I start my day with a cup of coffee, everyday. A cup of freshly ground, and brew Espresso or Long Black is essential. I am not a coffee expert, but I am a coffee lover. I have my grinder and Espresso machine at home. Barista technique breaks down into three time scales and skill levels:

I start my day with a cup of coffee, everyday. A cup of freshly ground, and brew Espresso or Long Black is essential. I am not a coffee expert, but I am a coffee lover. I have my grinder and Espresso machine at home. Barista technique breaks down into three time scales and skill levels:

The first is the minute or so spent grinding and making the shot. The key here is acquiring the skills to make shots consistently. One should be able to turn out four or five in a row with virtually the same timing, volume, color, crema and taste. This skill is a physical thing, that is, it’s a matter of training and practice rather than learning.

The second is the time spent carefully tasting an espresso or series of espressos, identifying the flavor balance and defects, and making adjustments to ones pull or machines to correct them. The “dialing-in” process for a new blend usually requires a series of shots to get a satisfactory result, and can proceed over several days to fine tune it. To do this well, one needs to have experience in tasting and analyzing good espresso. One also needs to know how changes in extraction variables and machine settings affect the espresso’s taste.

The third is acquiring experience and informed preferences with a wide range of coffees, blends, espresso equipment, and alternative techniques. If you or someone you’re serving wants an espresso with a specific pallette of flavors; you will know how to provide it. Home roasting and blending helps in this. So does visiting good cafés and roasteries, and talking with the knowledgeable people there.

I see a lot of similarities to trading. What do you think? Start making coffee…

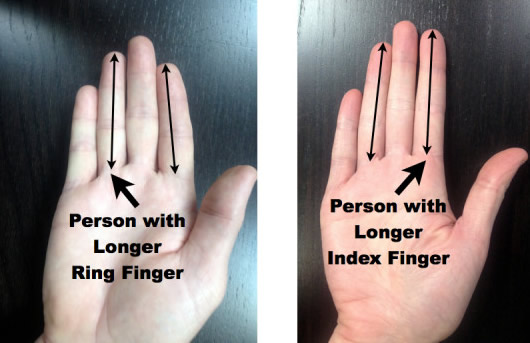

Take a moment and look at your hands. Specifically, compare the length of your ring finger to the one you use to point. Is the ring finger longer or shorter than your pointer, and by how much? It turns out that the answer to that question can tell a lot about your mental abilities and appetite for risk. As ConvergEx’s Nick Colas details, a 2009 study of mostly male traders working in London found that the ones with longer ring fingers were generally more profitable than those with shorter ones. Traders with the largest fourth finger/second (pointer) finger ratios actually made 11 times more than those with the smallest.

Take a moment and look at your hands. Specifically, compare the length of your ring finger to the one you use to point. Is the ring finger longer or shorter than your pointer, and by how much? It turns out that the answer to that question can tell a lot about your mental abilities and appetite for risk. As ConvergEx’s Nick Colas details, a 2009 study of mostly male traders working in London found that the ones with longer ring fingers were generally more profitable than those with shorter ones. Traders with the largest fourth finger/second (pointer) finger ratios actually made 11 times more than those with the smallest.  I took notes on Kiev’s book when I first read it, and I’m going to select four self-therapeutic passages from them for this post. I suspect that most of my notes are quotations, but I don’t think it’s important to check their accuracy, though I will provide page references.

I took notes on Kiev’s book when I first read it, and I’m going to select four self-therapeutic passages from them for this post. I suspect that most of my notes are quotations, but I don’t think it’s important to check their accuracy, though I will provide page references.

1. Remain Flexible – do not let your bias (”The Market MUST Go Down”) cloud the reality of what’s happening

1. Remain Flexible – do not let your bias (”The Market MUST Go Down”) cloud the reality of what’s happening When athletes are consumed by not losing rather than by winning, the game is over, often before it has even started. The same precept applies to trading. As crazy as it sounds, most traders aren’t making the money they could be — and the reason, I’d argue, is the fear of losing it. Traders are far too worried about giving money back. This paralyzing phobia can transform talented, elite professionals into disappointing underperformers.

When athletes are consumed by not losing rather than by winning, the game is over, often before it has even started. The same precept applies to trading. As crazy as it sounds, most traders aren’t making the money they could be — and the reason, I’d argue, is the fear of losing it. Traders are far too worried about giving money back. This paralyzing phobia can transform talented, elite professionals into disappointing underperformers.