- Are you trading because you want to trade? Consider trading a business not a game.

- Are you not trading? This is the opposite of trading too often. You may be so scared of taking a loss that you avoid trading altogether.

- If you get stopped out of several stocks, walk away.Paper trade until the profits return.

- Follow the system.Would you be making more money if you followed your trading signals? Understand why you’re ignoring the signals you receive.

- Don’t overtrade.Sometimes the best place for cash is in the bank. You don’t HAVE to trade.

- Learn from mistakes. Review your trades periodically. It’ll uncover bad habits.

- Focus on the positive. The loss your suffered today pales to the killing you made last week.

- Ignore profits. If you find yourself getting nervous about a winning trade or making too much money, then concentrate not on the bottom line but on improving your trading skills. Get used to making too much money.

- Obey your trading signals. Otherwise, what are you trading for? Plan your trade and trade your plan.

- Don’t trade when you’re upset.This also goes for being too excited.

- Abandoning a winning system. Don’t become bored with your winning system and search for new, more exciting ways to lose money.

Latest Posts

rssOne of the most LMAOest stuff i received in a long time.

Be Yourself

Everyone in this business will tell you how to be and what to do, but the bottom line is that you’ve got to always be yourself – flaws, emotions, stupidity, and all.

Everyone in this business will tell you how to be and what to do, but the bottom line is that you’ve got to always be yourself – flaws, emotions, stupidity, and all.

There’s a saying that the stock market is an expensive place to figure how who you really are but I completely disagree. Through the many years I’ve been trading, I’ve learned much more about myself and the way I am both good and bad than I think I would have any other way. And, for that I’m so very grateful.

It is with little doubt that my experience in the markets have in turn made me into a much better human being. For example, one who thinks before acting, one that appreciates the importance of looking at situations from different points of view, one that knows that you can do everything right but still be wrong, one that understands the influence that emotion has on decision-making, one that remembers that no matter what mistakes you and I make today – tomorrow we will have another opportunity to do better. I’ve learned a great deal more, but I think you get the point.

Speaking of which, a number of people have asked me recently that if train people to “be more like me” in my mentorship group. The truth is that I try my darndest to never do that. My goal with those who I personally mentor is to help them become who they really are and, by extension, to take full advantage of their own personality and skills whatever they may be and at whatever level they currently are. The primary problem, however, is that many of us really believe the key to success is to be more like others whether it be Warren Buffett, David Einhorn, George Soros, Doug Kass, Jim Chanos, Whitney Tilson, Jim Cramer, or whoever you admire and respect. As you know, one of the fastest growing businesses on the Internet right now is to enable you in new and exciting ways to trade and invest just like others, but in my view, that will only take you so far in your personal journey. In the markets, sooner or later, you have to find your own path!

Each of us have our own skills, strengths, weaknesses and personalities and matching those with a strategy you can use and develop over time is the closest key to your future success that I can help you with.

Bottom line – don’t be like me or anyone else for that matter, but instead just be yourself. Use this time in your life to find ways to take full advantage of your own God-given talents and skills as you develop them. While it is ok and, in fact recommended, that you try to learn as much as you can from others (I know I have), at the same time you must also understand and appreciate that to true key to success is to find your own path just like every trader and investor who you so admire right now has already done.

"It's not the daily increase but daily decrease. Hack away at the unessential." — Bruce Lee

Power production growth slips to 1.73% in March, lowest in 17 months.

