Locked and loaded for jobs day

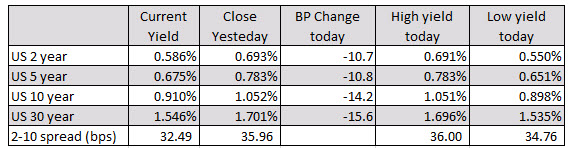

Stock up on weapons, food and ammunition as the bond market sends frightening signals about coronavirus. Gold is up about 1% and that might be the tip of the iceberg if it gets really bad.

Normally today would be all about non-farm payrolls but as Justin wrote today: This will be arguably one of the least important US jobs report ever.

The consensus is +175K versus +225K last month. We know the US economy was in decent shape before the virus hits, so this just sets a baseline. What will be interesting is the March/April data starting a month from now.

I think the Canadian jobs report is a bit more interesting because Poloz hinted yesterday that he was already leaning towards cutting rates. A soft number could put some pressure on CAD.

Other items on the agenda:

- Fed’s Evans and Mester 1420 GMT

- Ivey PMI 1500 GMT

- Wholesale inventories 1500 GMT

- Bullard 1620 GMT

- Williams, Rosengren 1900 GMT

- George 2030 GMT

All the Fed talk is because the blackout starts tomorrow ahead of the March 18 meeting.