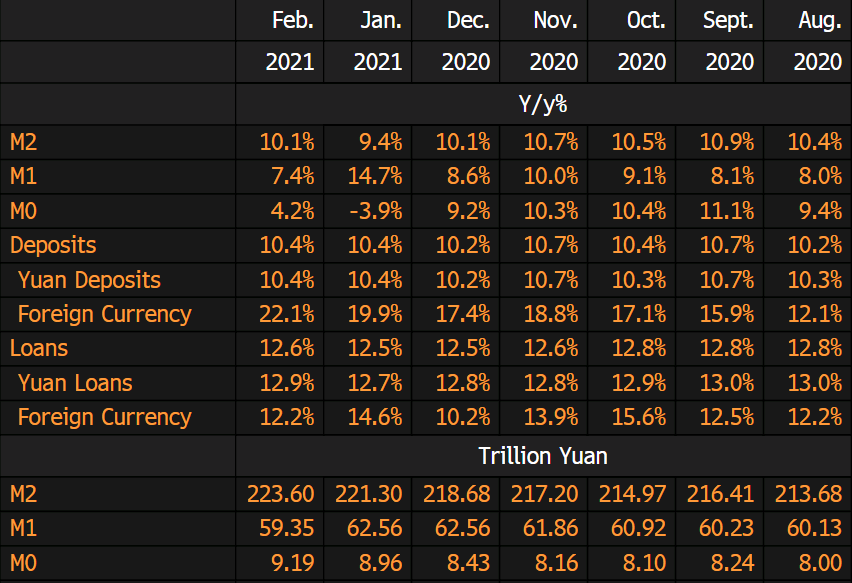

Latest Chinese credit data for February has been released – 10 March 2021

- Prior +9.4%

- New yuan loans ¥1,360.0 bn vs ¥950.0 bn expected

- Aggregate financing ¥1,710.0 bn vs ¥910.0 bn expected

Broad money growth kept on the higher side last month as Chinese authorities worked to keep liquidity and credit at sufficient amid the Lunar New Year holiday period. There isn’t much change to the big picture view though, as authorities are still trying to strike a fine balance in keeping a healthy supply of credit while keeping up deleveraging efforts.