Archives of “March 2021” month

rssUK March preliminary services PMI 56.8 vs 51.0 expected

Latest data released by Markit/CIPS – 24 march 2021

- Prior 49.5

- Manufacturing PMI 57.9 vs 55.0 expected

- Prior 55.1

- Composite PMI 56.6 vs 51.4 expected

- Prior 49.6

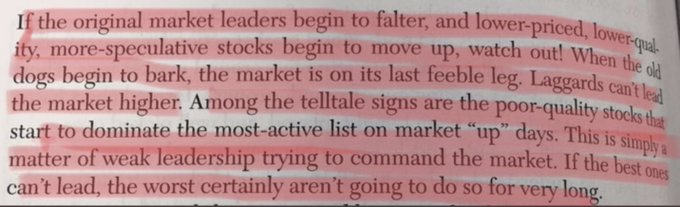

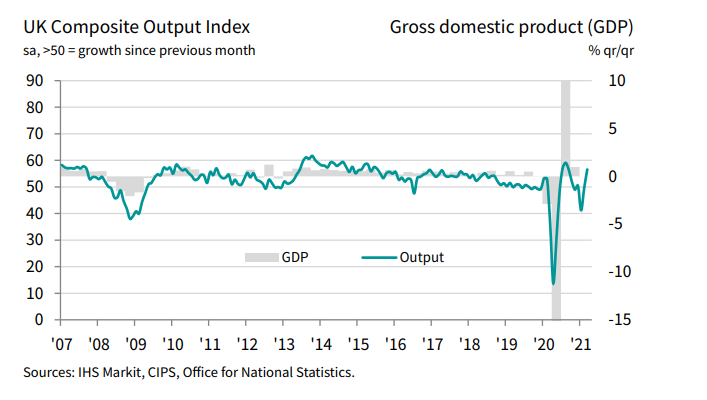

That is a solid beat and adds to the optimism surrounding the rebound in the UK economy once restrictions are eased later on in the year.

Business activity in the UK returned to expansion and improved at its quickest pace in seven months, with the services reading also coming in at the highest since August last year. Meanwhile, the manufacturing reading is the highest in 40 months.

Service providers noted forward bookings from domestic consumers as the higher level of activity is linked to the prospect of looser restrictions later in the year.

Manufacturers also noted advanced orders helping to boost demand conditions as export sales remain relatively subdued. Markit notes that:

“The UK economy rebounded from two months of decline in March, with business activity growing at its fastest rate since last August as children returned to schools, businesses prepared for the reopening of the economy and the vaccine roll-out boosted confidence. Companies reported an influx of new orders on a scale exceeded only once in almost four years, and business expectations for growth in the year ahead surged to the highest since comparable data were first available in 2012. Employment consequently rose for the first time since the pandemic struck as firms expanded capacity in response to the new inflows of work and brighter outlook.

“The surge in business activity is far stronger than any economists expected, according to Reuters polls, and hints at only a modest contraction of GDP during the first quarter, adding to evidence that the economy has shown far greater resilience in the third lockdown compared to the first. The encouraging readings on future expectations, job creation and new order inflows meanwhile all point to robust economic growth in the second quarter, especially if virus restrictions are lifted further.

“Worries persist though, especially in relation to near-record supply chain delays, a continued fall in exports and sharply rising prices, all of which are making life difficult for many companies. Many consumer facing companies meanwhile remain constrained by COVID-19 restrictions, which are likely to curb the overall pace of economic growth for some time to come, especially if we see a third wave of infections.”

Eurozone March preliminary services PMI 48.8 vs 46.0 expected

Latest data released by Markit – 24 March 2021

- Prior 45.7

- Manufacturing PMI 62.4 vs 57.6 expected

- Prior 57.9

- Composite PMI 52.5 vs 49.1 expected

- Prior 48.8

The French and German readings set out what to expect here and it is largely positive, with the services reading coming in at a 7-month high while the manufacturing reading is a record high for the overall Eurozone.

A record increase in the manufacturing output index contributed largely to the jump in factory activity, hinting that demand conditions are continuing to pick up.

Meanwhile, the services sector showed some signs of stabilisation at least but the outlook there still largely depends on how virus restrictions play out in the months ahead.

Markit notes that:

“The eurozone economy beat expectations in March, showing a much better than anticipated expansion thanks mainly to a record surge in manufacturing output.

“The service sector remains the economy’s weak spot, but even here the rate of decline moderated in March as companies benefited from the manufacturing sector’s upturn, customers adapted to life during a pandemic and prospects remained relatively upbeat.

“The outlook has deteriorated, however, amid rising COVID-19 infection rates and new lockdown measures. This two-speed nature of the economy will therefore likely persist for some time to come, as manufacturers benefit from a recovery in global demand but consumer-facing service companies remain constrained by social distancing restrictions.

“The surge in demand for manufactured goods is meanwhile stretching supply chains to an unprecedented extent, in turn pushing costs up at the fastest rate for a decade. These cost pressures will likely feed through to higher consumer price inflation in coming months.”

