“At the end of each trading day (week) you shouldn’t focus solely on your P/L. Instead, focus on your thought process during the day and how well you executed your plan. If you consistently execute your trades according to plan and still lose money, then you need to reevaluate your approach. While there is definitely a cyclical rhythm to the market, no strategy will always work. You need to constantly and objectively review what is working and what is not so you can make necessary adjustments to you plan.”

“At the end of each trading day (week) you shouldn’t focus solely on your P/L. Instead, focus on your thought process during the day and how well you executed your plan. If you consistently execute your trades according to plan and still lose money, then you need to reevaluate your approach. While there is definitely a cyclical rhythm to the market, no strategy will always work. You need to constantly and objectively review what is working and what is not so you can make necessary adjustments to you plan.”

Latest Posts

rssMindTraps-Great Book

I read a great book on trading psychology, called MindTraps by Roland Barach. MindTraps focuses on how the average person tends to think, compared to how we need to think to make money over time in the markets.

I read a great book on trading psychology, called MindTraps by Roland Barach. MindTraps focuses on how the average person tends to think, compared to how we need to think to make money over time in the markets.

Here’s a summary of points that can benefit you as a trader:

- 1.Before entering any trade, you should consider the other side of the trade and state the reasons you’d take the other side of the trade. This helps you objectively enter a trade with a full understanding of the major risks that involved.

- Analyze your behavior from the beginning to the end of the trading process (from idea generation to entry and finally to exit) – what are the areas you can improve to help your trading profitability the most?

- Keep a trading journal of your thoughts on open positions and new ideas – writing things down helps you objectively look back and see where you went right and wrong.

- Fear blinds us to opportunity; greed blinds us to danger – emotions cause “perceptual distortion” where we only see the part of the picture that our beliefs allow us to see.

- We are likely to continue doing things for which we are rewarded -this can cause us to get too bullish after the bulk of the uptrend has occurred, or get too bearish near the lows.

- Fear of regret slants stock market behavior toward inaction and conventional thinking – the person who is afraid of losing is usually defeated by the opponent who concentrates on winning (an analogy for sports fans is the Prevent defense in football – playing “not to lose” only prevents you from winning).

- Can’t have a personal agenda to prove your self-worth in the markets – the focus must be on following your plan to maximize the ability to make money.

- Don’t get overly attached to any one view on a stock or market – don’t talk to others about open positions; it just makes it that much harder to exit when your plan says it should.

- Our predictions are only as good as the information available to us – objectively look at the indicators and data you use, to get the best quality of information and focus available

- People prefer for gains to be taken in several pieces to maximize their feeling good about their ability, while they prefer to take all their losses in one big lump to minimize the pain they feel.

- People prefer a sure gain compared to a high probability of a bigger gain, so they can say they made a profit; in contrast, people will speculate on a high probability of a bigger loss over a sure smaller loss, because they don’t want to feel like a loser. In trading, we must flip around the conventional emotions to allow us to let profits run while cutting losses shorter.

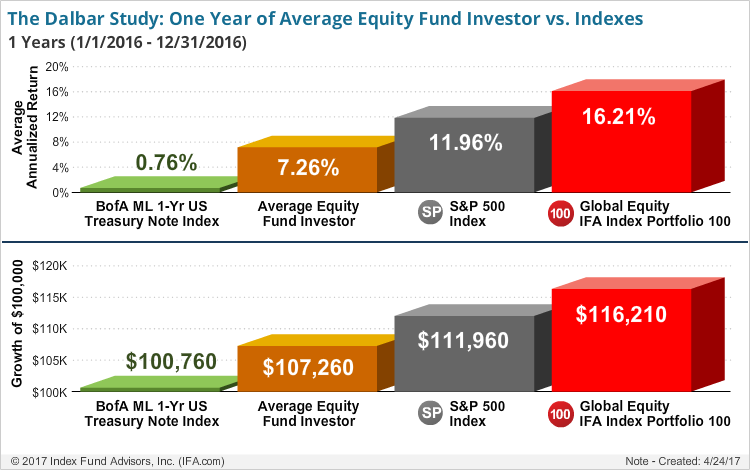

Interesting DALBAR study covering 2016 inclusive):

