The United States may fall victim to bond “vigilantes” targeting indebted nations from the United Kingdom to Japan in a potential second stage of the financial crisis, New York University professor Nouriel Roubini said.

The United States may fall victim to bond “vigilantes” targeting indebted nations from the United Kingdom to Japan in a potential second stage of the financial crisis, New York University professor Nouriel Roubini said.

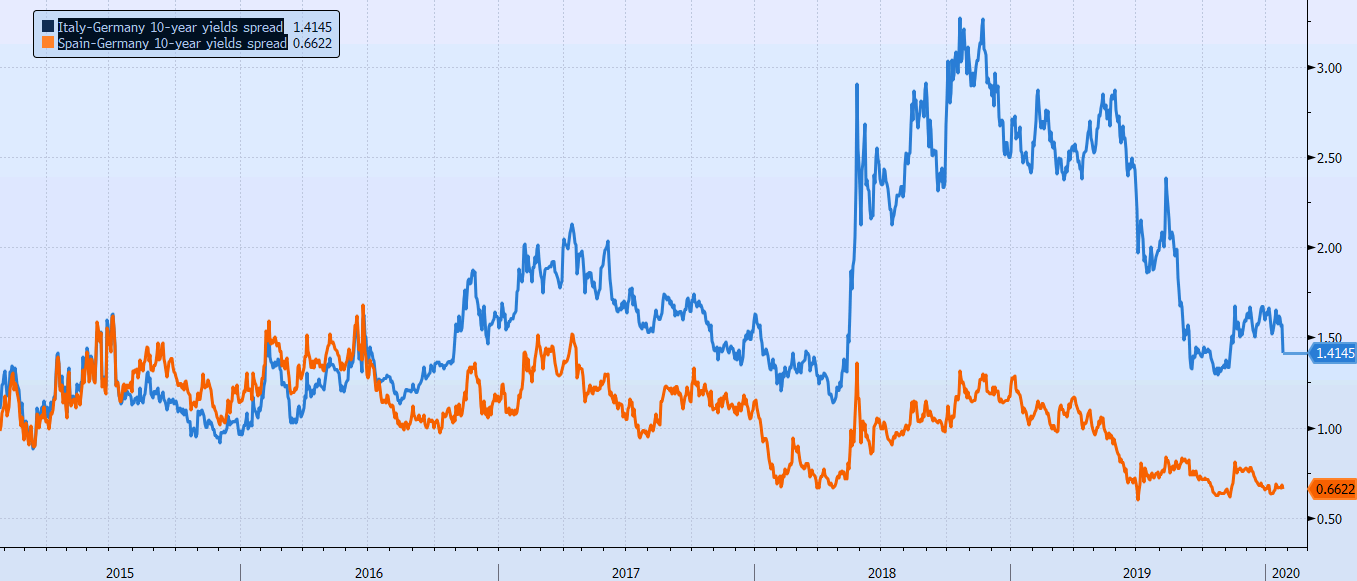

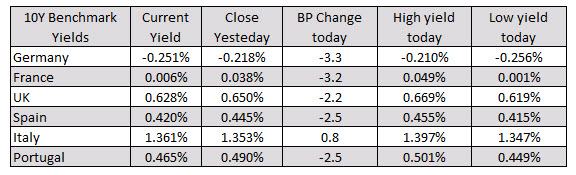

“Bond market vigilantes have already woken up in Greece, in Spain, in Portugal, in Ireland, in Iceland, and soon enough they could wake up in the UK, in Japan, in the United States, if we keep on running very large fiscal deficits,” Roubini said at an event at the London School of Economics. “The chances are, they are going to wake up in the United States in the next three years and say, ‘this is unsustainable.'”

The euro has touched a four-year low against the dollar on concern nations with the largest budget deficits will struggle to meet the European Union’s austerity requirements. Roubini, speaking in a lecture hall packed with students who then queued to meet him at a book-signing, suggested that the public debt burden incurred after the banking panic of 2008 may now cause the financial crisis to metamorphose.

“There is now a massive re-leveraging of the public sector, with budget deficits on the order of 10 percent” of gross domestic product “in a number of countries,” Roubini said. “History would suggest that maybe this crisis is not really over. We just finished the first stage and there’s a risk of ending up in the second stage of this financial crisis.”

The US posted its largest April budget deficit on record as the excess of spending over revenue rose to $82.7 billion. The federal debt is currently projected to reach 90 percent of the economy by 2020.

Roubini, who predicted in 2006 that a financial crisis was imminent, said that the record US budget deficit may persist amid a stalemate in Congress between Republicans blocking tax increases and Democrats who oppose cuts in spending.

“In many advanced economies, the political will to do the right thing is constrained,” he said.

Roubini reiterated that the euro region faces the threat of a breakup after the Greek budget crisis. The European Union said on Tuesday it transferred the first instalment of emergency loans to Greece, one day before 8.5 billion euros ($10.4 billion) of bonds come due.

“Even today there is a risk of a breakup of the monetary union, the euro zone as well,” Roubini said.

“A double dip recession in the euro zone” is “something that’s not unlikely, given what’s happening.”

The United States may fall victim to bond “vigilantes” targeting indebted nations from the United Kingdom to Japan in a potential second stage of the financial crisis, New York University professor Nouriel Roubini said.

The United States may fall victim to bond “vigilantes” targeting indebted nations from the United Kingdom to Japan in a potential second stage of the financial crisis, New York University professor Nouriel Roubini said.

It’s official: the double dip is here. Goldman’s Jan Hatzius just lowered his GDP forecast for 2011 from 2.5% to 1.9% (kiss goodbye all those 93 EPS estimates on the S&P), increased his unemployment forecast from 9.8% to 10.0%, boosted his inflation expectation from 0.4% to 1.0%, and said that QE lite is now on the table, as he expects that “the FOMC to announce that they will reinvest the paydown of mortgage-backed securities in the bond market at next Tuesday’s meeting.” Look for all other sell-side “strategists” (here’s looking at you Neil Dutta) to lower their economic outlook in kind, and the 2011 S&P consensus to decline accordingly.

It’s official: the double dip is here. Goldman’s Jan Hatzius just lowered his GDP forecast for 2011 from 2.5% to 1.9% (kiss goodbye all those 93 EPS estimates on the S&P), increased his unemployment forecast from 9.8% to 10.0%, boosted his inflation expectation from 0.4% to 1.0%, and said that QE lite is now on the table, as he expects that “the FOMC to announce that they will reinvest the paydown of mortgage-backed securities in the bond market at next Tuesday’s meeting.” Look for all other sell-side “strategists” (here’s looking at you Neil Dutta) to lower their economic outlook in kind, and the 2011 S&P consensus to decline accordingly.