Your Financial Life In 1 Chart How Many Have You Lived Through? Which One Is Your Favorite? How Did You Play Them?

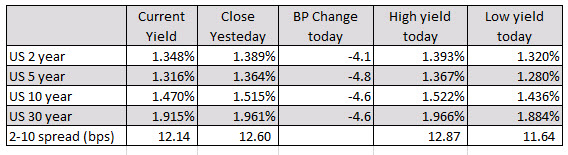

The headline of the day is that the 30 year yield traded to a new all time low of 1.8843%. That took out the August 2019 low yield of 1.9039% and although the yield is closing above that old low, the closing level will be the lowest on record.

Helping the yields move lower is the:

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

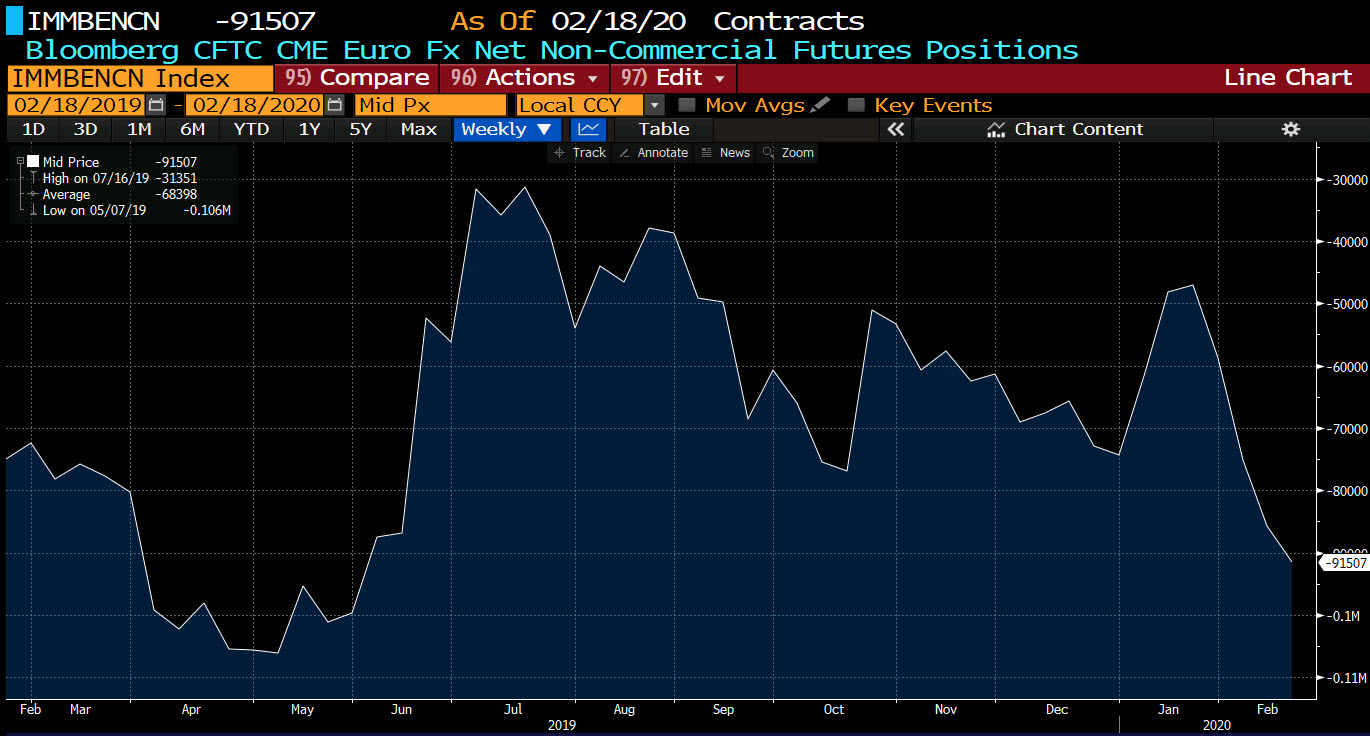

The EUR is the biggest position with the short at -92K from -86K last week. The shorts are winning as the price reached the lowest level since 2017 this week.

The major stock indices are ending the day lower with the NASDAQ falling by -1.79%. In a week where the NASDAQ and S&P index made new all-time highs, selling on Thursday and Friday have taken those gains away. The major indices are ending the week lower.