12 Things -Your Must Learn From Paul Tudor Jones About Investing and Trading

1. “Certain people have a greater proclivity for [macro trading] because they don’t have the need to feel intellectually superior to the crowd. It’s a personality thing. But a lot of it is environmental. Many of the successful macro guys today, they’re all kind of in my age range. They came from that period of crazy volatility, of the late ’70s and early ’80s, when the amount of fundamental information available on assets was so limited and the volatility so extreme that one had to be a technician. It’s very hard to find a pure fundamentalist who’s also a very successful macro trader because it is so hard to have a hit rate north of 50 percent. The exceptions are in trading the very front end of interest rate curves or in specializing in just a few commodities or assets.”

There are many ways to make a profit by trading and investing. For example, venture capitalists buy mispriced optionality and traders buy mispriced assets based on factors like momentum. Comparing value investing with what Paul Tudor Jones does for a living is interesting. What could be more anti-Ben Graham and value investing than a statement like: “We learned just to go with the chart. Why work when Mr. Market can do it for you?”

“While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape and proud of it.”

Set out below are some statements by Paul Tudor Jones that reveal a bit about his trading style:

“When I think of long/short business, to me there’s 5 ways to make money: 2 of those are you either play mean reversion, which is what a lot of long/short strategies do, or you can play momentum/trend, and that’s typically what I do. We’ve seen cheap companies get cheaper many, many times. If something’s going down, I want to be short it, and if something’s going up, I want to be long it. The sweet spot is when you find something with a compelling valuation that is also just beginning to move up. That’s every investor’s dream.”

“I love trading macro. If trading is like chess, then macro is like three-dimensional chess. It is just hard to find a great macro trader. When trading macro, you never have a complete information set or information edge the way analysts can have when trading individual securities. It’s a hell of a lot easier to get an information edge on one stock than it is on the S&P 500. When it comes to trading macro, you cannot rely solely on fundamentals; you have to be a tape reader, which is something of a lost art form. The inability to read a tape and spot trends is also why so many in the relative-value space who rely solely on fundamentals have been annihilated in the past decade. Markets have consistently experienced “100-year events” every five years. “ (more…)

Thermodynamics and the Market

Does Prigogine’s principle have any predictive market implications?

Well if you move from thermodynamics to information theory entropy, and consider the information content of market prices, then there are two clear analogies:

1. There should be local, transient edges (Prigogine, market prices self-organizing to minimize the rate of information loss).

2. Those edges are decaying (Second Principle, “Changing cycles”).

Trading Goals

"What if hidden in your greatest difficulty was actually your greatest opportunity."

The Goal of Successful Trader (Only 5% Traders )

It doesn’t get easier, you just get better. Or do you?

It doesn’t get easier you just get better. That’s a phrase often used in professional sport but when it comes to trading the harder you try, the more hours you watch the charts doesn’t necessarily mean you will get better at trading. With trading, it’s about understanding how to replicate an edge again and again with good risk management.

As time goes on you are either going to get better or worse at applying your edge. It’s black or white you’ll either be making money or losing money and if you are losing money it will be because you are continually switching edges and not applying sold risk to reward on your trades. Making money is a simple process of replicating an edge but it never gets easier and you will never be able to pick the winners, it’s a game of probabilities that requires you to win more than you lose and replicate it again and again.

Why can’t everyone do it? It’s because the outcome on each edge is random and you don’t know which trades (your edge) will be the winning ones and which ones will be the losing ones. That’s why trading is emotional for people because they feel like they’ve tried hard, worked hard on “getting the system right” and when it presents on the screen they expect certainty. Certainty does not exist, probability is what exists and unless you can learn to deal with random probability and let go of certainty you won’t likely get better as a trader. Apply a simple edge, ensure it has solid risk to reward and focus on replicating the edge over 50 trades. You will then have something that you can measure the success over a series of trades and look to see if you can improve the edge and money management.

You Want To Be A Modern "Trader": Here Are The Requirements