Comments by China premier Li Keqiang, via state media

- Will accelerate upgrade of manufacturing sector

- Will keep macro policies stable to achieve targets for 2019

- Will use counter-cyclical adjustment measures more effectively

The world is now 188 trillion dollars in debt, and that number continues to grow rapidly each year.

It is a form of enslavement that is deeply insidious, because most of those living on the planet do not even understand how the system works, and even if they did most of them would have absolutely no hope of ever getting free from it. The borrower is the servant of the lender, and the global financial system is designed to funnel as much wealth to the top 0.1% as possible. Of course throughout human history there has always been slavery, and the primary motivation for having slaves is to extract an economic benefit from those that are enslaved. And even though most of us don’t like to think of ourselves as “slaves” today, the truth is that the global elite are extracting more wealth from all of us than ever before. So much of our labor is going to make them wealthy, and yet most people don’t even realize what is happening.

Let’s start with a very simple example to help illustrate this. (more…)

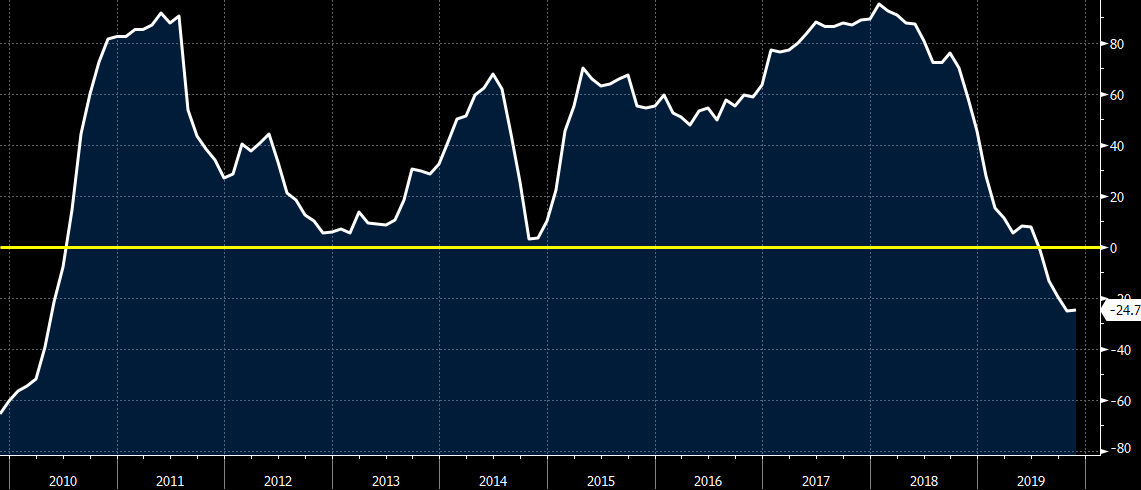

Moody’s downgraded its outlook on Britain’s debt (currently rated Aa2) to negative from stable after the market close on Friday, saying Brexit had been a catalyst for an erosion in the country’s institutional strength, perceived “material deterioration” in UK governance, and that the country’s ability to set policy has weakened in the Brexit era along with its commitment to fiscal discipline.

The outlook cut represents a catch down to its competitors: the UK is currently rated AA by S&P and AA- at Fitch Ratings, with both companies having the UK on negative watch.

“It would be optimistic to assume that the previously cohesive, predictable approach to legislation and policymaking in the UK will return once Brexit is no longer a contentious issue, however that is achieved,” the ratings agency said adding that “the increasing inertia and, at times, paralysis that has characterized the Brexit-era policymaking process has illustrated how the capability and predictability that has traditionally distinguished the U.K.’s institutional framework has diminished.”

“The decline in institutional strength appears to Moody’s to be structural in nature and likely to survive Brexit given the deep divisions within society and the country’s political landscape,” Moody’s added.

