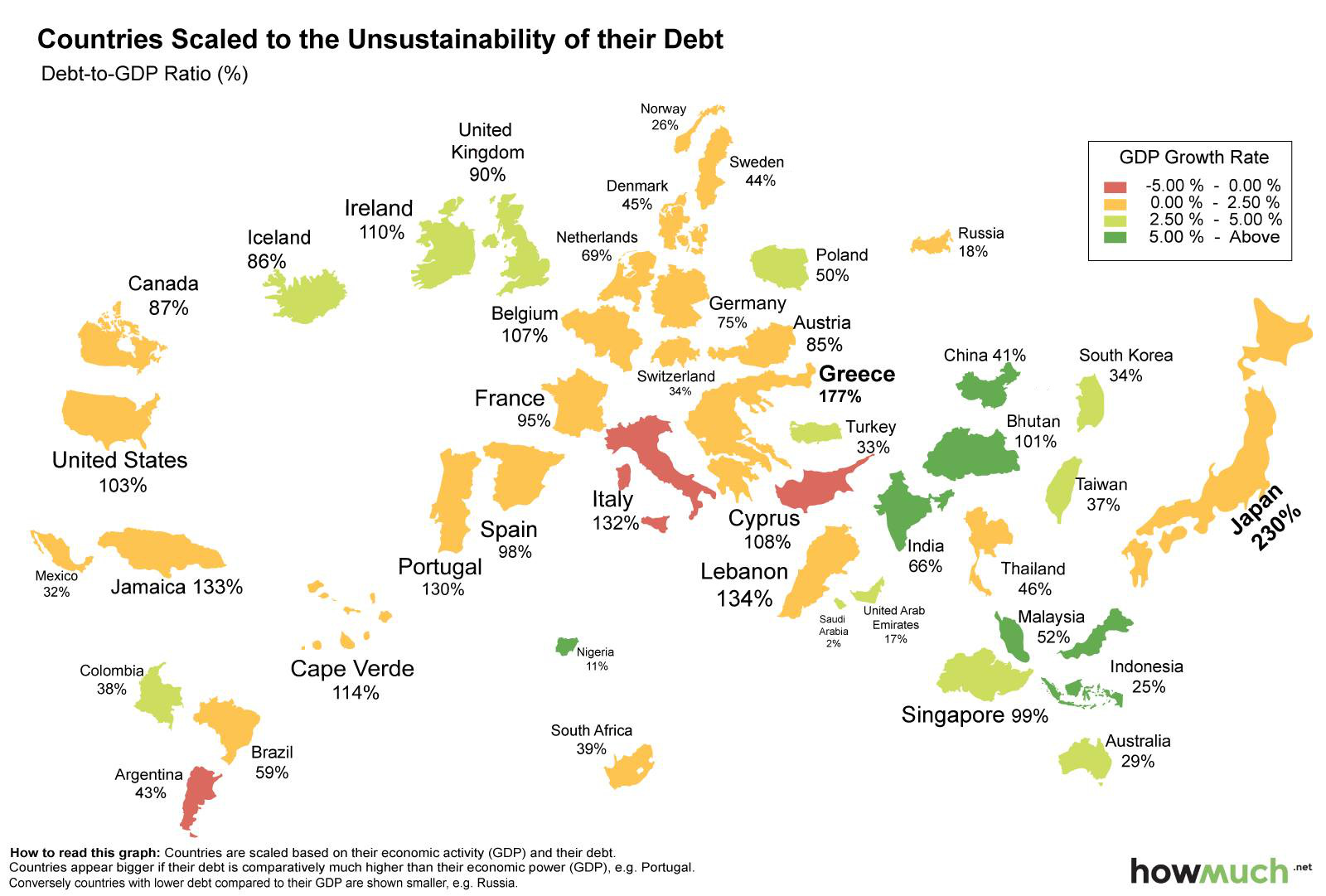

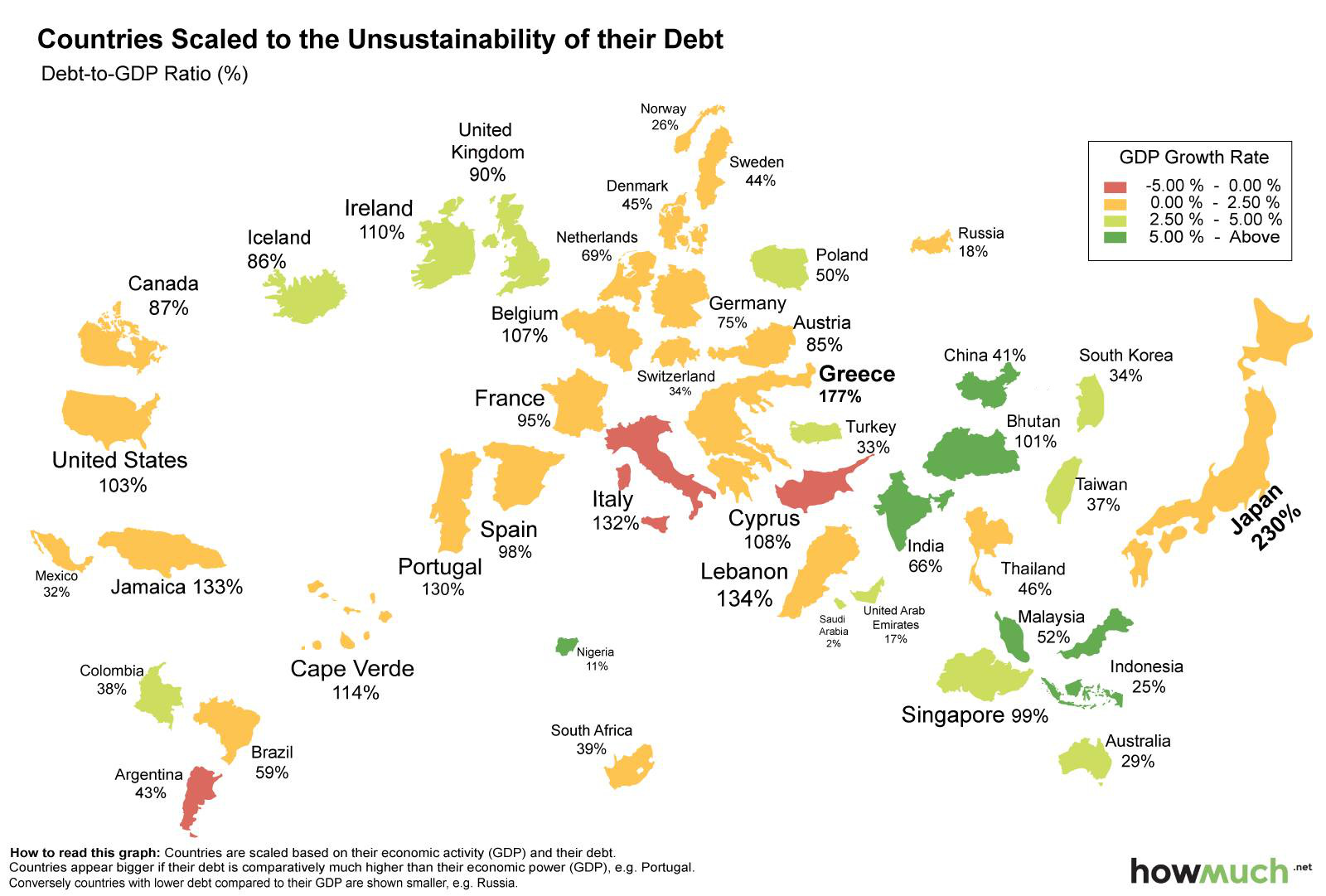

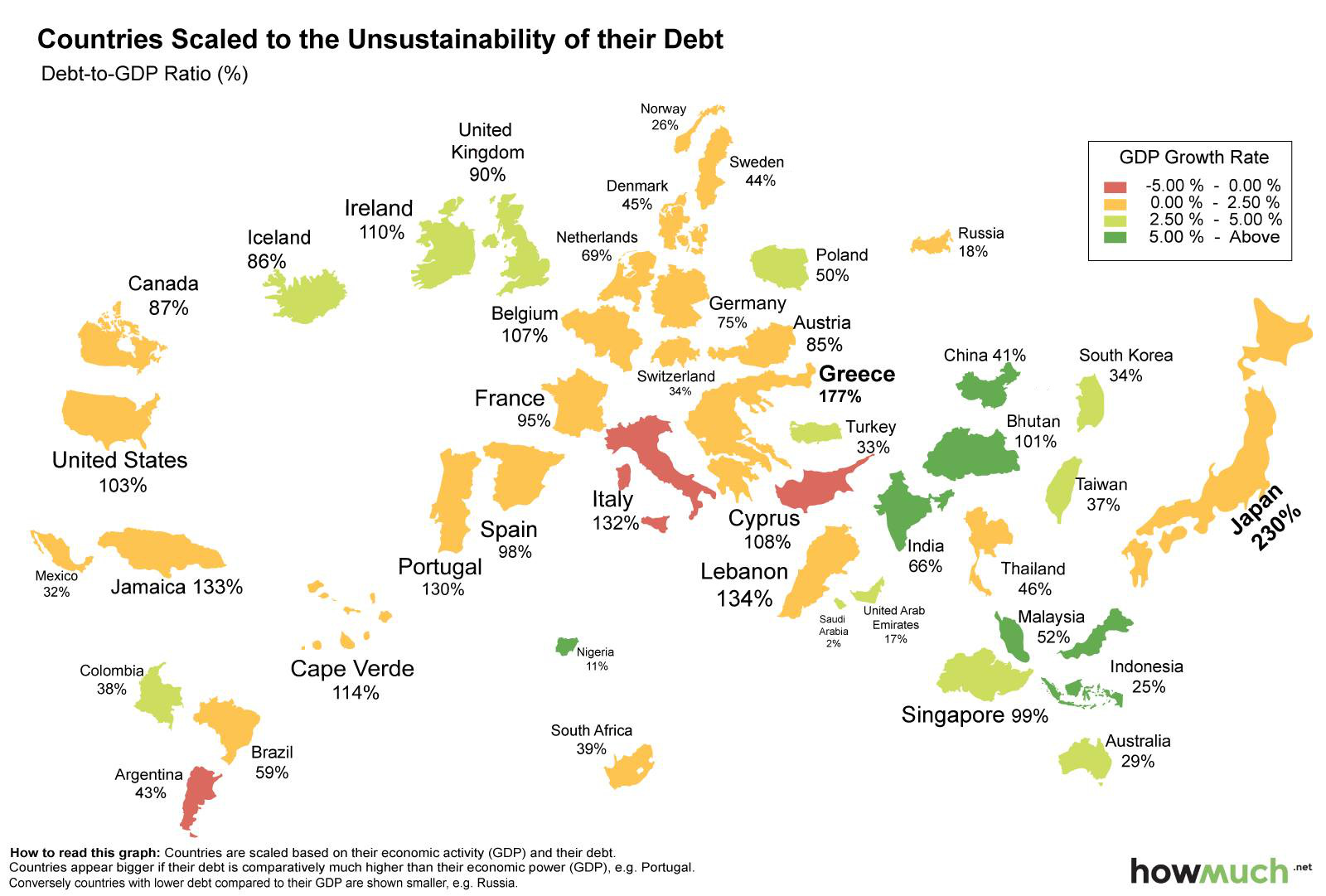

The World Map of Debt

Q: Doctor, I’ve heard that cardiovascular exercise can prolong life. Is this true?

Q: Doctor, I’ve heard that cardiovascular exercise can prolong life. Is this true?

A: Your heart only good for so many beats, and that it…don’t waste on exercise. Everything wear out eventually. Speeding up heart not make you live longer; it like saying you extend life of car by driving faster.

Want to live longer? Take nap.

Q: Should I cut down on meat and eat more fruits and vegetables?

A: You must grasp logistical efficiency. What does cow eat? Hay and corn. And what are these? Vegetables. So steak is nothing more than efficient mechanism of livering vegetables to your system. Need grain? Eat chicken. Beef also good source of field grass (green leafy vegetable). And pork chop can give you 100% of recommended daily allowance of vegetable product.

Q: Should I reduce my alcohol intake?

A: No, not at all. Wine made from fruit. Brandy is distilled wine, that mean they take water out of fruity bit so you get even more of goodness that way. Beer also made of grain. Bottom up! (more…)

Everyday receiving hundreds of emails for Subscriptions and many Traders are asking these type of questions …….

Q: Genie has granted you three wishes to help you improve your trading/investing skills. What would you ask the Genie?

Q: Genie has granted you three wishes to help you improve your trading/investing skills. What would you ask the Genie?

A: I would ask for three things: 1) better statistical analysis skills, 2) more time to devote to mechanical strategy development and research, and 3) straightforward guidance on what I need to do to improve the performance consistency of a few of my stock screens. The good thing with all three of these is that I don’t really need a “genie” to give it to me as each are within reach as long as I devote the time and effort.

1. Stubbornly holding onto losses.

1. Stubbornly holding onto losses.

2, Buying on the way down in price.

3. wanting to make a quick and easy buck.

4. Buying on tips, rumors, split announcements, and other news events, stories, or opinions you hear from supposed market experts on TV.

5. Selecting second-rate stocks because of dividends or low P/E ratios.

6. Buying because of old names you’re familiar with.

7. Being afraid to buy stocks that are going into new high ground in price.

8. Cashing in small, easy-to-take profits while holding the losers.

9. Not being able to make up your mind when a decision needs to be made.

10. Concentrating your time on what to buy and once the buy decision is made, not understanding when or under what conditions the stock must be sold.