UK FTSE 100, +0.23%

The major European indices are ending the session mostly lower. The the exception is the UK’s FTSE 100 which has moved up by 0.23% on the day.

The provisional closes are showing:

- German DAX, -0.28%

- France’s CAC, -0.2%

- UK’s FTSE 100, +0.23%

- Spain’s Ibex, -0.24%

- Italy’s FTSE MIB, -0.69%

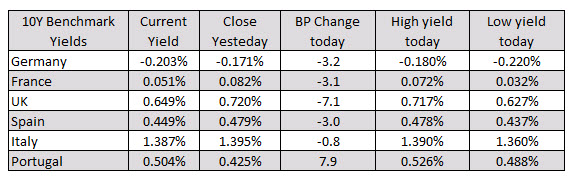

In the European debt market, the benchmark 10 year yields are mostly lower (with the exception of the Portuguese 10 year note):

In other markets as London/European traders look to exit for the day (and just ahead of the ceremonial signing of the US/China phase 1 trade deal):

- Spot gold is up $4.25 or 0.28% at $1550.63

- WTI crude oil futures are trading down $0.51 or -0.86% at $57.74

In the US stock market the major indices are higher and trading at record levels:

- S&P index up 14.9 points or 0.46% at 3298.13 (high for the day). It is getting closer to the 3300 level

- NASDAQ index is up 42.84 points or 0.46% at 9294.17. The high reached 9298.82 just short of the 9300 level

- The Dow is up 168 points or 0.58% at 29108.24

In the US debt market, the yields are lower and the yield curve flatter again with the 2 – 10 year spread down to 22.44 basis points from 24.09 basis points at the close yesterday.

In other markets as London/European traders look to exit for the day (and just ahead of the ceremonial signing of the US/China phase 1 trade deal):

In other markets as London/European traders look to exit for the day (and just ahead of the ceremonial signing of the US/China phase 1 trade deal):