Archives of “March 2021” month

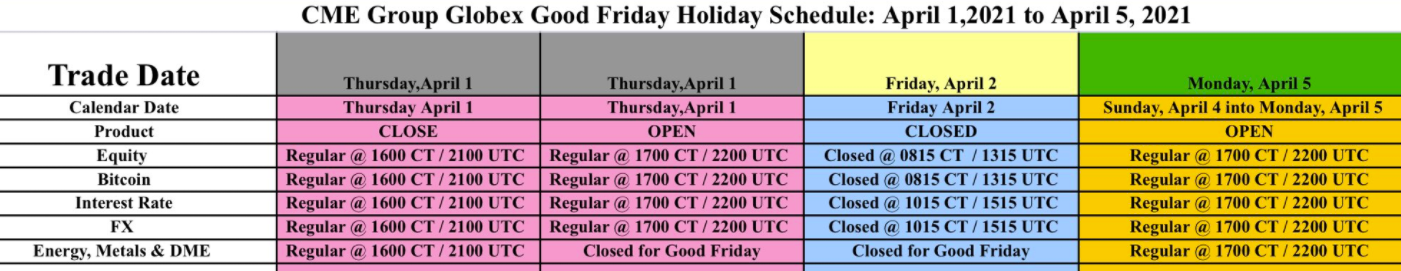

rssCME Group Globex Good Friday Holiday Schedule

Here is a summary pic of trading hours on the holiday Friday (April 2).

For further details, links to the CME here: 2021 CME Globex Trading Schedule

- and, more specifically here (Excel sheet): Good Friday1 – 5 April 2021

Latest picture from Mars.. Don’t know why I love looking at these.

A reminder of the OPEC+ meeting this week – rollover of existing output cuts expected

This will not be news to anyone following along. OPEC+ meeting is on April 1 (JMMC meets the day before)

Market consensus is for another rollover of OPEC production cuts. OPEC (especially Saudi Arabia) have been cautious on the demand recovery and that will not change at this meeting:

- renewed lockdowns in Europe

- the US is looking better (accelerating vaccination efforts)

- on the supply front, there is still plenty and the disruption from the Suez blockage will pass in coming weeks

Its Tuesday in Asia and the focus is already shifting to Wednesday

Wednesday 31 March will bring the latest PMI data from China and, during the US session Biden speaking on his US$3tln infrastructure plan.

For China, due at 0100 GMT on the 31st, China official PMIs for March

- Manufacturing expected 51.2, prior 50.6

- Non-manufacturing expected 52.0, prior 51.4

- Composite prior 51.6

For Biden, around half of the $3tln plan is expected to be announced (a second infrastructure announcement will follow at a later date) but markets could be more interested in any comment the Prez has on new taxes (the extent of the unwinding of the 2017 corporate tax cut and of course any increase to the top-end personal income tax rate).

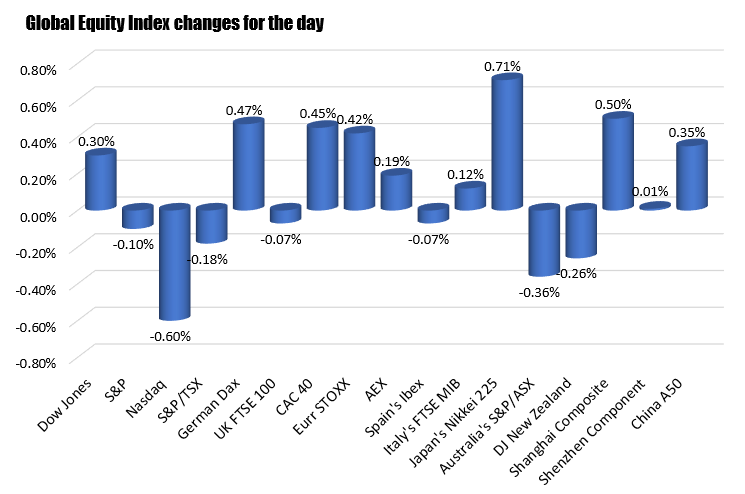

Dow posts a record close. Nasdaq underperforms.

Russell 2000 falls -2.8%

The Dow is closing at a record close. The Nasdaq lagged with the Russell 2000 of small-cap stocks taking it on the chin.

The final numbers are showing:

- S&P index fell -3.35 points or -0.08% at 3971.19

- Nasdaq fell -79.07 points or -0.60% at 13059.64

- Dow rose 98.43 points or 0.3% at 33171.31

- The small-cap Russell 2000 fell -62.8 points or -2.83% at 2158.50.

Below is a summary of him the % changes for the major global indices to start the trading week:

Yields rose with the yield curve steepening in the US today which has tended to weaken the high tech growth stocks.

- 2 year rose 0.7 basis points to 0.140%

- 10 year rose 3.3 basis points to 1.709%

- 30 year rose 3.0 basis points to 2.408%

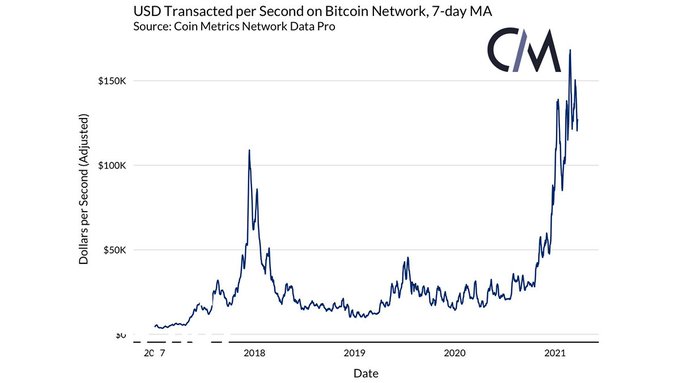

#Bitcoin hasn’t even overtaken a company in market capitalization yet. It’s just getting started.

Each red dot Red circle represents a headline in the news that called #Bitcoin “dead”, “failed”, or “worthless”.

#Bitcoin is now larger than the Australian Dollar (M1).

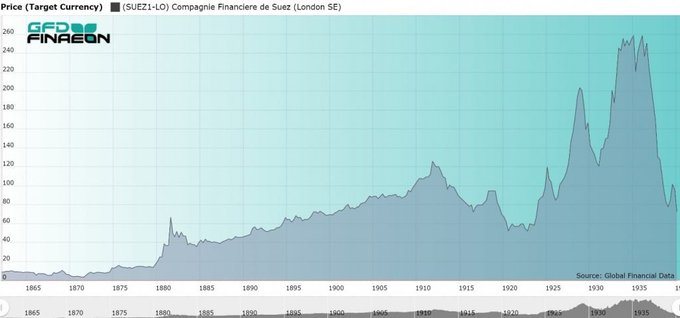

Did you know that the Suez Canal was a publicly traded company?

shows the stock returns from IPO in 1862 through the 1930s.