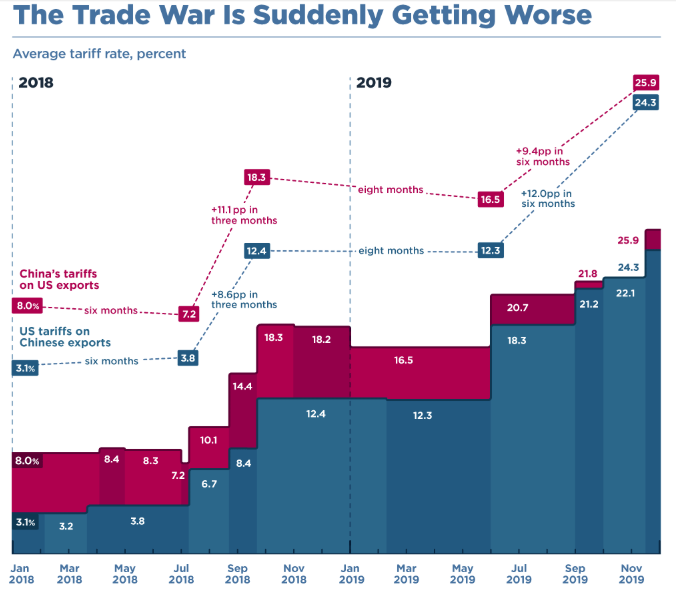

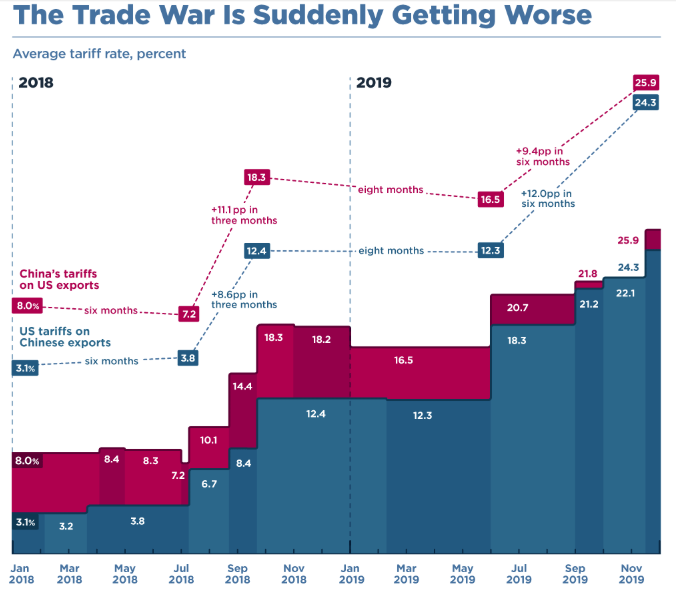

A graph here via this link, shows the rapid escalation:

- The upcoming tariff changes are large and swift.

What if you could read the principles for success for some of the world’s greatest traders? Well you can, here is how author Jack Schwager summed up the the similarities of the ‘Market Wizards’ he spent years interviewing in his second book.

The following is a summarized excerpt from Jack D Schwager’s book, The New Market Wizards. I highly recommend this book for all active traders.

|

These two rules or habits simply aren’t being utilised, either because people don’t know them, or think they’re better than them.

Let me tell you this – no-one is better than the rules. And the traders that have been ignoring them are feeling this right now where it hurts.

I know of professionals who are quitting over what the market has been doing recently. I know of professionals who are at breaking point – literally a nervous wreck because they cannot fathom that the market will go higher….and yet it does.

If you don’t follow these two rules, you will never flow with the market. You will constantly be in conflict; constantly fighting and stubbornly protecting your ‘rightness’, and you will never be in tune with what the market is saying.

These two rules can be neatly summed up in one sentence.

Shut Up and Listen.

Stop talking. Stop thinking. Just listen to what the market is telling you.

Overconfidence

As the name suggested, it is the irrational faith in one’s skills, methodology or beliefs. For example, you see a certain chart pattern and make a maximum leveraged trade, even though you understand that any chart pattern cannot predict market with certainty. Trading excessively after a winning streak also shows overconfidence.

