- A full blown US-China trade deal will be “game changer”

- Yuan will stay pretty stable and risk assets will rally

- Then you’ve got alternatives to the dollar

- But don’t hold your breath (on a deal)

- In the meantime, the dollar will “power ahead”

- The dollar is the currency to own

Archives of “November 2019” month

rssLet’s take stock of US-China trade talks

What is the sentiment like at the moment surrounding US-China trade talks?

Are we still on track for a “Phase One” deal?

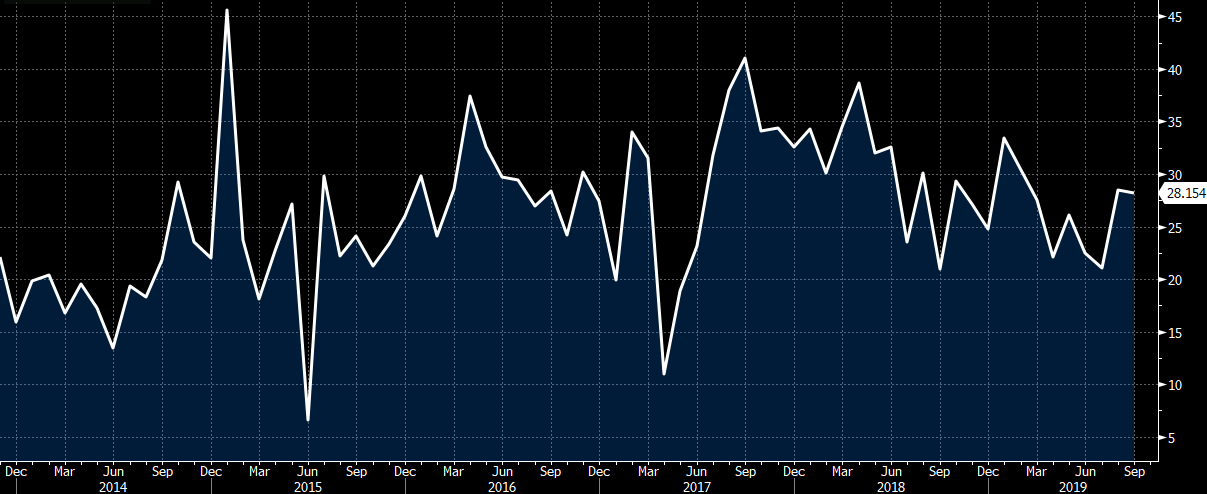

Eurozone September current account balance €28.2 billion vs €26.6 billion prior

Latest data released by the ECB – 19 November 2019

- Prior €26.6 billion; revised to €28.5 billion

Moody’s: Global economy will remain fragile in 2020

Moody’s weighs in with some commentary about the world economy

- Global economy will remain fragile next year as risks to credit conditions rise

- Rising political and geopolitical risks are exacerbating slow growth

- That reduces economies’ abilities to respond to shocks

- Trade uncertainty will continue to disrupt supply chains and weigh on investment

- Overall global growth will remain lackluster amid deceleration in US and China

- Recession risks will remain elevated in Europe and in the US

Gold in CNY ripe for another leg up.

– PBOC easing at record debt levels as CPI approaches 4%; – Shrinking current account; – Worsening HK social unrest; – EM currencies selling off; All foreshadows further CNY devaluation. Call it the Chinese banking recap 2.0

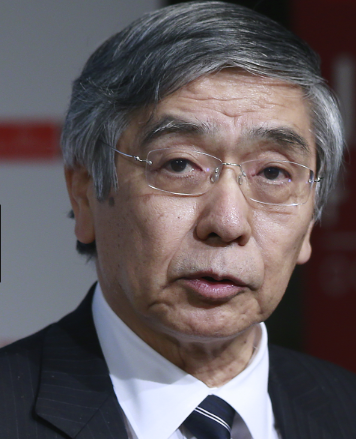

Bank of Japan Governor Kuroda crypto comments

BOJ Governor Kuroda remarks on cryptocurrency now

- Japan is not in need of BOJ digital currency now

- BOJ will continue to study digital currency

- no plan to issue yen-based digital currency

NASDAQ, S&P and Dow all close at record highs

Late rally kicks the S&P into positive territory

- The S&P index +1.37 points or 0.04% at 3121.84. The high reached 3124.17. The low extended to 3112.06

- The NASDAQ index +9.109 points or 0.11% at 8549.93. The high reached 8559.78. The low extended to 8503.625

- The Dow close up 530.52 points or 0.11% at 28035.43. The high reached 28040.97. The low extended to 27969.24.

- Lyft, +4.37%

- Nvidia, +3.99%

- AMD, +3.5%

- Netflix, +2.58%

- Chipotle, +2.22%

- Square, +1.59%

- UnitedHealth, +1.3%

- Facebook, +1.22%

- Nike, +1.18%

- Procter & Gamble, +1.14%

- Walmart, +1.1%

- Under Armour, -2.59%

- Fiat, -2.31%

- Schlumberger, -1.92%

- Chevron, -1.71%

- Bristol-Myers Squibb, -1.64%

- Beyond Meat, -1.26%

- Caterpillar, -1.2%

- Gilead, -1.14%

Thought For A Day

Sports equipment maker Yonex’s founder dies at 95

Minoru Yoneyama, a former prisoner of war who founded Japanese sports equipment maker Yonex, a favorite among pro tennis players, died on Saturday at the age of 95.

Yonex’s rackets have been used by such tennis stars as Billie Jean King, Martina Navratilova and Kimiko Date, garnering worldwide attention for a company that started out making fishing gear.

Yoneyama was born in Niigata Prefecture, north of Tokyo.

No stranger to adversity, he entered into business after being released from a prisoner of war camp in Okinawa. He was part of a Japanese suicide unit meant to ram explosive-laden boats into American transport ships, but never received an order for a mission.

In 1946, Yoneyama started making and selling floats for sport fishing. He began producing badminton rackets in 1957, and they remain one of the company’s mainstay products.

In 1958, Yoneyama established Yoneyama Co. to focus on rackets. It moved into tennis in 1969, followed by golf in 1982. The company was renamed Yonex and moved its headquarters to Tokyo.

Yonex secured contracts with King and other leading tennis players by asking them what they wanted in a racket, then improving the performance and design step by step until they were satisfied.

Yoneyama’s motto was, “If you fall, pick yourself up as a bigger man.”

His resilience was put to the test when a racket factory burned down in 1963. In just three days, the company was able to put up a new facility and resume production.

Yoneyama also played an active role promoting athletic activity through the Yonex Sports Foundation.

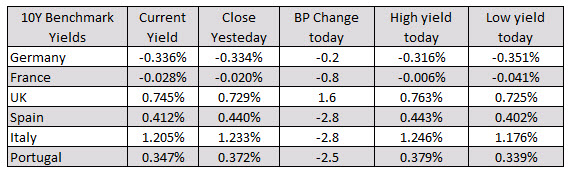

European shares end the day mostly lower

German DAX, -0.3%, France’s CAC, -0.3%. Spain’s Ibex, unchanged, UK FTSE +0.1%

the major European stock indices are ending the session mostly lower. The provisional closes are showing:

- German DAX, -0.3%

- France’s CAC, -0.3%

- UK’s FTSE 100, +0.1%

- Spain’s Ibex, unchanged

- Italy’s FTSE MIB, -0.5%

- spot gold is up $2.80 or 0.20% $1471.19

- WTI crude oil futures are down $1.03 or -1.8% at $56.68