Latest Posts

rssThe Psychology of Setting Goals

Blue Channels & Many More are Major Culprits

Time – Space – Reality – Oneness – Markets

What do the above all have in common? That’s right, “nonlinear” concepts!

It is interesting that one of the great minds of humanity, Albert Einstein spent his time on “nonlinear” concepts such as “time, space, reality, and oneness.” I find it more interesting that the interdependence of these “nonlinear” concepts is what makes a market tick as well.

It is interesting that one of the great minds of humanity, Albert Einstein spent his time on “nonlinear” concepts such as “time, space, reality, and oneness.” I find it more interesting that the interdependence of these “nonlinear” concepts is what makes a market tick as well.

As a trader, “timing” your trade within the “market” is based on “reality” in relation to the “oneness” of other traders and your outcome is determined by the “space” or movement of your position.

It is my opinion based on consulting with many traders that most traders incorrectly view the markets from purely a “linear” mindset and instead should view the markets from a “nonlinear” mindset as the markets are “nonlinear” themselves. This is why rigid logical thinkers or “linear intellectuals” find trading the markets so frustrating. Since they operate from their logical “linear” “beta” mind state, and become frustrated when market behavior does not do what it “should.” This is also why I feel that successful trading has to be both “art” & “science.”

Think about how you approach the markets and to what degree you are a “linear” vs. a “nonlinear” mindset. Also try and remember a trade or trading day where it seemed effortless and you just “let-go” and flowed with the market. In days like these, I’ll bet logical thinking was secondary to enjoying yourself, and selecting trades based on both your trading “tools” and your “intuition” which represents trading the markets as an “art” & “science.” Compare that to days when you where frustrated because the market did not do what it was suppose to based solely on logical assumptions.

Usually fear and greed are by products of logical thinking. Fear and greed are emotions and “nonlinear” in concept, but created by “linear” thinking. Isn’t it interesting that fear and greed are present in the markets and are “nonlinear” as well. Or is it because fear and greed are “nonlinear” and that they are present in the markets?

Maybe the key to a good trading system should be based on how to measure or determine “nonlinear” market events such as fear and greed. The purpose of this article is to have you look at the markets from a “nonlinear” point of view so that you can perhaps “see” market relationships that where invisible to you before.

Berkshire Hathaway’s Willingness to Kill

I’m poring over the just-release 2014 annual letter to Berkshire Hathaway shareholders today and, as usual, I’m finding nuggets of wisdom on every single page.

One really interesting bit I wanted to pass on concerns a crucial benefit that their conglomerate structure offers. In countering the idea that Berkshire should break itself up or spin off some businesses to “unlock shareholder value”, Warren Buffett explains a key advantage that his collection of companies offers – beyond the obvious ability to self-fund.

He reminds his shareholders that being able to channel capital across opportunities and be willing to walk away from a dying industry is critical to the corporation’s longevity. He laments the twenty years between 1965 and 1985 that he allowed the legacy New England textile assets to decay before finally pulling the plug. He talks about the conflicts that a more singularly-focused corporation might have when its central line of business goes into secular decline.

One of the heralded virtues of capitalism is that it efficiently allocates funds. The argument is that markets will direct investment to promising businesses and deny it to those destined to wither. That is true: With all its excesses, market-driven allocation of capital is usually far superior to any alternative. Nevertheless, there are often obstacles to the rational movement of capital. As those 1954 Berkshire minutes made clear, capital withdrawals within the textile industry that should have been obvious were delayed for decades because of the vain hopes and self-interest of managements. Indeed, I myself delayed abandoning our obsolete textile mills for far too long. A CEO with capital employed in a declining operation seldom elects to massively redeploy that capital into unrelated activities. A move of that kind would usually require that long-time associates be fired and mistakes be admitted. Moreover, it’s unlikely that CEO would be the manager you would wish to handle the redeployment job even if he or she was inclined to undertake it…

…At Berkshire, we can – without incurring taxes or much in the way of other costs – move huge sums from businesses that have limited opportunities for incremental investment to other sectors with greater promise. Moreover, we are free of historical biases created by lifelong association with a given industry and are not subject to pressures from colleagues having a vested interest in maintaining the status quo. That’s important: If horses had controlled investment decisions, there would have been no auto industry.

