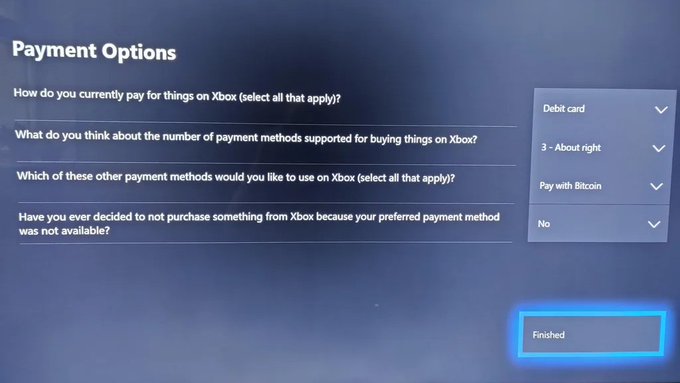

Comments from Bobby Lee, co-founder and former CEO of crypto exchange BTCC to CNBC Monday afternoon US time.

In Brief (link here for the full thing)

- could soar as high as $300,000 in the current bull market based on its historical patterns

- (he does add that he was not sure if history would repeat itself)

- “Bitcoin bull market cycles come every four years and this is a big one”

- “I think it could really go up to over $100,000 this summer.”

- warned the bubble will burst after peaking

- a “bitcoin winter” that could last for years … following its bull run

- Investors should be aware that bitcoin’s value could fall as much as 80% to 90% of its value from the all-time peak

BTC has dropped in past hours, maybe traders didn’t see the 300K forecast before the 90% drop bit?