Archives of “March 11, 2021” day

rssA single email changed the course of history.

BOFA talking about 1987

Goldman Sachs is comfortable with the stupendous level of US debt

Goldman Sachs urge “new thinking on fiscal sustainability”

(I didn’t make that up)

Says GS:

- Many investors and policymakers are accustomed to thinking about fiscal sustainability in terms of the debt-to-GDP ratio, which will soon rise to the highest level in US history.

- In a recent study, Jason Furman and Lawrence Summers argue that a better measure of the debt burden is real interest expense as a share of GDP, which captures the cost of servicing the debt, adjusting for inflation. That measure is currently at a more historically normal level.

Although its fun to have a giggle at GS and their defence of the level of debt that they cite (bolded above) its becoming more accepted, especially amongst those doing the spending. Not just in the US either.

And, we ain’t here to fight with trends, right?

More:

- Debt-servicing costs are low for now

- even the further increases in yields that our interest rate strategists forecast would leave debt-servicing costs well within the normal historical range

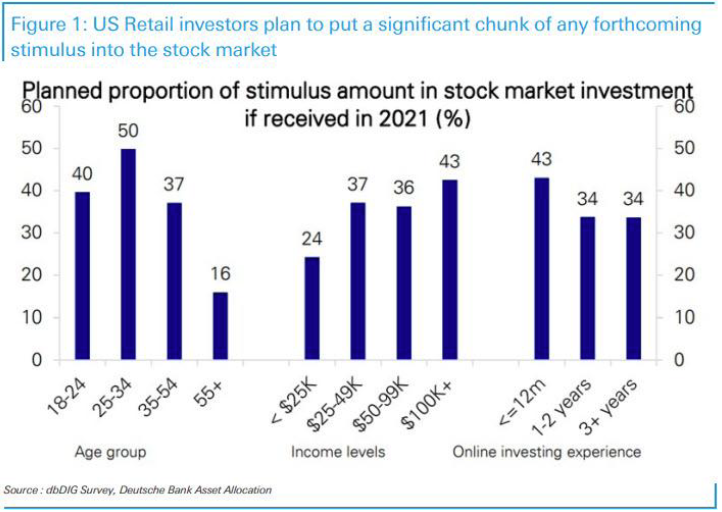

US stimulus checks – Deutsche Bank says 40% could go straight into stocks

DB looking for huge flows into equities:

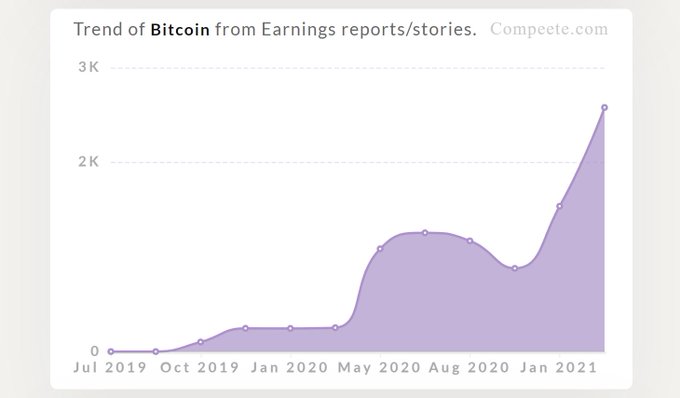

Makes you wonder where the other 60% will go. Bitcoin is my tip 😉

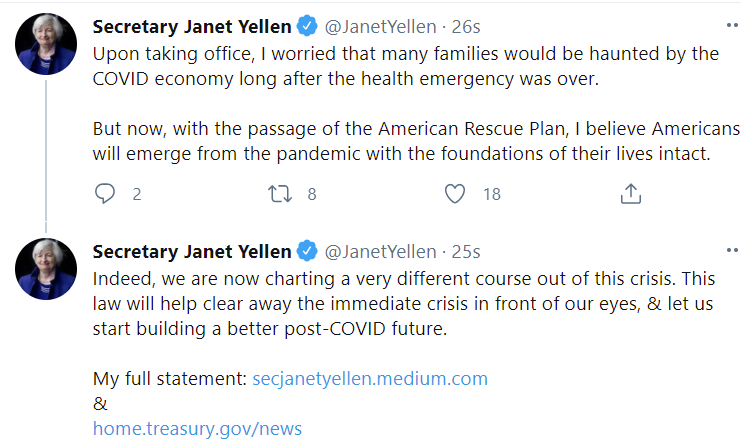

US Treasury Secretary Yellen says today was a pivotal day for the US economy

Yellen is referring to the US Congress approving the US$1.9 tln coronavirus relief bill

More:

- ready to get to work implementing the virus relief package

- rather than a long, slow recovery, I expect we could reach full employment by as soon as next year

Full employment by 2022 is good news, though it m right leave Fed Chair Powell considering his options on dialling back monetary stimulus sooner than expected.

Yellen also with the tweets:

S&P 500 closes up 0.6% after another wild ride

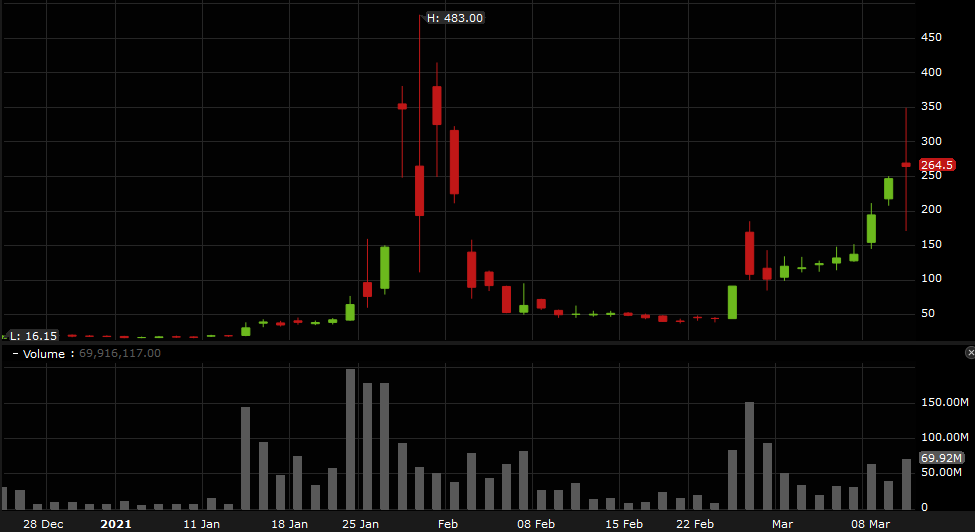

Meme stock insanity continues

- S&P 500 +23 points to 3899, +0.6%

- DJIA +1.4%

- Nasdaq -0.1%

- Russell 2000 +1.8%

There were some big swings in sentiment throughout the day. The the low CPI number calmed nerves and then decent 10-year auction also helped.

The ‘two markets’ theme I’ve been highlighting was particularly noticeable today as broad markets and small caps cheered lower rates but the Nasdaq was in its own world after yesterday’s surge.

Shares of GameHost went on an absolutely insane ride, hitting the record closing high of $347 and then crumbling to $172 only to rebound again to $264 at the close. Expect more of the same after hours. The most highly-traded option was an $800 call expiring Friday.

Thought For A Day