Hard to deny the logic. But if you don't like this one, what does yours look like?

Brent crude has been looking slightly cheaper on the cut in demand forecast and the 108.30/50 level is still the level that needs to be broken for a push up.

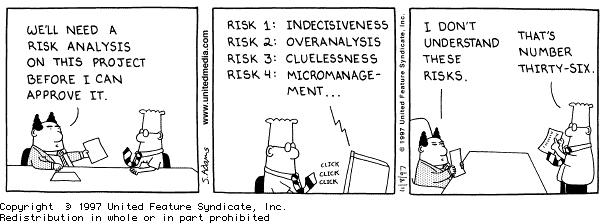

I offer my list of Investors’ 10 Most Common Behavioral Biases. There are a number of others, of course, and more will continue to be uncovered. But I think that these are the key ones. Your suggestions of important ones I have missed are welcome.

Continually strive for patience, perseverance, determination, and rational action.

Just look at weekly chart.

-Once breaks and closes below 322 level for 2 consecutive days.

-Stock will crash to kiss 298-293 level.

Any Rise ,Sell it & Enjoy Bloodbath in coming days.

(Only 1 or 2 Bank stocks are looking Hot for Bull’s otherwise huge unwinding not ruled out in coming days )

-But Thirsty Future Traders ,Concentrate on weak stocks only.This stock will die its natural death…..Sell Sell Sell.

-Big Vertical fall will start any time.

101% ,Don’t hold long in any ADAG Stocks.

Techically downslide will continue.

-Any Revival Sell Sell Sell.

Now about this stock.I expect price level of 881-815 level.Have patience then only trade and make position in this stock or in any ADAG Stock.

-Yes ,Stock will crash to kiss 881-815.

Don’t trade blindly.I will update more to my Subscribers.

Updated at 11:22/23rd Feb/Baroda

1. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape and proud of it.

1. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape and proud of it.

2. I see the younger generation hampered by the need to understand and rationalize why something should go up or down. Usually, by the time that becomes self-evident, the move is already over.

3. When I got into the business, there was so little information on fundamentals, and what little information one could get was largely imperfect. We learned just to go with the chart. Why work when Mr. Market can do it for you?

4. These days, there are many more deep intellectuals in the business, and that, coupled with the explosion of information on the Internet, creates an illusion that there is an explanation for everything and that the primary test is simply to find that explanation. As a result, technical analysis is at the bottom of the study list for many of the younger generation, particularly since the skill often requires them to close their eyes and trust price action. The pain of gain is just too overwhelming to bear.

5. There is no training — classroom or otherwise — that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it.

6. Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic.

7. That cotton trade was almost the deal breaker for me. It was at that point that I said, ‘Mr. Stupid, why risk everything on one trade? Why not make your life a pursuit of happiness rather than pain?’

8. If I have positions going against me, I get right out; if they are going for me, I keep them… Risk control is the most important thing in trading. If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.

9. Losers average down losers

10. The concept of paying one-hundred-and-something times earnings for any company for me is just anathema. Having said that, at the end of the day, your job is to buy what goes up and to sell what goes down so really who gives a damn about PE’s? (more…)