- You must have faith in yourself. You must believe that you can trade as well as anyone else.. This belief arises from doing your homework and staying disciplined in your system. Understanding that it is not you, that it is your system that wins and loses based on market action will keep the negative self talk at bay.

- You must have faith in your method. You must study the historical performance of your trading method so you can see how it works on charts. Also it is possible to quantify and back test mechanical trading systems for specific historical performance in different kinds of markets.

- You must have faith in your risk management. You must manage your risk per trade so it brings you to a 0% mathematical probability of ruin. A 1% to 2% of total capital at risk per trade will give almost any system a 0% risk of ruin.

- You must have faith that you will win in the long term if you stay on course. Reading the stories of successful traders and how they did it will give you a sense that if they can do it you can to. If trading is something you are passionate about all that separates you from success is time.

- You need faith in your stock. It helps in your trading if you trade stocks, commodities, or currencies that you 100% believe in. Traders tend to have no trouble trading a bullish system with $AAPL if they believe it is the greatest company to ever exist and will go to $500 within six months. It is much easier to follow an always in trend reversal system with Gold if you believe it tends to trend strongly one way or the other. Of course you have to follow a defined system and take the signals even if it goes against your opinions but believing in your trading vehicle helps tremendously.

Latest Posts

rssWisdom of Jesse Livermore

Legendary speculator Jesse Livermore is surely one of the most fascinating characters in all of financial-market history.

About a century ago Jesse Livermore blossomed into one of the most celebrated speculators of all time. He was trading heavily in the early decades of the 1900s, a wondrous era to speculate in stocks. His renowned exploits are still viewed with great awe and reverence by today’s elite speculators and his towering speculation wisdom will stand tall for ages to come.

If you are interested in more background information on Jesse Livermore and my reasons behind writing this series of essays on the man’s awesome speculation wisdom, you may wish to skim the introduction of the first essay in this series.

Mr. Livermore’s exploits were recorded in the greatest book on speculation of all time. Originally published in 1923, it is called “Reminiscences of a Stock Operator” and was written by a gifted financial journalist named Edwin Lefevre. Mr. Lefevre penned the account as if from the first-person perspective of a fictional trader named Larry Livingston. As Lefevre had spent weeks extensively interviewing Jesse Livermore, market historians are virtually unanimous in viewing Lefevre’s classic book as a thinly-disguised biography of Livermore’s trading life.

Today “Reminiscences of a Stock Operator” is fondly read with awe by speculators of all levels and abilities all around the globe. I have personally read the book many times and I try to re-read it at least once a year now. The speculation wisdom contained within these magical pages is just awesome and truly priceless for all speculators to digest. (more…)

Should equity investors fear rising rates?

Extension & Retracement patterns

- Extension patterns are Bullish Butterfly, Bearish Butterfly, Bullish Crab and Bearish Crab.

- Retracement patterns are Bullish Gartley, Bearish Gartley, Bullish Bat and Bearish Bat.

These are the patterns that I used, and the list is not exhaustive. The “hardcore” harmonic traders might look at more patterns such as 5-0, Shark etc and in more time frames.

So here are the key factors I am looking at when using harmonic patterns

- Identify key market levels, in other words, key support resistance levels. This one of the MOST important step.

- Identify established price channel. A channel also represent the current trend, applying the appropriate patterns to follow the trend.

Technically Yours/ASR TEAM/BARODA

Blackstone's Byron Wien Discusses Lessons Learned in His First 80 Years

Here are some of the lessons I have learned in my first 80 years. I hope to continue to practice them in the next 80.

- Concentrate on finding a big idea that will make an impact on the people you want to influence. The Ten Surprises which I started doing in 1986 has been a defining product. People all over the world are aware of it and identify me with it. What they seem to like about it is that I put myself at risk by going on record with these events which I believe are probable and hold myself accountable at year-end. If you want to be successful and live a long, stimulating life, keep yourself at risk intellectually all the time.

- Network intensely. Luck plays a big role in life and there is no better way to increase your luck than by knowing as many people as possible. Nurture your network by sending articles, books and emails to people to show you’re thinking about them. Write op-eds and thought pieces for major publications. Organize discussion groups to bring your thoughtful friends together.

- When you meet someone new, treat that person as a friend. Assume he or she is a winner and will become a positive force in your life. Most people wait for others to prove their value. Give them the benefit of the doubt from the start. Occasionally you will be disappointed, but your network will broaden rapidly if you follow this path.

- Read all the time. Don’t just do it because you’re curious about something, read actively. Have a point of view before you start a book or article and see if what you think is confirmed or refuted by the author. If you do that, you will read faster and comprehend more.

- Get enough sleep. Seven hours will do until you’re sixty, eight from sixty to seventy, nine thereafter which might include eight hours at night and a one hour afternoon nap.

- Evolve. Try to think of your life in phases so you can avoid a burn-out. Do the numbers crunching in the early phase of your career. Try developing concepts later on. Stay at risk throughout the process.

