"It's time, not timing, that makes money in the market."

We can not control:

Whip saws when the trend reverses on us. Gaps in opening prices both up and down. Headline risk. Natural disasters. Whether a trend continues or reverses the moment we open a position. Whether any individual trade wins or loses. How many winning or losing trades we have in a row. The battle for your long term trading success is won or loss in your head. The decision to whether keep going after losing money or to quit is made at the point of maximum frustration with the markets. To keep going you have to keep positive, and keep trading. Knowing the difference between you making a mistake or the market simple not matching your style will go a long way in keeping down your stress and negative self talk. Well, if Mark Zuckerberg’s image wasn’t already bolstered enough by his recent appearance on 60 Minutes, today’s announcement might help polish it a bit more.

Well, if Mark Zuckerberg’s image wasn’t already bolstered enough by his recent appearance on 60 Minutes, today’s announcement might help polish it a bit more.

Zuckerberg is one of 17 of the latest billionaires to sign the Giving Pledge, a joint effort from Bill Gates and Warren Buffet to encourage wealthy individuals “to commit to giving the majority of their wealth to the philanthropic causes and charitable organizations of their choice either during their lifetime or after their death,” according to the organization’sweb site. The Wall Street Journal first reported the news early Thursday morning.

“People wait until late in their career to give back. But why wait when there is so much to be done?” said Zuckerberg, according to a press release. ”With a generation of younger folks who have thrived on the success of their companies, there is a big opportunity for many of us to give back earlier in our lifetime and see the impact of our philanthropic efforts.”

First officially announced by Gates and Buffett in June of this year, The Giving Pledge touts a list of 57 billionaires who have pledged to give a majority of their wealth away over the course of their lifetime.

Dustin Moskovitz, a co-founder of Facebook and #290 on the list with $1.4 billion, has also agreed to join Zuckerberg in signing. Other names new to the list include ex-AOL CEO Steve Case and investor Carl Icahn.Mr. Icahn ranks 24th on this year’s Forbes 400 list, at an estimated net worth of $11 billion. Zuckerberg, whose soaring second-market shares valuation of Facebook stock brings his estimated net worth to $6.9 billion, is new to this year’s Forbes 400 list at #35. Gates and Buffettcontinue to top the list at #1 and #2, $54 billion and $45 billion, respectively. (more…)

Paul Tudor Jones was featured in Market Wizards and is one of the successful trend followers. In the Market Wizards book there are some interesting quotes & trading tips that are important for all stock traders & trend followers.

Quoting Paul Tudor Jones

“I become quicker and more defensive. I am always thinking about losing money as opposed to making money.”

“Risk control is the most important thing in trading.”

“Don’t be a hero”.

“Don’t have an ego.”

“Always question yourself and your ability”.

“I am more scared now that I was at any point since I began trading, because I recognize how ephemeral success can be in this business. I know that to be successful, I have to be frightened. My biggest hits have always come after I have had a great period and I started to think that I knew something.”

“One of my strengths is that I view anything that has happened up to the present point in time as history. I really don’t care about the mistake I made three seconds ago in the market. What I care about is what I am going to do from the next moment on. I try to avoid any emotional attachment to a market.”

“I never apologize to anybody, because I don’t get paid unless I win.”

“When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion.”

“Advice: don’t focus on making money; focus on protecting what you have.”

“Trading gives you an incredibly intense feeling of what life is all about.”

Past performance is not necessarily indicative of future performance. The risk of loss in trading futures contracts, commodity options or forex can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

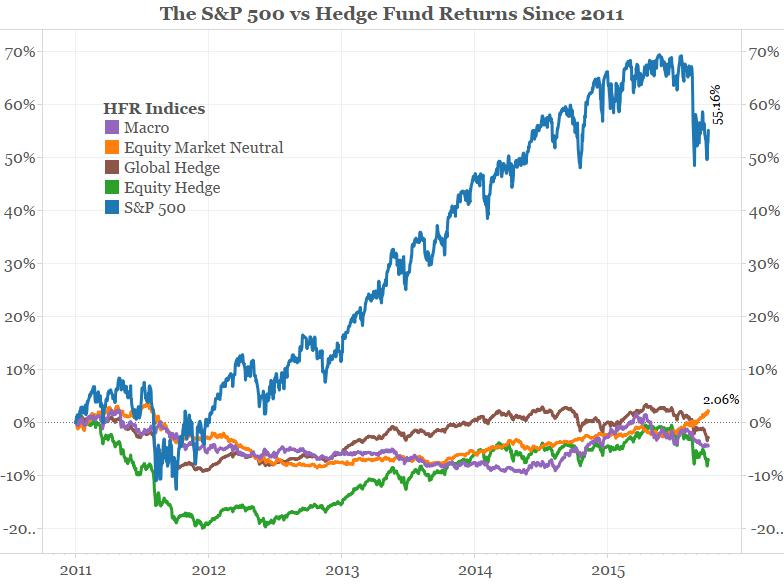

The average hedge fund returned 5.6% last year compared to 12% for the S&P 500 but that doesn’t mean the managers of the SPY ETF earned the most.

Forbes put together a list of the hedge fund managers who earned the most in 2016 and the results probably won’t surprise you. The familiar names are there and the paychecks are out-of-sight.