Looks toward a test of the 200 bar MA on the 4 hour and 38.2% retracement

The agency says that it expects global oil markets to remain “calm” next year as soaring non-OPEC production and high inventories will keep consumers comfortably supplied.

“The calmness is supported by a well-supplied market and high inventories. This may continue into 2020 because non-OPEC countries will grow their production significantly.

The hefty supply cushion that is likely to build up during the first half of next year will offer cold comfort to OPEC+ ministers gathering in Vienna at the start of next month.

However, a continuously well-supplied market will lend support to a fragile global economy.”

.jpg)

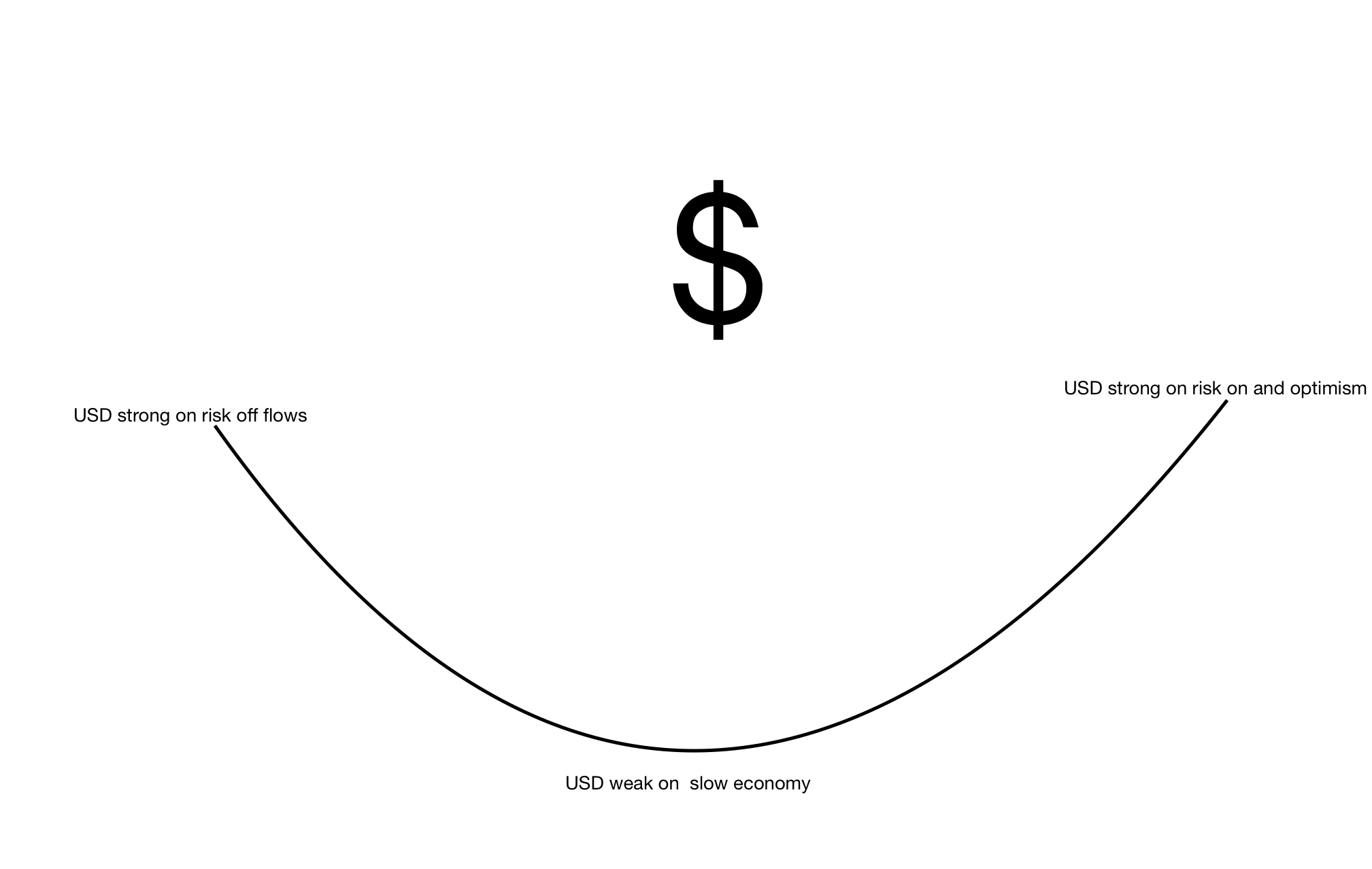

Dollar moves can be tricky to understand at times., as the USD is pushed and pulled by different forces. The dollar is the most widely traded currency, with 70% of all transactions dollar based on a day to day basis. The dollar smile theory was outlined by Stephen Jen, a former currency strategist and economist at Morgan Stanley. He said that understanding the currency movements of the dollar can be illustrated with a smile. That ‘smile’ consists of three distinct reactions:

Reaction 1: Risk off: Dollar rises

The left side of the smile shows that the U.S. dollar benefits from risk off moves. During times of global concern the USD is considered a safe haven along with the Swiss franc and the yen.

Reaction 2: Economic slowdown and recession

The middle part of the smile. When the Fed begins to reduce interest rates the USD falls. The demand for the USD is reduced and so the USD alls

Reaction 3: Economic growth and risk on

The right part of the smile is when the USD gains value on a hawkish fed and a risk on environment. In an optimistic environment investors are willing to take more risks. The USD gains on higher GDP growth and expectations that the Fed will be increasing interest rates.

Happy Friday, everyone! Hope you’re all doing well as we look to get things going in the session ahead. Risk trades are in a better mood today with some recovery seen in yen pairs and gold is also lower to start the day.