- Travel extensively. Try to get everywhere before you wear out. Attempt to meet local interesting people where you travel and keep in contact with them throughout your life. See them when you return to a place. (more…)

Pride-Fear -Greed-Hope :Video

Some great videos about these emotions by Scott O’Neil. He is President of MarketSmith Incorporated, a stock research tool developed by a team of investment professionals at William O’Neil + Company, a Registered Investment Advisor for Institutional Money Managers providing equity market buy/sell recommendations and independent research. Scott is also a portfolio manager with O’Neil Data Systems, Inc.-Forbes

12 rules of leadership by a retired navy seal commander

Two Equations that Lead to Wealth

Yep, that’s it. It seems pretty simple, doesn’t it? In fact, these seem to be “common sense.” But remember that these are two equations that 70% of Americans can’t get right.P

Yep, that’s it. It seems pretty simple, doesn’t it? In fact, these seem to be “common sense.” But remember that these are two equations that 70% of Americans can’t get right.P

If you look at these equations, you’ll see that all efforts to improve your finances come down to two things: increasing your income or decreasing your expenses. The more you do of each of these, the better. Of course, there are a few more details to fill in the gaps. You need to understand the basic definitions of each term above and know the steps to take to ensure your success in each area. I’ll be talking about these as well as sharing ideas to make the most of them as time goes on, but for now, here’s a quick overview of each one.P

Income

You need at least a minimum level of earnings just to survive. Any amount above that qualifies you as a person who can build wealth. And since the minimum in America isn’t that high compared to what people earn (average household income is around $50,000, and you can start building wealth well below that level), almost everyone qualifies.P

Your career is where most people get the vast majority of their income. As such, we’ll spend a lot of time here talking about how to manage and grow your career so you can maximize your earning potential. The bottom line: even a small change for the better can mean hundreds of thousands in extra income over a lifetime.

In addition to your job, there are a whole host of ways you can earn extra money these days. If you’re industrious enough, the money you make on the side can be quite substantial.P

SpendingP

No matter what you earn—whether it’s $30,000 or $1 million a year—you must keep your expenses below your income. You MUST spend less than you earn. If you don’t, you will go backwards financially.P

Consider two people: (more…)

Essentials of a Winning Psychology

Four fears that block a winning psychology:

- Fear of Loss

- Fear of being wrong

- Fear of missing out

- Fear of leaving money on the table.

Realize that trading is based on probabilities, as such, every trade is unique. In other words, the past does not equal the future.

- Because we know that we will succeed in the long run and because we know we will protect ourselves no matter what the market does, we acquire the state of “self trust” and the state of being “carefree”.

In turn these states allow us to remain….

- Focused, confident and carefree when we are experiencing the inevitable prolonged drawdown.

- Because at the micro level we know that the market is random, we will not allow euphoria to set in and lead us to reckless trades. Each trade will only be one in a series of probabilities.

- We will view market information not as a source of pleasure or pain but merely as data providing us with opportunities.

- Awareness – the ability to step outside ourselves and observe. The more effectively we can do this, the easier our progress to “Acceptance”.

- Honesty – the ability to seek to perceive reality in spite of our filters.

- Courage – the willingness to bear the pain brought about by our awareness and honesty.

- Commitment – the willingness to do whatever is necessary to achieve our goals

To succeed, a trader must have a vision about where he is heading, and must internalise that a winning attitude is total submission to the trading outcome.

This means managing Fear and Euphoria. To do this, we need to ACCEPT, with every fibre of our body, the belief that at the micro level the market is uncertain and unpredictable and at the macro level it is relatively certain and predictable.

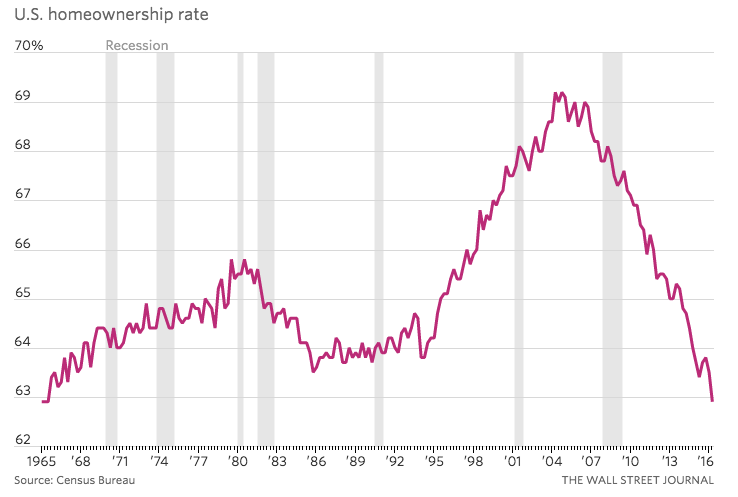

U.S. Homeownership Rate Falls to Five-Decade Low