Archives of “March 2021” month

rssWorld Bank predicts China’s economy will expand by 8.1% in 2021 (vs. 2.3% in 2020)

From the World Bank’s latest East Asia and Pacific Economic Update.

China’s economy will expand by 8.1% in 2021

- compared with 2.3% the previous year

7.4% region-wide expansion

- from 1.2 per cent in 2020

Excluding China growth will be 4.4% in East Asia and the Pacific

- 3.7% contraction the year before

More:

“COVID-19 is proving hard to suppress even a year after the first case was confirmed in Wuhan”

economic growth for individual nations “will depend on containing the novel coronavirus; their ability to take advantage of a revival of international trade; and the capacity of governments to provide fiscal and monetary support”.

Thought For A Day

US jobless claims drop to their lowest point since the pandemic began. First time the number has been under 700K during covid.

EURUSD lower for the third day in a row and trades to new 2021 low

Trades at lowest level since November 12

The EURUSD is trading lower for the 3rd day in a row. The price action is a little more choppy, but currently the price is down -4 pips at 1.1809. The low reached 1.1791. The close from yesterday reached 1.1813.

Technically, the pair broke away from the 200 day MA yesterday (currently at 1.1855). The last time the price was below the 200 day MA was back in May 2020 when the price was around 1.1000 (see green line in the chart above). Looking at the daily chart above, the pair today fell below the swing low from November 23rd at 1.17994 (call it 1.1800). A lower trend line cuts across at 1.17669. The price is seen a rebound and trades back above the 1.1800 level.

2% is the “proper place” for 10-year Treasury yields – JP Morgan Asset Management

The firm expects 10-year Treasury yields to eventually settle at 2%

After the recent volatility in the bond market, the firm’s chief investment officer, Bob Michele, says that the “proper place” for 10-year Treasury yields is around 2%. Adding that:

“We’re first likely to see some consolidation in the 1.5-1.75% range as quarter-end brings rebalancing in multi-asset class accounts, flows from pension funds and insurance companies taking advantage of the higher yields and flows from Japan.”

Thereafter, 10-year yields should move towards 2% and take real yields to about zero as based on the Fed’s inflation target.

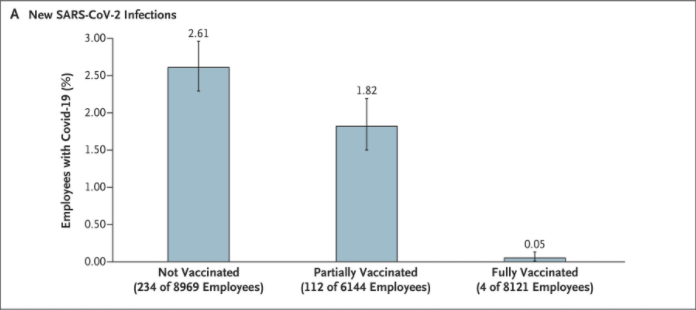

A small real-world study shows that the vaccine is working well among frontliners

A study shared by the New England Journal of Medicine

This is based on data from the University of Texas Southwestern Medical Center (UTSW), which started its vaccination program on 15 December last year to offer frontline employees either the Pfizer or Moderna vaccines based on emergency-use authorisation.

The study took into account vaccinations during the period of 15 December to 28 January and saw a total of just 350 of 23,234 employees, or 1.5%, who were eligible to receive the vaccine had been newly infected by COVID-19.

Although, 234 of those employees did not opt to be vaccinated so it is just the 116 of those who were partially or fully vaccinated that matters more in this study.

In particular, among those who were fully vaccinated i.e. received both vaccine shots, only 4 of 8,121 employees had been newly infected by COVID-19.

Just be mindful that there is some room for slippage error since employees with no infections detected between 15 December to 28 January will have their vaccination status on 28 January used as a benchmark for the result instead.

But for those who were infected by COVID-19, their vaccination status at the time is used to tabulate the findings so it is likely that any error is minimal in this instance.

This may be a small study but it does highlight the effectiveness of the vaccine in keeping frontliners safe. It also reaffirms the notion that the vaccine is not full proof and we also don’t really know how virus variants will affect its efficacy moving forward.

Oil, EUR heading down in Asia morning trade

Oil is lower and int FX EUR/USD has dropped under is overnight low on approach to 1.1800 now.

Cable weak also

AUD and NZD had ticked higher in preceding hours but those are now giving some back

Regional stocks lower

- HK’s Hang Seng is -1.4% (the tech index on HK is doing much worse, down circa 4%)

- Shanghai Comp -0.6%

- Nikkei 225 in the green for now at +0.15%

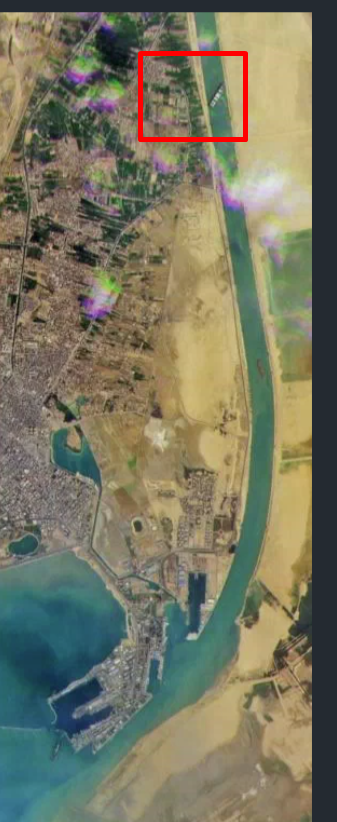

One estimate says it may take 6 days to free the ship stuck in the Suez canal

One of the impacts of the complete blockage of the Cana; has been a jump in oil prices.

Lloyds, the shipping insurance people, convey information saying the grounding of the similar-sized ship in 2016 (the 19,000 teu CSCL Indian Ocean on the Elb)e in 2016 took six days to re-float.

Ever Given is a 20,000 teu ship and is fully laden.

More from Lloyds:

around 165 vessels representing 13m dwt are currently either waiting at either end of the canal or blocked from exiting.

total includes:

• 41 bulk carriers (2.9m dwt) including six capes and 20 panamax and supramaxes. Two bulk ore carriers

• 24 crude tankers, including three VLCCs and nine suezmaxes

• 33 containerships, including four of 197,000 dwt-plus (including Ever Given) which puts them in the 20,000 teu category.

• 16 LPG or LNG carriers

• 15 product tankers including three long range two ships. These will likely be carrying 90,000-tonne cargoes of jet fuel or diesel to Europe or the Mediterranean.

• Eight vehicle carriers

ICYMI – China, Russia vulnerable to dollar risks as sanctions from West multiply

While we await a little more activity in the Asia timezone a catch-up piece ICYMI via Reuters on a ‘theoretical hazard for Russia and China accessing global financial payments:

- Given the influence of the dollar and U.S. banks in global financial flows, the United States dominates the Belgium-based SWIFT financial messaging service, a network used by banks across the world to make transactions. It could in theory use this influence to reduce other countries’ access to the global financial system.

Reuters cite as an example:

- Hong Kong leader Carrie Lam said last year she had to pile up cash at home as she was unable to open a bank account in the global financial centre since Washington sanctioned her after Beijing imposed a national security law on the city.