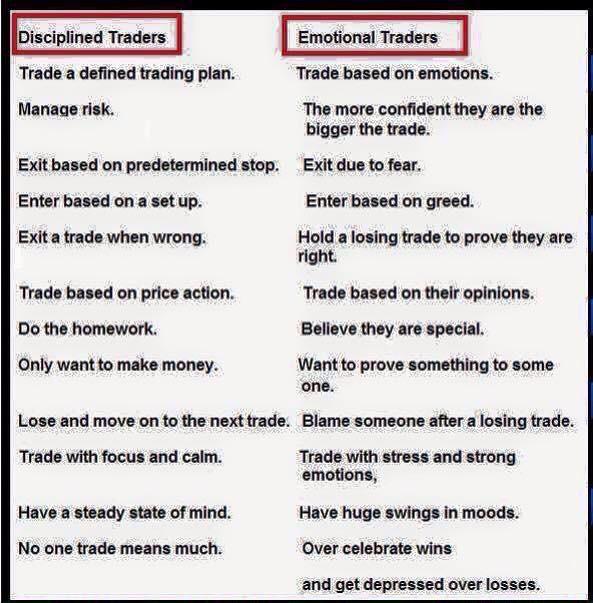

Discipline vs. Emotions

Thought For A Day

Greece Prepares To Sue Wall Street

The only benefit of hitting rock bottom is you can’t really fall further. Which is precisely what has happened with Greece. The little country that started off the chain reaction that has already led to a currency and liquidity crisis, and made the solvency crisis in Europe all too tangible, by belonging to a monetary union it had no place in (a union which no reason to exist in the first place), is once again reminding the world of its existence, this time by G-Pap opening his mouth and inserted two whole legs in it. In an interview with CNN’s Fareed Zakaria to be aired today, G-Pap has threatened he may sue US banks for “contributing” to his country’s debt crisis. For those of you lacking in analogy skills, Greece is in the same shoes as a bankrupt debtor who wants to sue his creditors for daring to hike up his interest rate when the only means he has to roll his debt is by using another credit card (this one issued by US and European Taxpayers), even as bankruptcy is literally hours away. The Greek summation: that of a petulant 5 year old who has just broken dad’s favorite gadget: “We have made our mistakes,” Papandreou said. “We are living up to this responsibility. But at the same time, give us a chance. We’ll show you.” Now that would be amusing – after Greece destroyed its economy the first go round, we can’t wait to see what the country does for an encore. The only reason Greece is not bankrupt now is because even as its past mistakes have caught up with it and climaxed in a solvency and liquidity crisis unseen since the Lehman days, the country’s end would bring down all of Europe. If Greece would not have impaired French, German and UK banks, the country would have long been allowed to default. Yet diversion is always a good tactic: let’s bring the “speculators” into this yet again. After all it is unheard of in these turbulent Keynesian times for anyone, especially our own Fed Chairman, to own up to their endless mistakes. It is always, without exception, someone else’s fault.

The only benefit of hitting rock bottom is you can’t really fall further. Which is precisely what has happened with Greece. The little country that started off the chain reaction that has already led to a currency and liquidity crisis, and made the solvency crisis in Europe all too tangible, by belonging to a monetary union it had no place in (a union which no reason to exist in the first place), is once again reminding the world of its existence, this time by G-Pap opening his mouth and inserted two whole legs in it. In an interview with CNN’s Fareed Zakaria to be aired today, G-Pap has threatened he may sue US banks for “contributing” to his country’s debt crisis. For those of you lacking in analogy skills, Greece is in the same shoes as a bankrupt debtor who wants to sue his creditors for daring to hike up his interest rate when the only means he has to roll his debt is by using another credit card (this one issued by US and European Taxpayers), even as bankruptcy is literally hours away. The Greek summation: that of a petulant 5 year old who has just broken dad’s favorite gadget: “We have made our mistakes,” Papandreou said. “We are living up to this responsibility. But at the same time, give us a chance. We’ll show you.” Now that would be amusing – after Greece destroyed its economy the first go round, we can’t wait to see what the country does for an encore. The only reason Greece is not bankrupt now is because even as its past mistakes have caught up with it and climaxed in a solvency and liquidity crisis unseen since the Lehman days, the country’s end would bring down all of Europe. If Greece would not have impaired French, German and UK banks, the country would have long been allowed to default. Yet diversion is always a good tactic: let’s bring the “speculators” into this yet again. After all it is unheard of in these turbulent Keynesian times for anyone, especially our own Fed Chairman, to own up to their endless mistakes. It is always, without exception, someone else’s fault.

Papandreou said the decision on whether to go after U.S. banks will be made after a Greek parliamentary investigation into the cause of the crisis.In the CNN interview, Papandreou said many in the international community have engaged in “Greek bashing” and find it easy “to scapegoat Greece.” He said Greeks “are a hard-working people. We are a proud people.”

“Greece will look into the past and see how things went,” Papandreou said. “There are similar investigations going on in other countries and in the United States. This is where I think, yes, the financial sector, I hear the words fraud and lack of transparency. So yes, yes, there is great responsibility here.” (more…)

How to Trade in Stocks by Jesse Livermore

I will just write what the market is going to do tomorow, for that just have some patience for time being till then few quotes from Jesse Livermore’s book How to Trade in Stocks (one of my favorites, originally written in 1940). Pay particular attention to the first quote!

- “Successful traders always follow the line of least resistance – follow the trend – the trend is your friend”

- “Wall Street never changes, the pockets change, the stocks change, but Wall Street never changes, because human nature never changes”

- “Just because a stock is selling at a high price does not mean it won’t go higher” (more…)

Characteristics of Successful Trader

- Successful traders have absolute control over their emotions, they never get too elated over a win and too depressed over a loss.

- Successful traders seldom think of prices too high or low.

- Successful traders do not panic, they make adjustments rather than revolutionary changes to their trading style. (more…)