What impacts most in Machine learning

1. The losing position wasn’t my fault, the market moved against me.

1. The losing position wasn’t my fault, the market moved against me.

2. The trade was right and the market wrong.

3. I just have bad luck.

4. Eventually the stock will go up (or down)…eventually.

5. Bigger size equals bigger profits.

6. No need to close the postion just yet. I can average down.

7. Because I made so much money on the last trade I can take on more risk the next.

8. If the market is going down I can’t make any money.

9. I need to trade a larger account in order to be a better trader.

10. I’ve had many winners in a row, so now I need a big loser.

Any of these resonate with you? I am sure there are others but there is not enough room here to elaborate. Besides, I need to get back in the market. It can’t move without me!

Selecting the one or two super trades should consume most of your time. There’s a great deal of work and thinking to be done in comparing markets, finding the best Open Interest play and carefully reviewing the premiums. The average tendency is to rush over this section of trading simply because it seems more productive to look at all the technical wiggle-waggles.

Selecting the one or two super trades should consume most of your time. There’s a great deal of work and thinking to be done in comparing markets, finding the best Open Interest play and carefully reviewing the premiums. The average tendency is to rush over this section of trading simply because it seems more productive to look at all the technical wiggle-waggles.

In actuality, as I’ve said so many times, unless you are fundamentally right in your initial selection decisions, all the technical tools will do is get you in trouble. Please devote all your concentration and energies to the selection of your commodities before you give the technical data any consideration at all. Technical data is secondary to screening out the potential big winning trades.

The only technical tool to look at during this screening is the ten week moving average trend line. For a bullish situation it should be slanting up; for a bearish market, it should be slanting down.

by Larry Williams, excerpt from his book, How I Made $1,000,000 Trading Commodities Last Year.

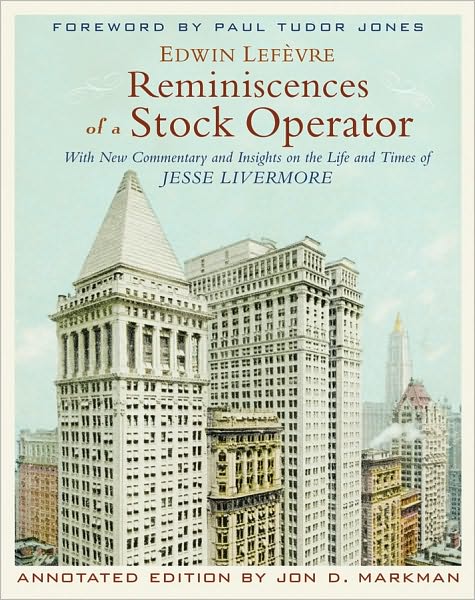

“History Lessons for Investors: An annotated reissue of Edwin LeFevre’s

Reminiscences of a Stock Operator is reviewed by hedge-fund manager and

author Victor Niederhoffer.”

IMAGINE THAT MASTER NOVELIST and chess

aficionado Vladimir Nabokov wrote a fictional memoir about

Capablanca—the 1920s world champion who never made a mistake on the

board—and that Bobby Fisher then published an updated and annotated

version, incorporating all of the important developments of modern

chess strategy, along with a foreword by Anatoly Karpov.A similar multilayered feast on investment is now available, with minor differences. Edwin Lefevre’s Reminiscences of a Stock Operator

is a novel told in the first person by a character inspired by

legendary trader Jesse Livermore. This classic is now graced with

extensive annotations by investment advisor Jon Markman and a foreword

by hedge-fund manager Paul Tudor Jones.The result is big and beautiful, cutting across two centuries of

booms and busts and market and economic history, with a myriad of

vintage historical photos and instructive historical charts throughout.One of Lefevre’s favorite adages is that there’s nothing new on Wall

Street. The similarity between the financial panic of 2008 and the 1907

panic recounted in the book is a prime example.The numerous squeezes, manipulations,

insider trading, government hauling in of scapegoats and frauds settled

for pennies on the dollar that Lefevre and Markman recount are horses

that are found as well in the modern stable.

Full article here.

Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules, and they have no respect for the status quo. You can quote them, disagree with them, glorify and vilify them. About the only thing you can’t do is ignore them because they change things. They push the human race forward. And while some may see them as crazy, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.

Catecholamines, acetylcholine, and vasopressin, are three [among many] of the beneficial hormones and other helpful neuropeptides that are produced in specific brain frequencies. Studies have shown that acetylcholine is vital for long term memory. They have also found that when acetylcholine production [in the brain] is high, we experience boosts in our long-term memory. Individuals who have lower levels of acetylcholine usually struggle with tasks involving learning and memory. At the end of your day listening to Traders Mindset produces the neuropeptide vasopressin – a neuropeptide which improves reaction time, ability to learn, and ability to remember.

It is not only our production of neuropeptides that allows us to learn more effectively we experience decreased blood pressure, heart rate, and our entire body feels relaxed. This boosts the overall oxygen level in our brains and maximizes blood flow to our cortex. This naturally boosts our attention span and level of alertness. Boosted attention and alertness makes it much easier to memorize and learn new things.

All successful traders use methods that suit their personality; You are neither Waren Buffett nor George Soros nor Jesse Livermore; Don’t assume you can trade like them.

All successful traders use methods that suit their personality; You are neither Waren Buffett nor George Soros nor Jesse Livermore; Don’t assume you can trade like them.

What the market does is beyond your control; Your reaction to the market, however, is not beyond your control. Indeed, its the ONLY thing you can control.

To be a winner, you have to be willing to take a loss; (The Stop-Loss Breakdown)

HOPE is not a word in the winning Trader’s vocabulary;

When you are on a losing streak — and you will eventually find yourself on one — reduce your position size;

Don’t underestimate the time it takes to succeed as a trader — it takes 10 years to become very good at anything; (There Are No Shortcuts)

Trading is a vocation — not a hobby

Have a business/trading plan

Identify your greatest weakness, Be honest — and DEAL with it

There are times when the best thing to do is nothing; Learn to recognize these times

(Nothing Doing)

Being a great trader is a process. It’s a race with no finish line.

Other people’s opinions are meaningless to you; Make your own trading decisions

(The Wrong Crowd)

Analyze your past trades. Study what happened to the stocks after you closed the position. Consider your P&L game tapes and go over them the way Vince Lombardi Bill Parcells reviewed past Superbowls

Excessive leverage can knock you out of the game permanently

The Best traders continue to learn — and adapt to changing conditions

Don’t just stand there and let the truck roll over you

Being wrong is acceptable — staying wrong is unforgivable

Contain your losses (Protect Your Backside)

Good traders manage the downside; They don’t worry about the upside

Wall street research reports are biased

Knowing when to get out of a position is as important as when to get in

To excel, you have to put in hard work

Discipline, Discipline, Discipline !