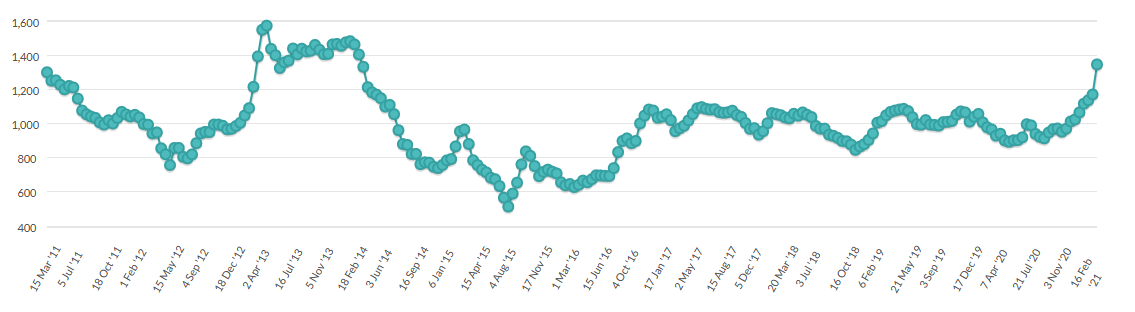

EUR/USD bounces from 1.20

Today’s dip below 1.20 in EUR/USD has been met by steady buying. Some USD selling is mixed in but it’s been an impressive rebound, rising a full cent from the lows.

The bounce comes even with the ECB’s Panetta saying that unwanted tightening in the market will not be tolerated. The ECB will get a chance to underscore that at the March 11 meeting.

With this bounce and the one in February, it’s getting tougher to bet against the euro, even with a lot of negative fundamentals in place. The problem is that the negative story is so well known. A slow vaccine rollout, negative yields and a dovish ECB is all priced in. Leaning against that are some decent valuations in asset prices.