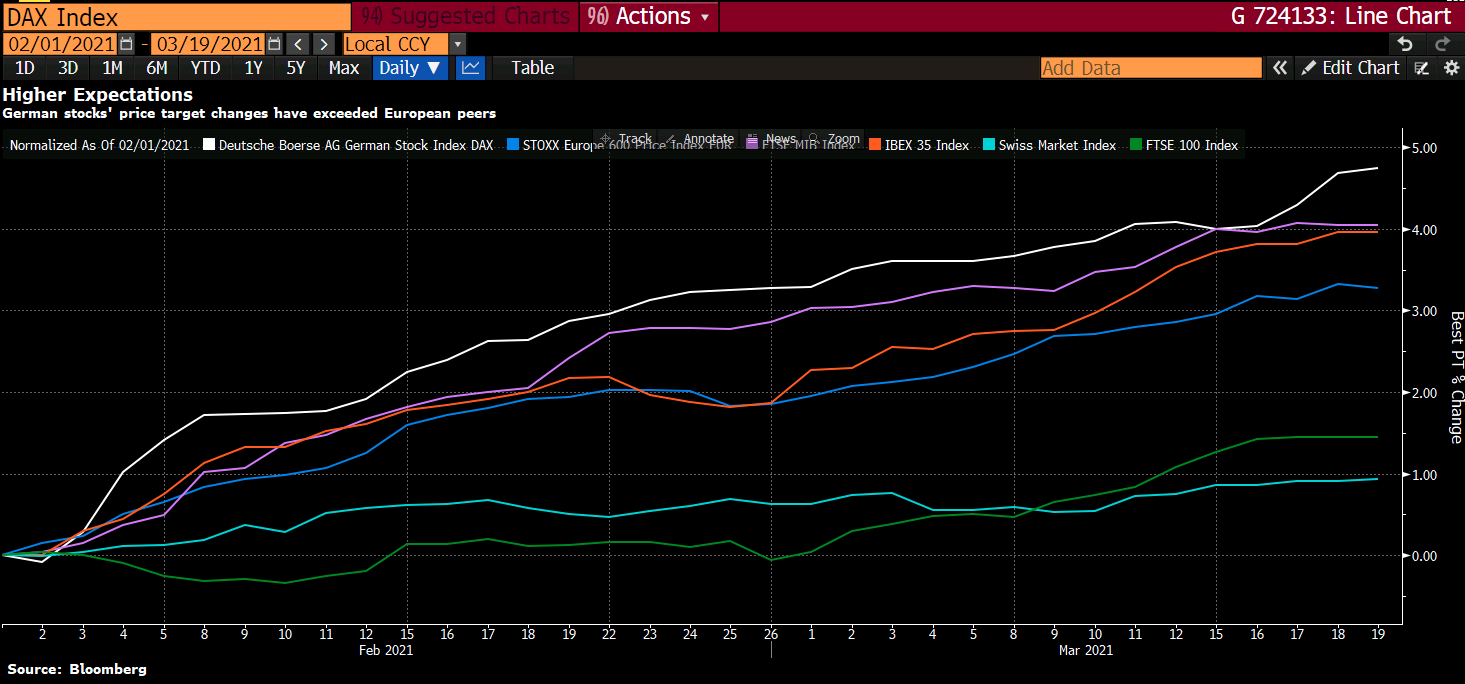

DAX the favoured cyclical recovery play?

Via Bloomberg

The surge in Volkswagen shares last week that helped German stocks higher underlines the DAX as a cyclical recovery play.

The DAX outperformed European stocks overall last week with the DAX edging ahead of the FTSE MIB. A large part of the rally has been as Volkswagen bids to rival Tesla in electric vehicles. Volkswagen overtook SAP as Germany’s most valuable public company. The slowdown in Germany remains as the vaccine rollouts are dogged by delay. Eventually, though, the recovery should come to Germany. That is of course with all the caveats that we currently have regarding how the variants will develop and the pandemic proceed.

Bloomberg survey puts DAX ahead of the European pack

On average the anticipated gain is 2% by the end of the year. This is slightly more than in February. Since the start of February the DAX’s 12 month forward price target percent change has moved ahead of other European peers. Check out the comparison below:

Today is not the best day to chase this as the reflation trade is having a wobble. Whether it is a deeper pullback in equities or not is uncertain, but there is a bit or re-orientation going on right now.

Today is not the best day to chase this as the reflation trade is having a wobble. Whether it is a deeper pullback in equities or not is uncertain, but there is a bit or re-orientation going on right now.

ICYMI – Honda will extend production suspensions at some North American plants on supply chain issues

Honda will extend production suspensions at some North American plants into the week of March 29.

- Production was stopped at a majority of North American plants for the entire week of March 22

- Other factories had reduced production

Honda cite:

- the impact from COVID-19, congestion at various ports

- microchip shortage

- severe winter storms

Honda is not alone, Toyota and Ford are at least two others slowing US production.

China’s anti-pollution emissions targets cited for lower aluminium futures

China is considering a sale of around half a million tons of aluminium from state reserves

In order to both

- help achieve emissions targets

- cool the price gains for the metal

Futures in the metal are trading lower again in China today

PBOC sets USD/ CNY mid-point today at 6.5228 (vs. yesterday at 6.5036)

The People’s Bank of China set the onshore yuan reference rate for the trading session ahead.

- Reuters estimate from their survey was 6.5232, Bloomberg 6.5241

PBOC injects 10 billion yuan liquidity via 7-day reverse repo

- 10 billion yuan reverse repo matures today

- thus neutral, no net injection nor drain

- 18th day in a row of neutral

Here’s a plug for the Suez Canal (I’ll see myself out)

The Suez Canal has been blocked in both directions by a grounded container ship, MV Ever Given (operated by Evergreen Marine)

Its one of the largest container ships in operation.

- 400m long

- 59m wide

- Gross tonnage: 219,079

- Capacity: 20,388 TEUs (20ft container equivalents)

Ships are backed up behind as tugs try to move the ship.