Japanese candlesticks, which have been enjoying the spotlight in recent years, are difficult to explain in one broad brush. Candlesticks draw on the same open-high-low-close data as do bars. Here the length of the bar, or “candle,” is determined by the high and low, but the area between the open and close is considered the most important.

This area, the “body” of the candle, is filled with blue (or white for most charting programs) for closes higher than open, and is filled with red (or black from most charting programs) for down days. The wicks above and below constitute the “shadow” of the candle, or high or low.

No pattern is 100% correct, but these formations are often time incorporated into many mechanical systems and can provide as great information source for the naked eye.

Doji – When the open and close price is almost the exact same value and the tails are not excessively long. This formation can alert investors of a possible indecision and during oversold or overbought conditions can possibly signal for reversal. The bulls and bears are equally pushing the price.

Long-Legged Doji – You can recognize this formation by one or two long tails (shadows). This formation will sometimes alert that we have reached the top of the market or warn that the trend has lost sense of direction.

Gravestone Doji – This formation occurs when the open and close price is the same or near the low of the bar (period). Although this can be found at the bottom of a trend, this formation can be used to pick out market tops.

Hanging Man – This formation looks like a body with feet dangling… or a hanging man. This occurs when there is profit taking near market open, then a rally with a close at or near the open price. This formation can alert of a reversal and is typically found at the top of an up-trend. The longer the shadow, the greater the change is for a reversal.

Hammer – This formation is a short body with a tail that is twice the body’s length. This occurs when there is a sell off near open, but then a rally supports a close at or near the open. This formation can alert of a reversal and is typically found at the bottom of a downtrend. The longer the shadow, the greater the changes are of reversal.

Spinning Top – This short body has sizable tables both on the top and bottom of the bar. This formation often times represents indecision and a standoff among the bears and bulls. There is little movement between the open and close, but both the bears and the bulls were active that trading day. After a long blue candlestick, a spinning top suggests weakness among the bulls. After a long red candlestick, a spinning top suggests weakness among the bears.

Bearish Engulfing Pattern – This formation is a major reversal pattern after the completion of an uptrend. After a blue candlestick, the next day will open above the previous day’s positive close, throughout the trading day it will blow past the previous days open completely engulfing the previous day’s movement.

Bullish Engulfing Pattern – This formation is a major reversal pattern after the completion of a downtrend. After a red candlestick, the next day will open below the previous day’s negative close, throughout the trading day it will blow past the previous days open completely engulfing the previous day’s movement.

Evening Star – This is a top reversal signal suggesting that prices will go lower. It is formed after an obvious uptrend. The 1st candlestick is a long blue box (usually when the confidence had peaked). This stick is followed by a small blue body, when the trading range for the day has remained small. The third bar (red) plows down at least 50% past the 1st day’s bar signifying that the bears have taken control.

Morning Star – This is a bottom reversal signal suggesting that prices will go higher. It is formed after an obvious downtrend. The 1st candlestick is a long red box followed by a small blue box, when the trading range for the day has remained small. The third bar (blue) shoots up at least 50% over the 1st day’s bar signifying that the bulls have taken control.

Dark Cloud Cover – This is a two bar formation that is found at the end of an upturn or at a congested trading area. The first bar is a blue (positive movement) bar followed by a red bar which reaches over the open of the previous days close and closes at least 50% down the previous days bar.

Piercing Pattern – This is a two bar formation that is found at the end of a declining market. The first bar is a red (declining movement) bar followed by a blue bar which opens (often gaps) below the previous days close and reaches at least 50% of the previous days bar.

Dear Traders ,If you want to know more about any other formation ..Just send me mail

Technically Yours

Anirudh Sethi

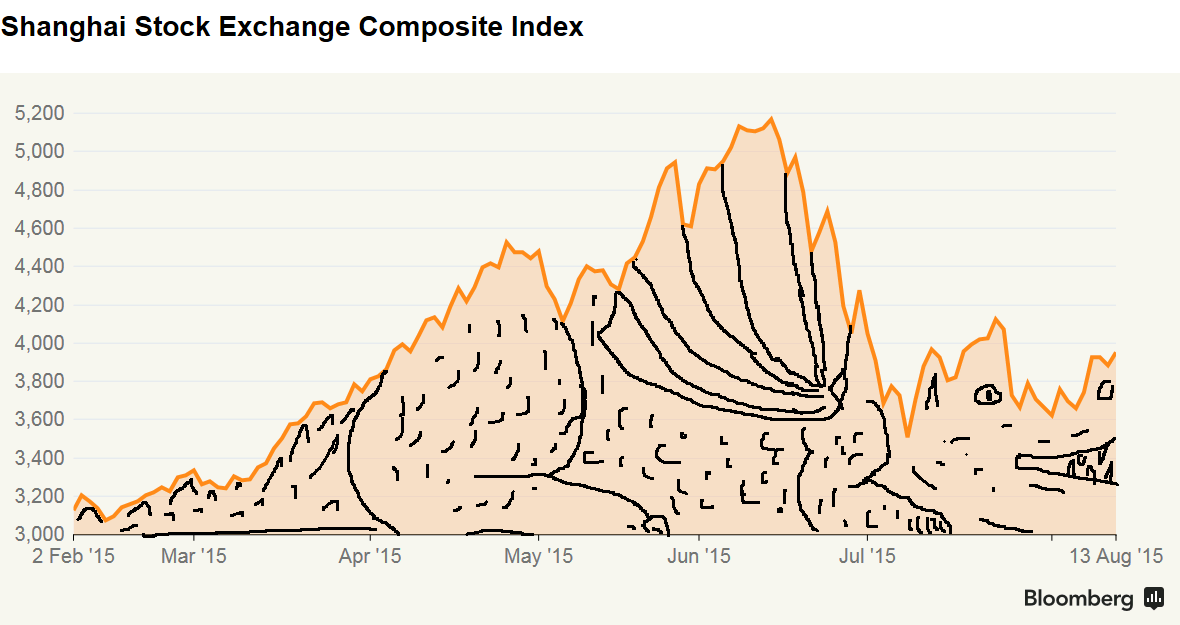

in to the main streets. Real estate is one of the sectors where prices have scaled up. Automobile followed with cements and capital goods are also under the ambit of excess flow of funds resulting over capacity bubble .Asset prices and commodity prices are also under the threat of excess valuation.

in to the main streets. Real estate is one of the sectors where prices have scaled up. Automobile followed with cements and capital goods are also under the ambit of excess flow of funds resulting over capacity bubble .Asset prices and commodity prices are also under the threat of excess valuation. given by banks without taking care of any quality measures on the loan papers. Its juts like US mortgage case where quality of loans was never taken in to account. China’s 9.35 trillion yuan of loans in 2009 have given birth to the fear of another financial

given by banks without taking care of any quality measures on the loan papers. Its juts like US mortgage case where quality of loans was never taken in to account. China’s 9.35 trillion yuan of loans in 2009 have given birth to the fear of another financial crisis in the fastest growing economy.

crisis in the fastest growing economy.