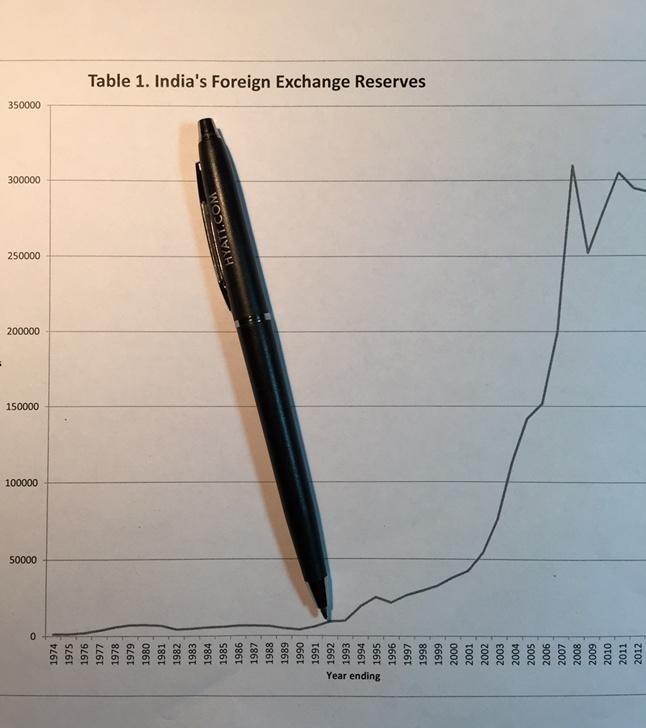

Graph of India's foreign exchange reserves 1974-2012. The pen marks the 1991-3 reforms. -Must see

10 Characteristics of Successful Traders

1) The amount of time spent on their trading outside of trading hours (preparation, reading, etc.);

2) Dedicated periods to reviewing trading performance and making adjustments to shifting market conditions;

3) The ability to stop trading when not trading well to institute reviews and when conviction is lacking;

4) The ability to become more aggressive and risk taking when trading well and with conviction;

5) A keen awareness of risk management in the sizing of positions and in daily, weekly, and monthly loss limits, as well as loss limits per position;

6) Ongoing ability to learn new skills, markets, and strategies; (more…)

Thought For A Day

Help Wanted: Humans Need Not Apply-video

Universal Lessons

What follows are some of the most well-known investment disciplines along with a lesson or two from each that every investor should be able to use in their own strategy.

Focused Value Investing: Buying stocks that are underpriced in relation to their intrinsic value.

Lesson(s): It’s important to invest from the perspective that stocks represent an ownership interest in a business. You get your share of corporate profits from the stocks you own and over the long-term the value of the business should be reflected in the stock price.

Quantitative Investing: Using a systematic, mathematical approach to make buy and sell decisions within a portfolio.

Lesson(s): A rules-based, objective approach to investing is a great way to take out the emotions which can trip up so many investors and introduce biases into the investment process. Automating good decisions can reduce costly mistakes.

Technical Analysis: Studying charts, past prices and volume for security and market analysis by using patterns.

Lesson(s): An understanding of the history of the financial markets is extremely important to be able to define your tolerance for risk and gain the correct perspective on what couldhappen in terms of gains and losses. And at the end of the day markets rise and fall because of supply and demand.

Index Investing: Owning the entire market/index at a low cost.

Lesson(s): Beating the market is hard. Keeping your expenses, activity and turnover to a minimum is a prudent way to earn your fair share of the market’s return over time. (more…)