#Germany’s producer prices drop way faster than expected. PPI -0.6% in Oct YoY vs forecast of -0.4%, lowest since 2016.

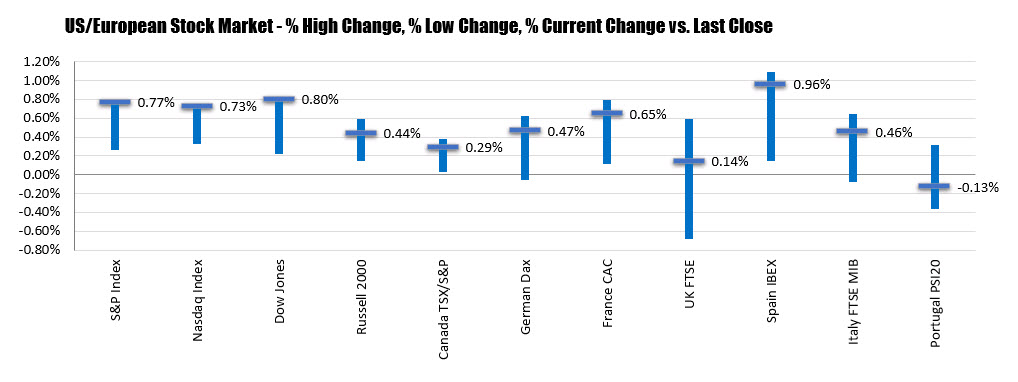

the major European stock indices are ending the session mostly lower. The provisional closes are showing:

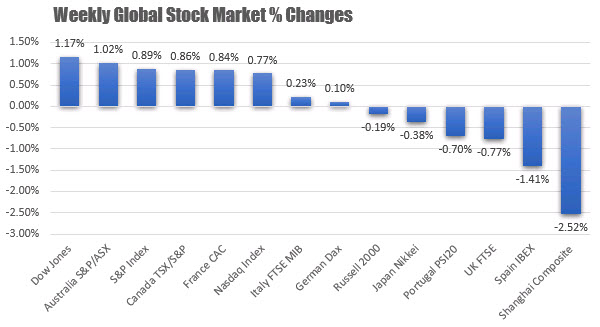

For the week, the Dow was the biggest gainer of a sample of major indices. The Shanghai composite index was the biggest decliner at -2.52%.

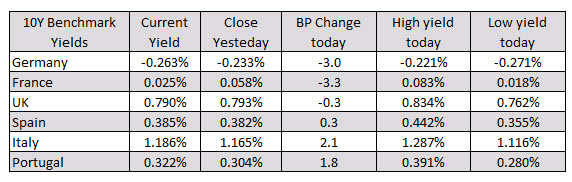

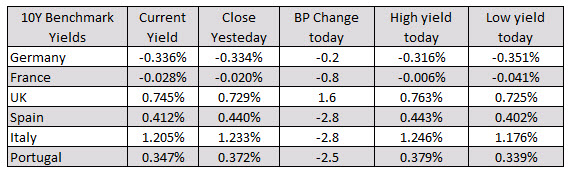

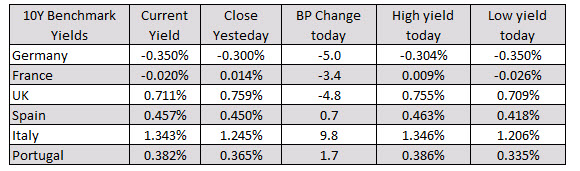

A look at the benchmark 10 year yields is showing a mixed picture with Germany France and UK yields moving lower, while the more risky Spain Italy and Portugal moving higher.

Japanese stocks are lower as tariffs continue to be a niggling issue in US-China trade talks. We had Trump threaten more tariffs – should talks not go well – in his speech before a WSJ report noted that both sides are still struggling to find common ground on the matter.