be defined as a trader’s desire to trade in order to provide an unrealistic profit. Greedy traders focus only on how much money they could have made. This emotion frequently leads to ignoring proper money management and often prevents a trader from taking profits on a winning trade.

1. Greed could be defined as a trader’s desire to trade in order to provide an unrealistic profit. Greedy traders focus only on how much money they could have made. This emotion frequently leads to ignoring proper money management and often prevents a trader from taking profits on a winning trade.

2. Fear is a survival response and probably the most powerful of all human emotions. When afraid, a trader will sell a position regardless of the price. Fear usually leads to panic, which again causes poor decision making.

3. Hope is what keeps a trader in a losing trade after it has hit the invalidation level. It may be the most dangerous of all human emotions when it comes to trading.

4. Regret is defined as a feeling of sadness or disappointment over something that has happened, especially when it involves a loss or a missed opportunity.

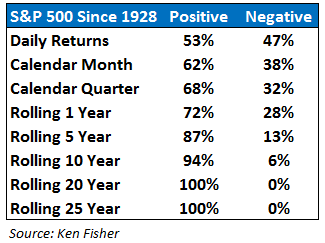

You can see that daily returns in the market are more or less a fifty-fifty proposition. Since loss aversion means that losses make us feel worse than gains make us feel better by a factor of 2:1, this means that if you check the value of your stock portfolio on a daily basis, you will feel terrible every single day.

Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. But lengthen your time horizon and the effects of loss aversion slowly start to fade. (more…)