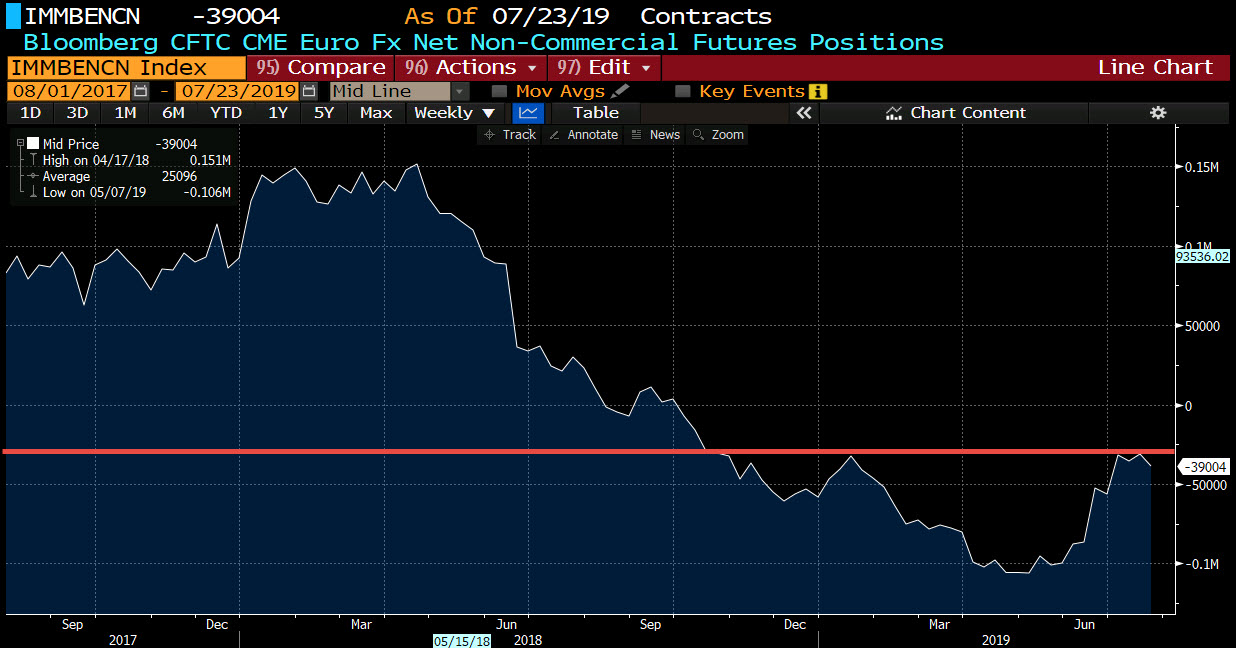

The dollar gained against most of the world’s currencies last week. With a few sessions left in July, the greenback has advanced against the major and all but a handful of emerging market currencies. It rose to new highs for the year at the end of last week against sterling. The risk of a no-deal exit has increased with the new UK’s new Prime Minister making demands that the EC is not prepared to grant.

The dollar is testing key levels against other major currencies that could signal a technical breakout. The euro made a marginal new low for the year last week, but the $1.1100 level held, perhaps helped by the defense of some options. The dollar knocked on JPY109, an important barrier whose break could confirm a bottom is in place and signal scope for additional near-term gains. The US dollar had recorded the lows for the year against the Canadian dollar on July 19 a little above CAD1.30 and before the weekend tested CAD1.32, the end of and band of resistance, which if broken could spur a move toward CAD1.3350-CAD1.3400.

To read more enter password and Unlock more engaging content