The decision to put the UK on negative outlook even as Moody’s affirmed Britain’s Aa2 long-term issuer and senior unsecured ratings comes one month before an election that is likely to determine the future of Brexit. While the election will have a big impact on Brexit, this week has seen both sides escalate their spending pledges, drawing election battle lines with plans to end a decade of U.K. austerity. (more…)

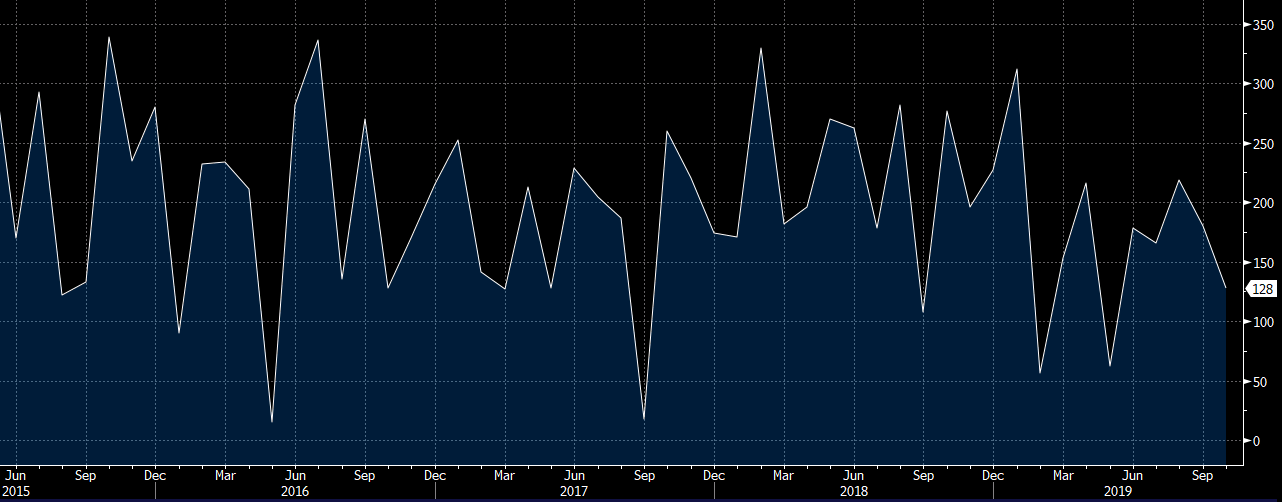

A total of 125 Japanese manufacturers have revised down their net profit forecasts for the current fiscal year by a sum of 939.3 billion yen ($8.6 billion), the largest collective downgrade in seven years, data compiled by Nikkei shows.

The wave of profit warnings stands in contrast to the upbeat forecasts of the nonmanufacturing sector, such as IT and services, and highlights the ripple effects of sluggish economic growth in China and other parts of the world.

Of the 171 manufacturing companies that have revised their earnings forecasts for the fiscal year ending March 31, 2020, about 70%, cut their forecasts, the largest proportion in seven years.

Upward revisions have totaled just 272.9 billion yen so far this fiscal year.

The downward revisions have already exceeded last year’s total of 832.5 billion yen. The total is the highest since 2012, when the figure reached 2.21 trillion yen.

The profit outlook for this fiscal year stands to get worse. Only 30% of companies have so far announced earnings results for the April-September period, indicating that the total figure for downgrades of profit outlooks could go much higher.

The auto industry felt the impact of slowing economic growth in China and elsewhere in the world. “The Chinese market is still tough, and its state is unclear,” said Ryuichi Umeshita, an executive at Mazda Motor, at a news conference on Friday. “The U.S. in the mass-market price range is also a struggle.” The company now expects net profit for the current year to decline to nearly 43 billion yen, just about half the previous forecast of 80 billion yen.

Suzuki Motor also cut its net profit forecast to below last year’s levels due to weak four-wheeler sales in India. Hino Motors sees sluggish sales in Asia. “The recovery in overseas demand has generally been slow,” said CEO Yoshio Shimo. Major automotive parts supplier Aisin Seiki has seen s fall off in demand for transmissions among local manufacturers in China.

Other manufacturers are being hit from a decline in corporate investment.

Mitsubishi Electric’s factory automation equipment sales are weak. “The demand for smartphones and 5G that was expected to recover in the second half of the year is likely to be pushed back,” said Tadashi Kawagoishi, a director at Mitsubishi Electric.

Hiroyuki Ogawa, President and CEO of Komatsu, said the scale of the decline in sales of construction machinery in China and elsewhere in Asia is “unexpected.”

In the nonmanufacturing industry, by contrast, more companies have revised their profit forecast upward than downward, led by solid earnings among small and medium enterprises.

As of early October, total net profits for Japanese companies was expected to be flat compared with the previous year. But if the downturn in manufacturing, which accounts for large share of profits, continues at this pace, the figure may decline for the second consecutive year.