The firm says that the dollar is well placed to benefit from the situation compared to other G-10 currencies in the market

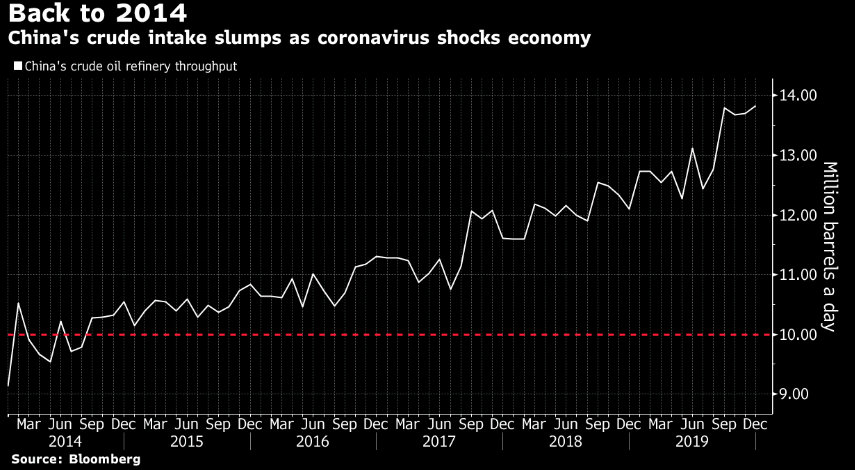

Citi’s currency strategist, Adam Pickett, says that “consensus expectations have not yet fully adjusted to the reality of weaker Chinese growth that will result from efforts to contain COVID-19”.

Adding that the market is underpricing the possibility of China’s economy being dealt a blow and overvaluing the prospects of recent stimulus measures. As such, Pickett argues that the dollar stands to benefit and outperform in this scenario.

Noting that the greenback should outperform against open manufacturing economies such as the NOK, NZD and EUR. Although safe havens may perform better, the US economy and key trading partners are “likely to be insulated”, he argues.

Additionally, he points out that market hopes for meaningful Chinese stimulus to ensure a V-shaped recovery are overblown – saying that the current Chinese administration “still prefers slower, sustainable growth than previous cycles”.

This adds to the NAB dollar call earlier in the day here but again, I would say it is conditional upon which currencies you’re looking at and on what scenario.

A highly risk-off landscape would still favour the yen more so than the greenback but against the likes of the kiwi and euro, the dollar definitely will shine if the situation plays out as what is described by Pickett above.