Archives of “March 2021” month

rssDeutsche Bank’s end of 2021 US 10-Year yield forecast is 2.25%

Outdone by DB now, who have raised their forecast to 2.25% from 1.25% previously! And the 30-year yield to be 3%.

Citing

- vigorous growth and risks of upward pressure on inflation

- steady bearish steepening of the yield curve through year end as the economy reopens, Congress turns to a potential infrastructure package before fiscal 2022 begins in September, and the Fed forewarns the market of plans to taper QE asset purchases

DB expect the Federal Reserve prime markets for a 2022 taper beginning in the third quarter of 2021

US President Biden to make all adults eligible for vaccines no later than May 1

A White House official with a heads up on what Biden will speak about this evening (US time, speech begins at 8pm Eastern, which is 0100GMT)

Says Biden:

- will direct states to make all adults eligible for vaccines no later than May 1

- has the power to compel states to open up vaccines to all adults by May 1

- will set a target date of July 4 when Americans can get closer to normal

- will announce new website to help Americans figure out where to get vaccines

- will announce the deployment of 4,000 active-duty troops to help with vaccinations

Also

- will set a goal for the public to be able to gather in small groups during the Fourth of July holiday

European Union aims to produce battery cells for at least 7m electric cars a year by 2025

An upcoming piece in the German press (Handelsblatt business daily) from the economy ministers for Germany and France and an EU official

Plans for the EU wanting to boost local production of battery cells

Info comes via Reuters, here’s the link for (not very much) more.

This guy could probably do it better?

More rumours on the BOJ policy review – Bank may abandon its ETF target

Rumour (unconfirmed, and let me repeat again … rumour) the Bank of Japan may bin its ETF target at its March policy review

- The Bank currently has a 6tln yen target (target to buy each year) & upper bound of 12 tln yen

Newswires with the rumour (did I mention its a rumour?)

Record closes for the S&P, Dow and Russell 2000

Nasdaq lead the way with a gain of 2.56%

The S&P, Dow and Russell 2000 all closed at record levels today. The Nasdaq index led the way to the upside, but is still 5 1/2% away from it all time high.

- Dow up for the 5th consecutive day and closed at a new record for the 3rd consecutive day

- S&P is up for the 3rd consecutive day and trading to a new all time high at 3960.27.

- Nasdaq index closed back above its 50 day MA at 13358.083 (closed at 13398.67).

The final numbers are showing:

- S&P index rose 40.53 points or 1.04% at 3939.34. The new all time intraday high reached 3960.27. The low extended to 3915.54

- Nasdaq rose 329.84 points or 2.52% at 13398.67. The hi reached 13433.62. The low extended to 13246.32

- Dow rose 188.57 points or 0.58% at 32485.59. The new intraday high reached 32661.59. The low reached 32345.70.

- Russell 2000 rose 52.86 points or 2.31% at 2338.54. The index is up for the 5th consecutive day.

Thought For A Day

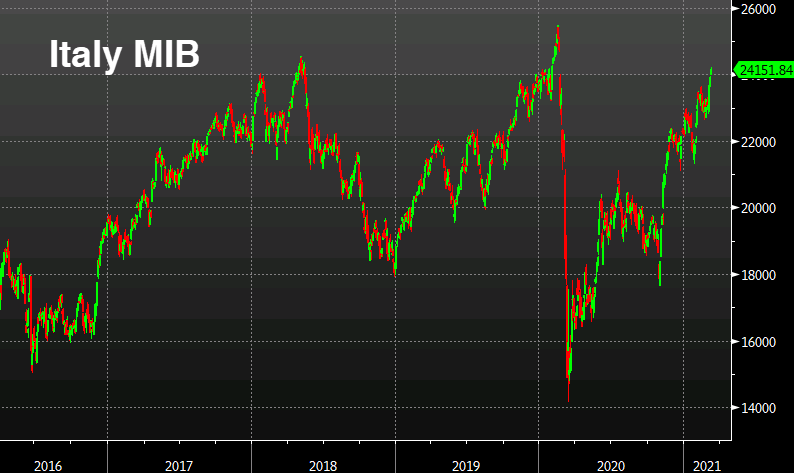

European equity close: Solid day after ECB picks up the pace

Closing changes for the main European equity markets

- UK FTSE 100 +0.2%

- German DAX +0.3%

- French CAC +0.6%

- Italy MIB +0.9%

- Spain IBEX +0.6%

You can see the case for outperformance in the periphery given the step up in the PEPP pace from the ECB. It all looks a bit sluggish compared to the huge gains in the US today. The S&P 500 is up 1.4% and Nasdaq up 2.4%.

US dollar climbs higher with yields

US dollar at the highs of the day

The US dollar is catching a broad bid following the ECB press conference. I’m not sure I would connect the two events because there’s nothing particularly notable happening in the euro at the moment.

Yields are moving up at the long end in the US with 10s now at a session high of 1.53%. They had fallen as low as 1.47% a few hours ago. 30s are at 2.27% from a low of 2.21%. There’s a 30-year auction today.

The rise in the dollar has done little so far to dent equities but gold is now negative on the day and oil has carved out a double top at $65.60.

In short, there’s not a great reason for this move but keep an eye on yields.

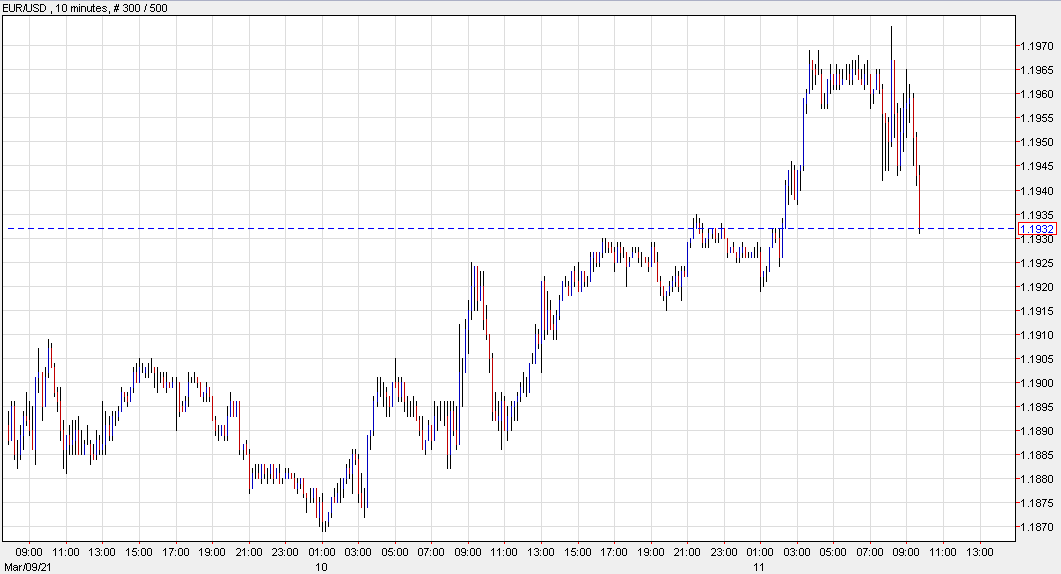

EUR/USD: