Eurozone February inflation data due today

After the broader rebound yesterday, the market is failing to find much reprieve on Tuesday so far with a lack of fresh cues to work with.

A firmer dollar is also making its way into the market narrative today and that is weighing on sentiment a little across the board, even as bonds remain calmer.

Asian equities are down alongside US futures, with the greenback keeping higher across the board. Notably, EUR/USD is testing its 100-day moving average while USD/JPY is slowly making its way towards the 107.00 handle.

Elsewhere, the pound’s upside momentum continues to stall as EUR/GBP keeps above key near-term levels around 0.8642-45 to trade around 0.8660 levels currently.

Oil is also down a little over 1%, trading back under $60 as traders get a bit jittery ahead of the OPEC+ meetings at the end of the week.

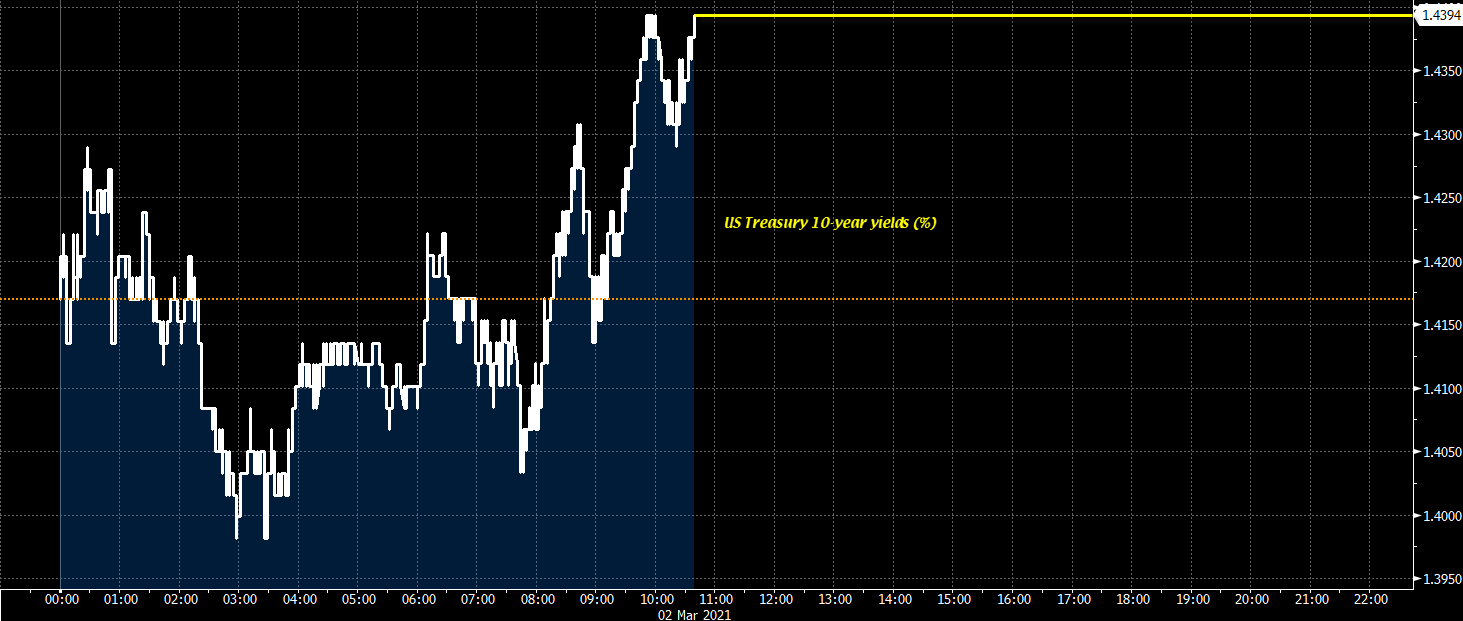

Risk sentiment remains the key focus with the market continuing to keep a watchful eye on bonds once again today. Fedspeak will be among the things to be mindful about this week and we’ll be getting more of that later today (I’ll outline in a separate post).

0700 GMT – UK February Nationwide house prices

Prior release can be found here. The surge in the housing market since last year – due to the stamp duty holiday – is running into a bit of moderation as of late and that might stay the case until there is a decision made on the stamp duty holiday expiration (which is set to carry on until 31 March for the time being).

0700 GMT – Germany January retail sales data

Prior release can be found here. After the massive slump in December, German retail sales is expected to improve slightly to start the new year but conditions are still relatively subdued due to lockdown measures still in place for most of Q1.

0855 GMT – Germany February unemployment change, rate

Prior release can be found here. German labour market data continues to be distorted somewhat by the furlough and short-time work schemes, so it is tough to really draw much conclusions from the report above still.

1000 GMT – Eurozone February preliminary CPI figures

Prior release can be found here. The main inflation reading is expected to keep steady at +0.9% y/y but the core reading is expected to fall slightly to +1.1% y/y from +1.4% y/y in January. Base effects will continue to play a factor in keeping the price trend more choppy and volatile in 1H 2021, so expect the ECB to keep brushing aside any positive ticks in inflation over the next few months.

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.