Stock traders are the world’s worse at making poor trading decisions while denying that poor decisions were made in the first place. It is a disease called denialism and it starts when a trader abandons his rules (or worse yet has none), and trades whatever feels or looks right whenever it feels or looks right Once the trade is entered, denialism begins to spread like a cancer looking for its next body part to attack. The disease grows in stages, with each successive stage sucking more life out of its victim.

Latest Posts

rssBuffett's answer to "When did you know you were rich?" is as good as it gets

Howard Seidler-Trading Quotes

The single most important element to being successful in the markets is having a plan. First, a plan forces discipline, which is an essential ingredient to successful trading. Second, a plan gives you a benchmark against which you can measure your performance.

It’s important to distinguish between respect for the market and fear of the market. While it’s essential to respect the market to assure preservation of capital, you can’t win if you’re fearful of losing. Fear will keep you from making correct decisions.

Jesse Livermore -Great Quote

5 Market Insights from Paul Tudor Jones

Paul Tudor Jones is one of the most emblematic figures in the hedge fund industry. His best percentage returns happened during severe market corrections: 126% after fees in 1987 when U.S. markets lost a quarter of their market cap in one day. 87% in 1990 when the Japanese stock market plunged. 48% during the tech crash of 2000-2001. He returned 5% in 2008. His funds have underperformed in the past 8 years. He charges 2.75% management fee and 27% performance fee, which significantly above the industry average of 2 and 20.

Outside of financial markets. PTJ founded the Robin Hood foundation, which attempts to alleviate problems caused by poverty in NYC.

The biggest conundrum when studying successful money managers is do you pay attention to what they are doing today or do you focus on what they were doing before they became widely popular, were managing a lot less money and had a lot higher returns?

Here PTJ talks about how new powerful trends often start – basically, a big price expansion from a long base.

The basic premise of the system is that markets move sharply when they move. If there is a sudden range expansion in a market that has been trading narrowly, human nature is to try to fade that price move. When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion.

PTJ on risk management

If I have positions going against me, I get right out; if they are going for me, I keep them… Risk control is the most important thing in trading. If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.

USD -Euro Index :Update

Refresh your memory and see from ,What level Iam Bullish in USD an US Dollar INDEX.

Above is the Monthly chart.

My Target intact :Heading towards –81.91-82.87 level very soon.

Already last week ,I had given alert :Below 136 level it will be major problem for Euro.

I expect 130.83-129.12 level.

Will update more to our Forex Traders.

Updated at 8:14/19th Feb/Baroda

The 7 Habits of Highly Successful Traders

Traders must have the perseverance to stick to trading until they break through to success. Many of the best traders are just the ones that had the strength to go through the pain, learn, and keep at it until they learned to be a success.

- Great traders cut losing trades short. The ability to accept that you are wrong when a price goes to a place that you were not expecting is the skill to push the ego aside and admit you are wrong.

- Letting a winning trade run as far as it can go in your time frame is crucial to having big enough winners to pay for all your small losing trades.

- Avoiding the risk of ruin by risking only a small portion of your capital on each trade is a skill to not get arrogant and trade too big, if you risk it all enough times you will lose it all eventually.

- Being reactive to actual price action instead of predictive of what price action will be is a winning principle I have seen in many rich traders. Letting price action give you signals is trading reality, trading your beliefs about what price should be is wishful thinking.

- Great traders are bullish in bull markets and bearish in bear markets, until the end when then trend bends.

Great traders care more about making money more than any other thing. Proving they are right, showing off, or predicting the future is not as important as hearing the register ring.

If You Want to be Uncommon You have to do Uncommon Things -Paul Tudor Jones

Selflessness

The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

So how it is possible that you and millions like you can create the greatest illusionist, the market, and ironically fight against it in every moment of your trading life.

In other words, the market becomes the ultimate enemy of yours and you fight it all the time? As an unit reflection of the market’s image, can you defeat yourself?

Your fight can only be as good as your best, but you create your enemy with your best as well.

That is why this is an endless game because no one can win it all the time as no one can keep beating himself all the time… UNLESS YOU ARE A SELFLESS PERSON. (more…)

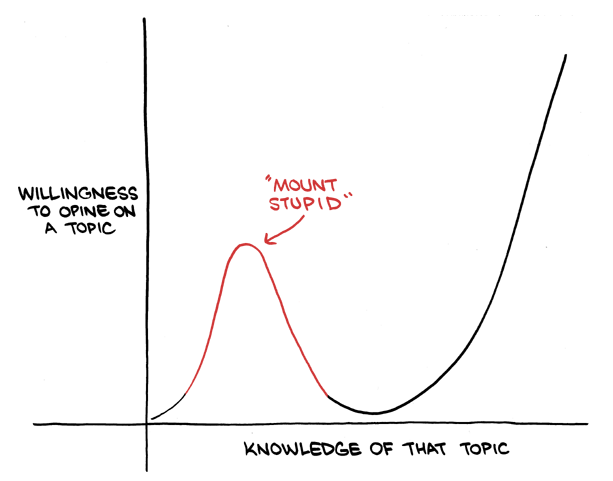

Mount Stupid