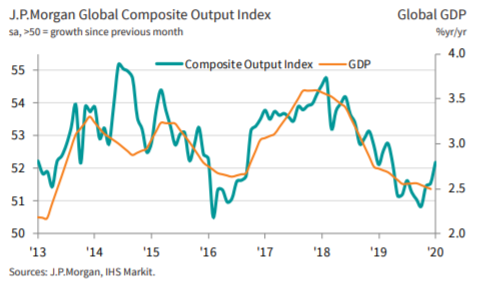

ICYMI, the J. P. Morgan Global PMI Composite Output Index hit 52.2, taking it to a 10 mth high

- from 51.6 in December

- (says the report – It should be noted that the majority of the January PMI survey data were collected before the nCoV outbreak.)

Keeping in mind the impact that the virus will have ahead this is nevertheless a piece of good news. Better to be into economic headwinds in a better place than a worse one.

Comments from JPM:

- “The global economy started 2020 on a stronger footing, with output growth rising for the third straight month to its highest since March of last year suggesting global growth at an-above potential pace. However, we brace ourselves for a much weaker outcome this quarter as the outbreak of the nCoV virus disrupts activity in China and potentially around the world. Encouragingly, the gains in the PMI were not just confined to the Output Index, with trends in new orders, business sentiment and employment also firming.”