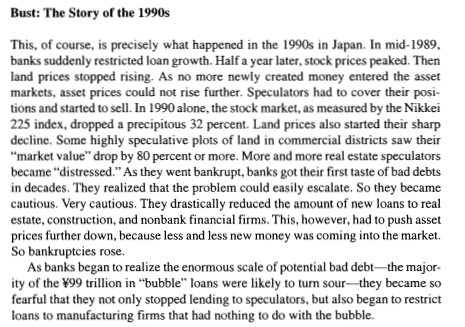

Archives of “March 2021” month

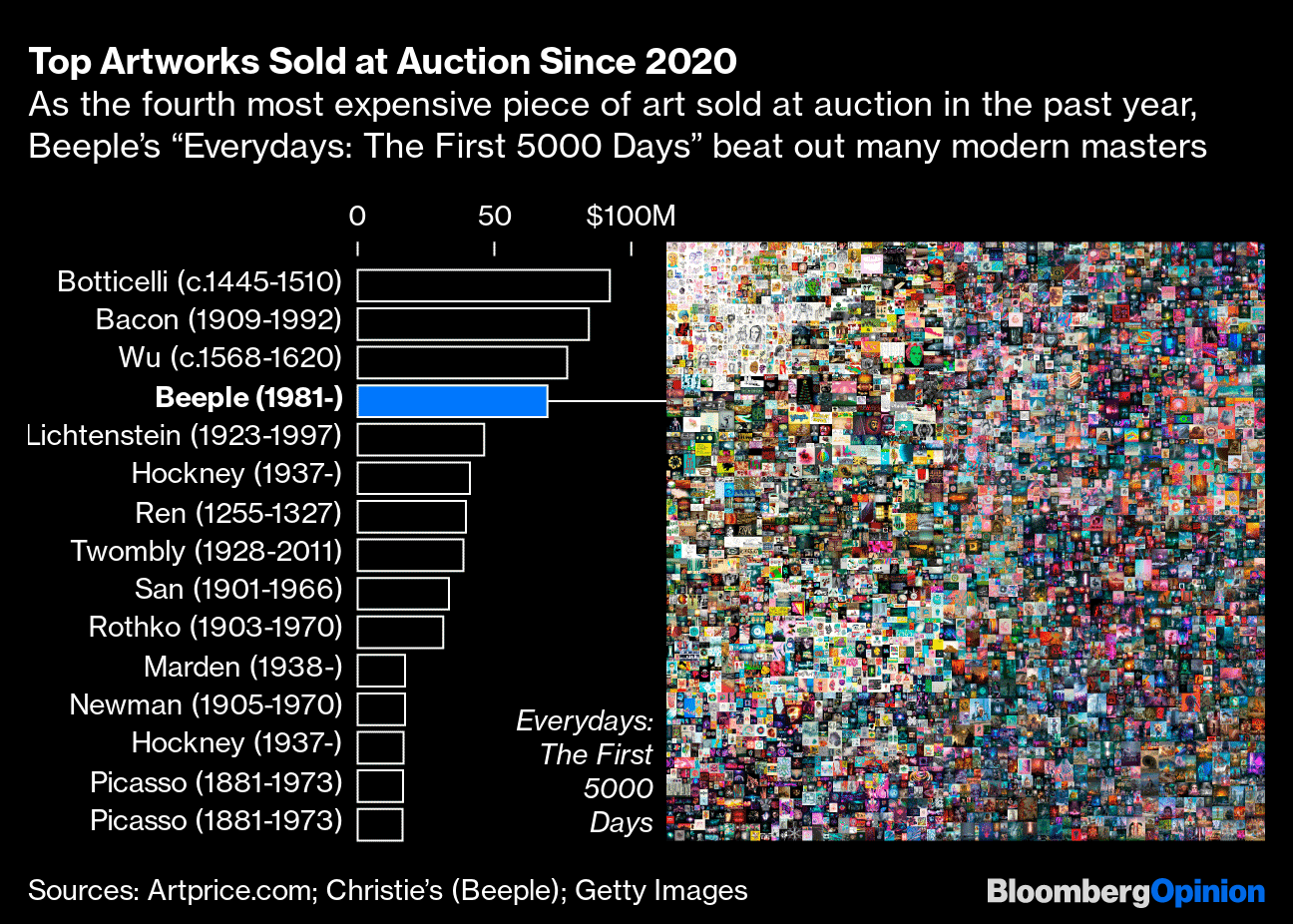

rssRich Millennials Are Splashing Millions on Crypto Art

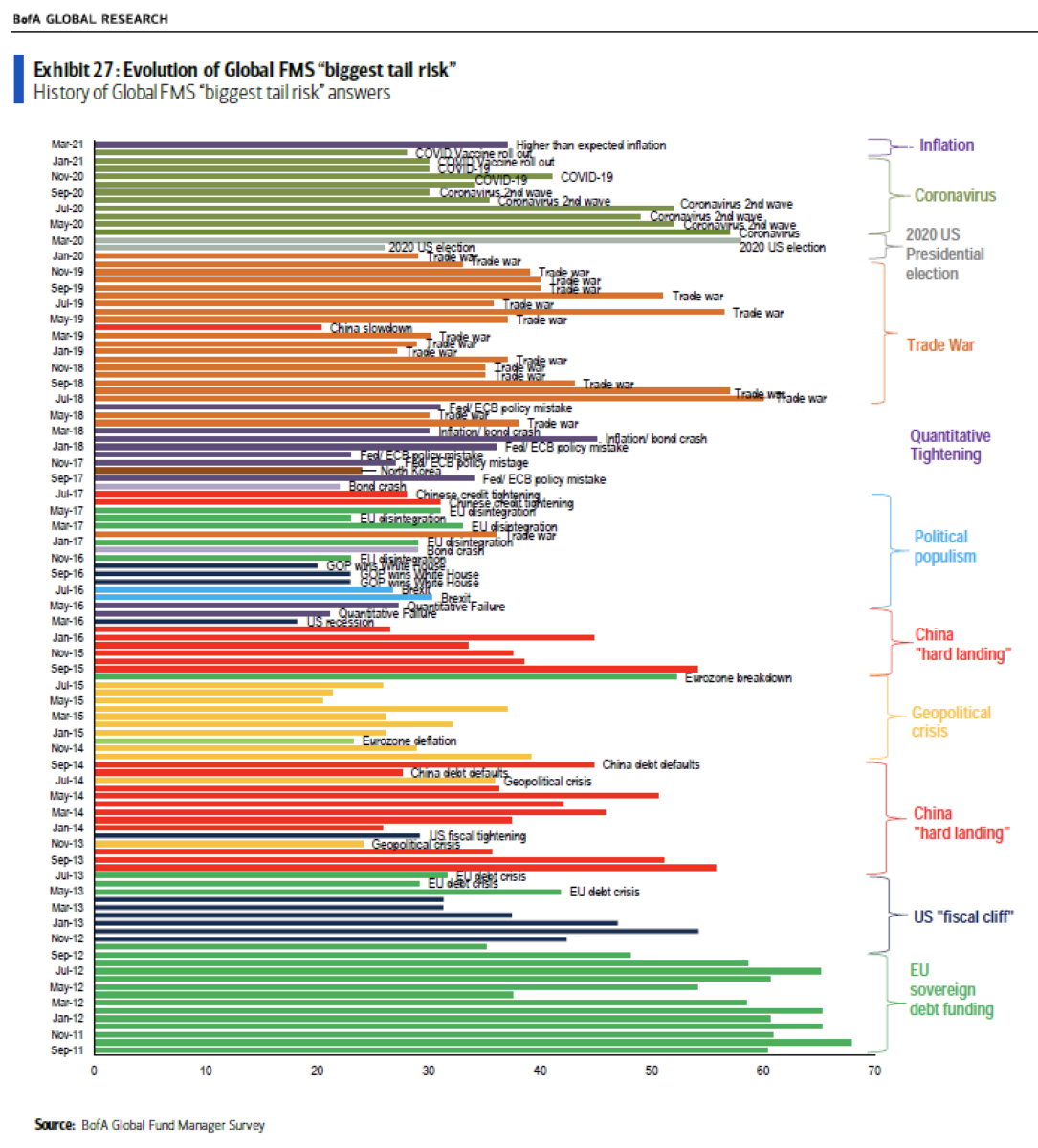

Fund Manager Survey: 10 years of markets’ top worries

Gerald Loeb’s Market Wisdom

1. The most important single factor in shaping security markets is public psychology.

2. To make money in the stock market you either have to be ahead of the crowd or very sure they are going in the same direction for some time to come.

3. Accepting losses is the most important single investment device to insure safety of capital.

4. The difference between the investor who year in and year out procures for himself a final net profit, and the one who is usually in the red, is not entirely a question of superior selection of stocks or superior timing. Rather, it is also a case of knowing how to capitalize successes and curtail failures.

5. One useful fact to remember is that the most important indications are made in the early stages of a broad market move. Nine times out of ten the leaders of an advance are the stocks that make new highs ahead of the averages.

6. There is a saying, “A picture is worth a thousand words.” One might paraphrase this by saying a profit is worth more than endless alibis or explanations. . . prices and trends are really the best and simplest “indicators” you can find.

7. Profits can be made safely only when the opportunity is available and not just because they happen to be desired or needed. (more…)

Rational vs Irrational Execution

It is one thing to develop a trading edge; quite another to follow through with it. On a rational level setting up a trading edge based on historical testing, with a pre-determined risk calculation (i.e., where to exit if wrong) and how long to stay in if right, is common sense, especially since the future is unknown. The only way to plan for an unknown future is by planning for several possible scenarios. This is rational. To assume that the future can be pre-determined, that we can predict the buying and selling decisions of all other traders and investors is a pipedream. It is purely irrational. It is indeed foolish.

