Latest Posts

rssRead Something (Very Rare ) about Jesse Livermore

Indecision and the Win

Watching cricket (or the same could be applied to baseball for the Americans or football for the Europeans and Brits…and South Americans and…) I have often considered how structured and polished the performances are– clean batting, clean bowling and clean fielding.

When is a risk taker going to be coach? When will some one bring the advantages of risk and a polished team into play?

Indecision must bring opportunities.

Why couldn’t a fielding team (that’s getting flogged or maybe not flogged) start to miss EASY field returns, but have a back up plan–thereby allowing for the batting team to be lured into a second run and capitalise on the often poor communication between batters looking for a run out.

Many other ideas and ways of creating opportunities to take advantage of a situation could be put in play. It seems most areas are not being explored.

Markets certainly don’t have those problems with a muliple of false break outs catching everyone on the hop, and whether we like it or not, keeping the game interesting.

Seven habits of successful traders

1) Understand the true realities of the markets. 2) Be responsible for your own trading destiny. 3) Trade only with proven methods. 4) Trade in correct proportion to your capital. 5) Manage risk. 6) Stay long-term oriented. 7) Keep trading in correct perspective and as part of a balanced life. The common theme is self-control. As I’ve often said, if you can master yourself, you can master the markets

1) Understand the true realities of the markets. 2) Be responsible for your own trading destiny. 3) Trade only with proven methods. 4) Trade in correct proportion to your capital. 5) Manage risk. 6) Stay long-term oriented. 7) Keep trading in correct perspective and as part of a balanced life. The common theme is self-control. As I’ve often said, if you can master yourself, you can master the markets

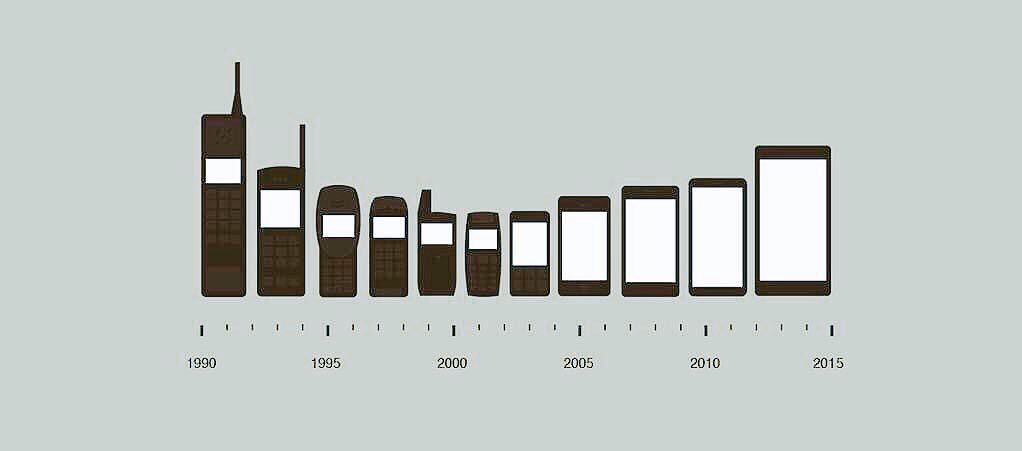

The mobile phone evolution

Job ad fail

Best Florist Sign Ever

Getting Started in Chart Patterns -Thomas Bulkowski (Book Review )

Thomas Bulkowski is probably the best known chart pattern researcher. Among his credits are theEncyclopedia of Chart Patterns and the three-volumeEvolution of a Trader. In this second edition ofGetting Started in Chart Patterns (Wiley, 2014), a book originally published in 2006 and newly revised and expanded with updated statistics, he introduces more than forty chart formations. Better yet, he explains how to trade using them.

Thomas Bulkowski is probably the best known chart pattern researcher. Among his credits are theEncyclopedia of Chart Patterns and the three-volumeEvolution of a Trader. In this second edition ofGetting Started in Chart Patterns (Wiley, 2014), a book originally published in 2006 and newly revised and expanded with updated statistics, he introduces more than forty chart formations. Better yet, he explains how to trade using them.

Although the title indicates that the book is for novices, it is equally valuable—perhaps even more valuable—for more experienced pattern traders. Without continually reviewing, testing, and revising pattern trading strategies, it’s all too easy to trade yesterday’s market.

In two action-packed chapters Bulkowski explores trendlines and support and resistance. He considers support and resistance to be “the most important chart patterns” because “they show how much you are likely to make and how much you are likely to lose on each trade. That’s like playing poker and knowing the hands of your opponents. You won’t always win, but it helps.” (p. 35)

Recipe for catching a reversal:

Ingredients: For this recipe you will need one (1) well-known or “classic” technical chart pattern on a daily time frame, preferably near the high or low of the mid-term price range. When your pattern of choice has been observed, you will then need to collect at least two (2) or more instances of public expressions of sentiment which confirm the prognostication of said pattern: pre- or post-market media bytes, business news website headlines, confident/fearful declarations on your favorite trading forum, or any other variety of before-the-fact assumption.

Ingredients: For this recipe you will need one (1) well-known or “classic” technical chart pattern on a daily time frame, preferably near the high or low of the mid-term price range. When your pattern of choice has been observed, you will then need to collect at least two (2) or more instances of public expressions of sentiment which confirm the prognostication of said pattern: pre- or post-market media bytes, business news website headlines, confident/fearful declarations on your favorite trading forum, or any other variety of before-the-fact assumption.

Preparation: When the above ingredients have been secured, wait for a daily close which would confirm “ripeness” of the pattern. Next morning, enter a stop order at the confirmation price in the opposite direction of pattern breakout to initiate position. If stop is triggered, immediately enter protective stop at prior low/high.

Parboiling: If market moves quickly in your favor, take profits on at least a partial portion; mentally “set aside” closed profit for re-entry if market pulls back towards initial entry price with next few days. If pullback manages to hold above prior high/low, re-enter full position at your discretion.

Cooking: Set protective stop for entire position at breakeven and let sit undisturbed for a few days or more if possible.

Presentation: Dish is ready when “failure” point of pattern is breached; serve at market or with trailing stop, whichever you prefer.

Facebook, Amazon, Netflix, and Google: Over $440 Billion in Cap Creation Over 2015.India's Forex Reserve Just $ $352.515 Billion