After Having position in market …do u pray ?see What Mark Ritchie says pic.twitter.com/1oGvcoOP2G

— Anirudh Sethi (@anirudhsethi71) January 19, 2016

Latest Posts

rssTHE NEED FOR INDEPENDENCE

You need to do your own thinking. Don’t get caught up in mass hyste-ria. As Ed Seykota pointed out, by the time a story is making the cover of the national periodicals, the trend is probably near an end. Independence also means making your own trading decisions. Never listen to other opinions. Even if it occasionally helps on a trade or two, listening to others invariably seems to end up costing you money-not to mention confusing your own market view. As Michael Marcus stated in Market Wizards, “You need to follow your own light. If you combine two traders, you will get the worst of each.”

You need to do your own thinking. Don’t get caught up in mass hyste-ria. As Ed Seykota pointed out, by the time a story is making the cover of the national periodicals, the trend is probably near an end. Independence also means making your own trading decisions. Never listen to other opinions. Even if it occasionally helps on a trade or two, listening to others invariably seems to end up costing you money-not to mention confusing your own market view. As Michael Marcus stated in Market Wizards, “You need to follow your own light. If you combine two traders, you will get the worst of each.”

A related personal anecdote concerns another trader I interviewed in Market Wizards. Although he could trade better than I if he were blindfolded and placed in a trunk at the bottom of a pool, he still was interested in my view of the markets. One day he called and asked, “What do you think of the yen?” The yen was one of the few markets about which I had a strong opinion at the time. It had formed a particular chart pattern that made me very bearish. “I think the yen is going straight down, and I’m short,” I replied. (more…)

"To be at the top of your game – you must constantly evolve and adapt to your surroundings."

Risk explained for economists and fragilistas

Are You a Gambler or a Trader?

Here is a quick checklist to see if you are a bad gambler or a good trader:

|

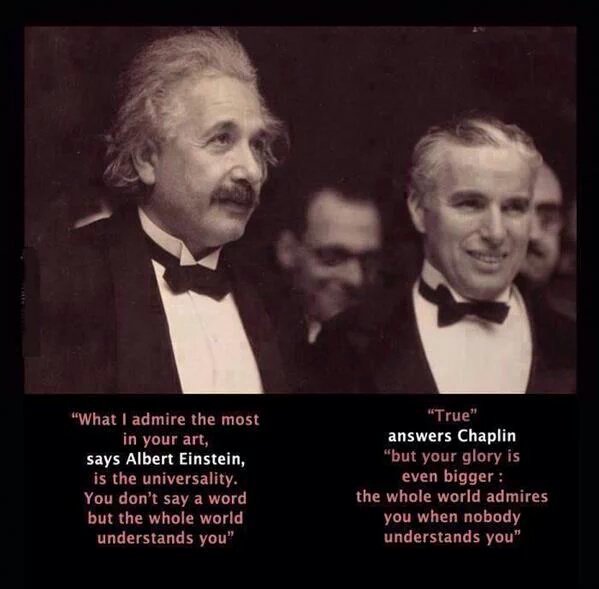

Two great minds showing each other great respect

"Never risk more than 1%…Keeping risk small and constant is absolutely critical."

Jim Grant on Wacky Federal Finances

Brief Eight-Decade History of Volkswagen-VIDEO

//

Trading Notes for Traders

Traders should work on replacing subjectivity with cut and dry analysis. Keep yourself in a box and stick with what you know. The markets are complicated enough without our tendency to over analyze. All a trader needs is to learn how to read a small number of indicators and trade them well. Find a niche; your own niche. Simplification not complication makes a successful trader. When contemplating a trade think first and foremost about how much you are willing to lose before you attempt to calculate your expected gain. A stock is, at any given time, in the process of testing a specific price level. Questions that make a trading decision valid: WHY are you considering a trade? WHEN will you enter it? WHERE do you see it going? Multiple time frame correlation is important for high probability trades. Let the chart tell you its story. OBEY your rules of engagement…ALWAYS. Be well paid to be a follower. Loss of mental capital (drive, will, confidence) is greater than loss of monetary capital. Let the price action CONFIRM your trade analysis. Example: let a break-out test the break-out first. Trading Errors: The “Fudge” Factor 1. Trying to catch a falling knife. 2. Picking Tops 3. Failure to wait for confirmation. 4. Lack of patience. 5. Lack of a clear strategy. 6. Failure to assume responsibility. 7. Failure to quantify risk. |