Calculated Risk vs Emotional and Monetary Rewards:

There is no doubt that trading can be an emotional roller coaster as traders swing from winners to losers and vice versa. Successful traders realize that calculating risk involves much more than money. It involves the emotional risk associated with winning and losing. Of course, we all can understand the risk associated with losing. No one likes to lose but it is part of the speculative game. If the trader cannot lose for fear of losing money, the fear will cause greater losses. The trader who expects to be paid with each risk on trade sets himself up for greater disappointment because in an uncertain environment there are no guarantees. There is also the risk associated with winning, especially when we win big. Winning can cause the trader to make hasty, irrational decisions based on the need to feel the emotional “high” associated with that last big win. Trading for guaranteed monetary rewards and the high associated with winning can be a fatal combination as preparing for a possible loss is not considered. Instead, only profits are calculated. The successful trader calculates both the potential for loss and profit associated with each new trade, allowing himself to accept any possible outcome; not the one most desired.

Thought For A Day

“In the stock market, the most important organ is the stomach. It’s not the brain.” Peter Lynch

The first online pizza order was in 1994. The buyer paid with 1 million Bitcoin, and shortly after died broke and alone

TWO CIRCLES… TWO TRADERS

The following describes two types of traders. The circle on the left describes the characteristics of all beginning traders, most of whom end up quitting. There is a progression from bad to worst. However, if the beginning trader can break through this cycle somewhere around undisciplined fear (#3) and paralysis of analysis (#4), his chance of success improves exponentially.