Via Bloomberg, question of the day ?

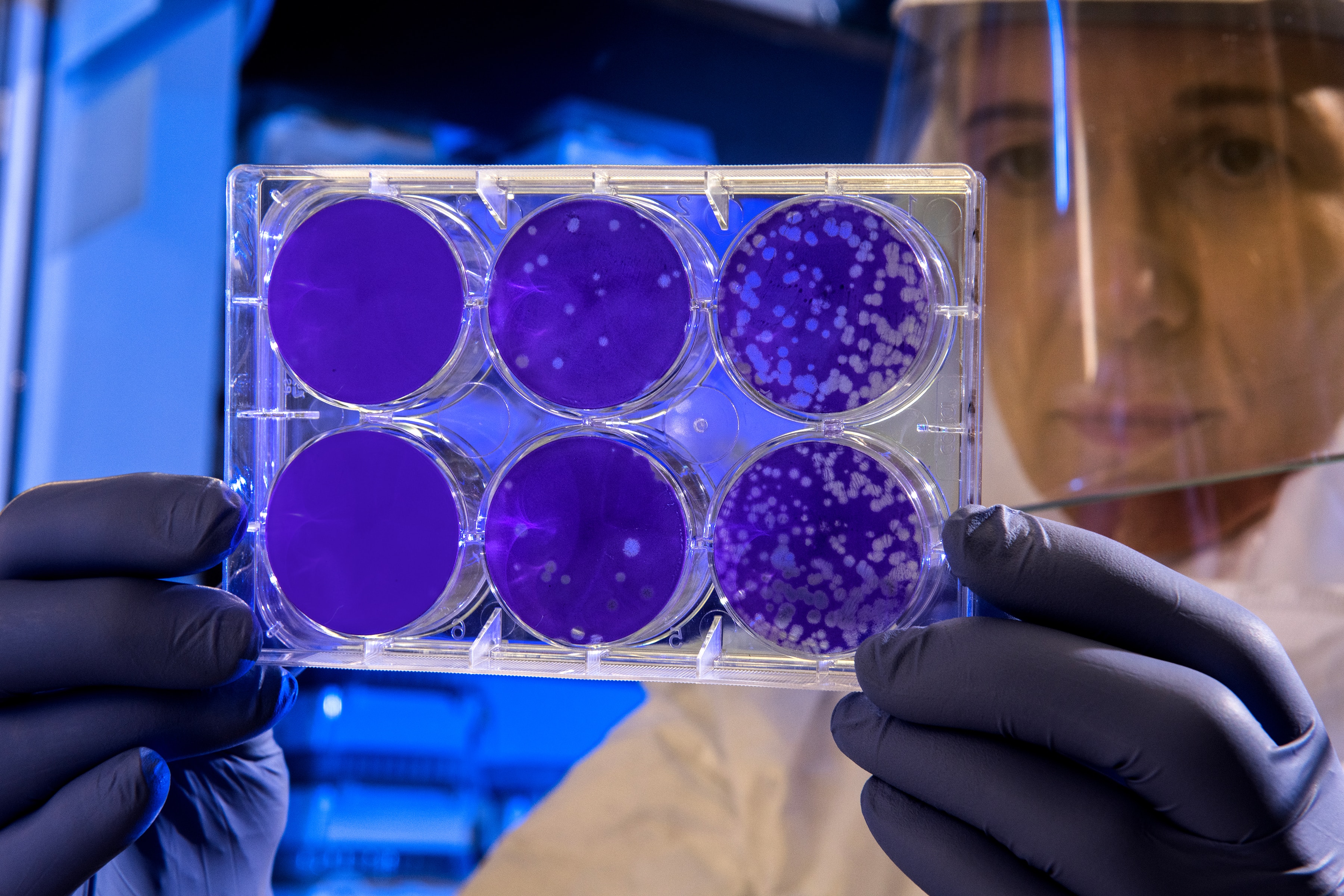

This was a question on Bloomberg Market’s Live blog this week and I thought I would ask our Forexlive readership the same question. What are you looking at for safety in the current concerns over the coronavirus?

- Treasuries: One of the first ‘go to places’.

- Gold: Another quick go to place for value. Short term it makes sense for a quick spike, but longer term the improving US outlook means that gains should be capped

- Bitcoin: Sometimes mirrors gold as a digital ‘gold’, but for some investors the jury is still out whether bitcoin is here to stay or a first flush of a changing digital age that may or may not be here. For me, when investing in a safe haven on the coronavirus fears, I would favour gold over bitcoin every time. Is that just an unfair bias and unnecessary conservatism, or sensible? Anyone take the other view?

- Tech stocks: Seen as less vulnerable as industrials, finance or energy stocks. Perhaps long health stocks?

Other areas to look at?