Cognitive Dissonance

It means finding excuses for something which makes you ‘uncomfortable’. For example, jumping from one indicator to another when you face losing trades; or continuing to trade in stock even your trading methodology does not gives you a positive expectancy.

Availability Bias

It means being biased to information which is readily and easily available. For example, people begin to trade using RSI without understanding the internal relative strength; that is, RSI is most talked about on forums so start using them without rationally researching it. Being affected from attractive advertisement or intelligent sounding articles (including this one!) without due diligence also signifies availability bias.

Self-Attribution Bias

It means giving yourself unwarranted praise for outcomes which may just be an outcome of chance. For example, people make money in a bull market through buy and hold and start begin to believe on their trading acumen rather than the market regime which favors their trading style. (more…)

While day-trading is a great way to make a living when you are consistently profitable, it can also be the worse career choice if you consistently lose. Continue forward with system development, or working towards effective risk management, money management, or mastery of your trading psychology. Trading psychology means the big 3: discipline, confidence and consistency.The trading psychology takes precedence because it is needed to make sure that the other two are followed.

While day-trading is a great way to make a living when you are consistently profitable, it can also be the worse career choice if you consistently lose. Continue forward with system development, or working towards effective risk management, money management, or mastery of your trading psychology. Trading psychology means the big 3: discipline, confidence and consistency.The trading psychology takes precedence because it is needed to make sure that the other two are followed.

It takes a skilled trader to understand execute all of the things that are needed to be successful and earn a significant amount of profit doing this alone. Money Management is essential to preserve your trading capital and is simply a set of rules that governs how much money you have at risk. Take control of your trading Psychology and adhere to strict discipline in trading your developed and refined Trading System.

Building confidence on the system is extremely important as that is the only reason why you stick to the system during bad times. Day trading requires focus and discipline on the part of the trader with a high degree of risk tolerance since losing trades are numerous. (more…)

Anxious: Am I prepared? Can I afford to lose what I am risking? Am I breaking my rules? Did I drink too much caffeine?

Anger: Have I not moved from the last trade? Am I tired? Is there conflict in my personal life?

Happiness: Are psychological gains more important than monetary gain? Am I overconfident?

Indifference: Do I care? Is something more important?

It is natural to feel emotion but in an appropriate and proportional way.

Anxious:

To this day, the first trade always produces a little anxiety. That little tingle in your stomach and shallow breathing. The same is true when I a trade I have been waiting for sets up. Above that, I know there is something wrong.

Anger and Happiness:

I am angry after a negative outcome and happy after a positive outcome but in order to adapt more quickly I have to remove emotion from the outcome as soon as possible. It is more important to focus on what happened and less how I feel about it. Prolonged feelings of anger or happiness causes risk blindness and impedes my learning. Misjudging risk will prevent me from taking a trade or taking too much risk. (more…)

Tony Saliba

“How do you lose money? It is either bad day trading or a losing position. If it’s a bad position that is the problem, then you should just get out of it.”

“Clear thinking, ability to stay focused, and extreme discipline. Discipline is number one: Take a theory and stick with it. But you also have to be open-minded enough to switch tracks if you feel that your theory has been proven wrong. You have to be able to say, “My method worked for this type of market, but we are not in that type of market anymore.”

“Until recently, I set goals on a monetary level. First, I wanted to become a millionaire before I was thirty. I did it before I was twenty-five. Then I decided I wanted to make so much a year, and I did that. Originally, the goals were all numbers, but the numbers are’t so important anymore. Now, I want to do some things that are not only profitable, but will also be fun.”

Dr Van K. Tharp

“The composite profile of a losing trader would be someone who is highly stressed and has little protection from stress, has a negative outlook on life and expects the worst, has a lot of conflict in his/her personality, and blames others when things go wrong. Such a person would not have a set of rules to guide their behaviour and would be more likely to be a crowd follower. In addition, losing traders tend to be disorganized and impatient. Thet want action now. Most losing traders are not as bad as the composite profile suggest. They just have part of the losing profile.” (more…)