Can the euro and risk take heart from the arguably better readings today?

From the headlines alone, the euro can take heart in the fact that the readings today show some relative improvement – with domestic demand and services holding up – and there are also some signs of moderation in the manufacturing contraction.

Although it needs to be put into perspective, the market may not necessarily look at that considering the tendency to be short-sighted at times.

Going into the PMI releases today in Europe, risk was in a softer spot and the worry is that poor readings may compound virus fears ahead of the weekend.

The natural reaction would be such a scenario will be bad for risk and good for the dollar.

However, that did not play out. Instead, we are in a situation where the market could interpret things in two ways i.e. focus on the arguably better readings or proceed with some caution considering the details are still masking some potential issues.

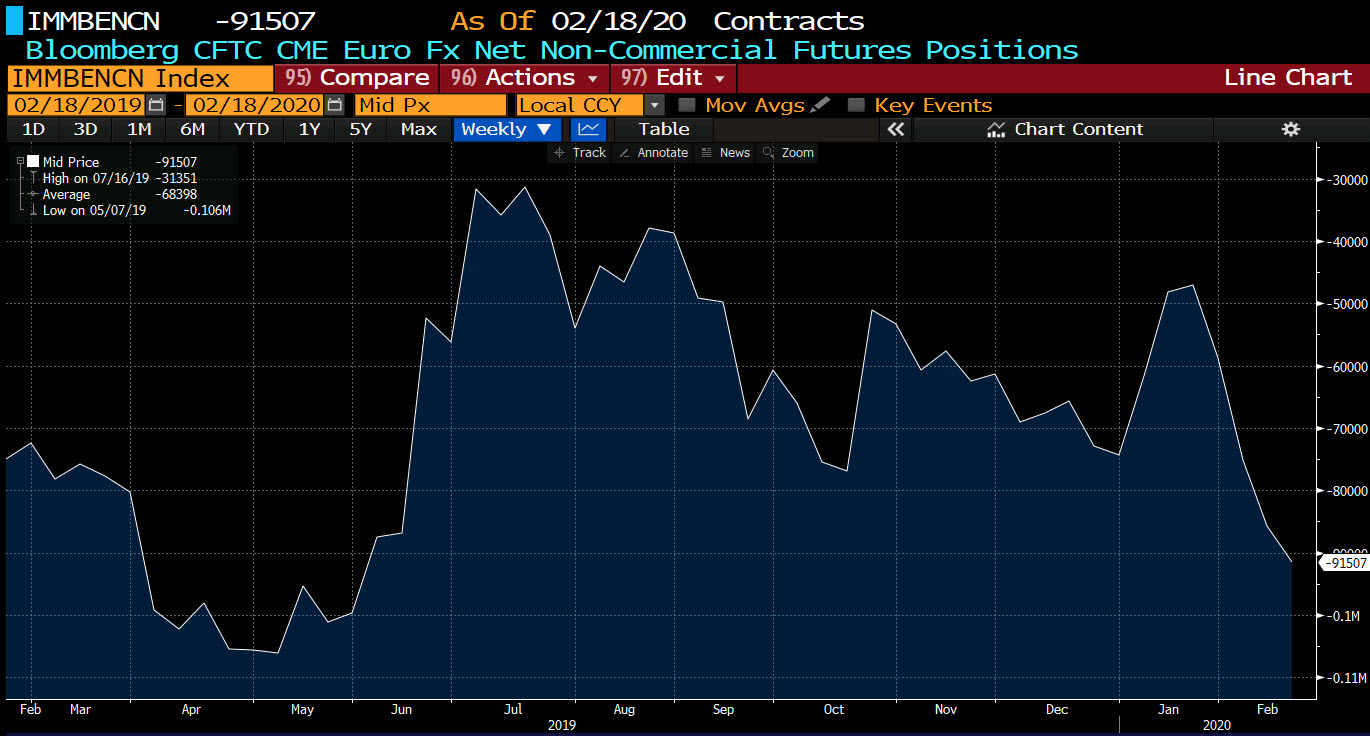

The former would mean a possible short covering in the recent downside run in the euro and a short squeeze could see the dollar feel some pain ahead of the weekend.

Meanwhile, the latter could see the market sit in limbo for a bit before having to decide what may happen to risk (fear or greed) when Wall Street comes in. That means price action may be confined to levels that we are seeing now.

I would say this is the current predicament that the market is facing after the PMI readings in Europe today. In any case, don’t forget that there is also the US PMI readings later in the day so perhaps the market will be more responsive after clearing that hurdle.