Latest data released by Ifo – 25 July 2019

- Prior 97.4; revise to 97.5

- Expectations 92.2 vs 94.0 expected

- Prior 94.2; revised to 94.0

- Current assessment 99.4 vs 100.4 expected

- Prior 100.8; revised to 101.1

Slight delay in the release by the source. A measure of business conditions and sentiment/expectations towards the German economy. Do be reminded the Ifo changed the indicator measurement to take into account of services data too as of April 2018.

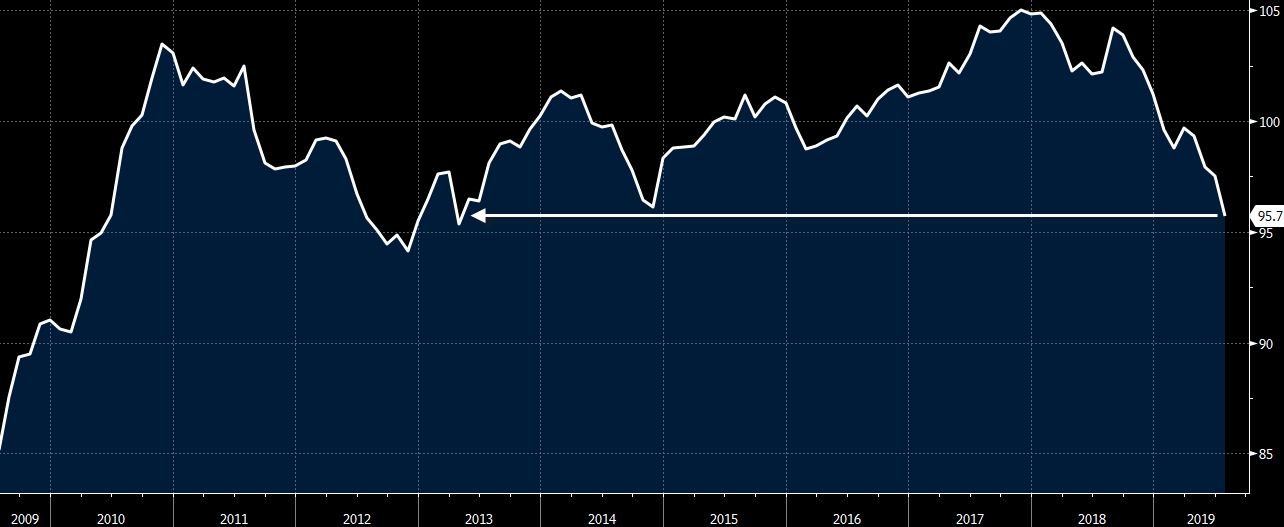

That’s the weakest headline reading since April 2013 with expectations and current conditions both also seen slumping further in July. This continues to reaffirm weakness in the German economy as we begin Q3.

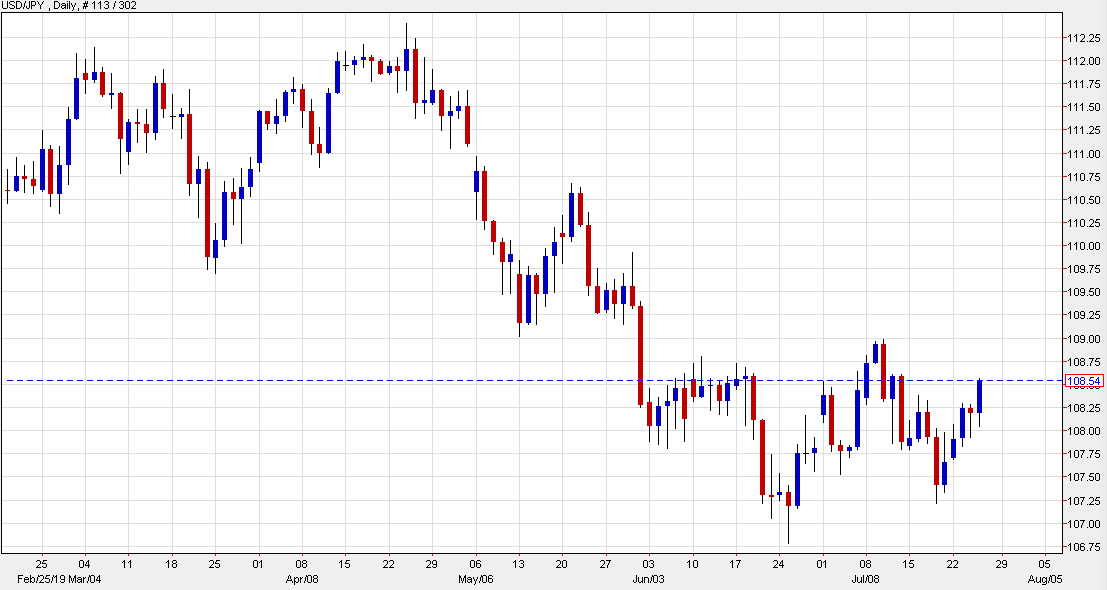

I reckon concerns about a recession won’t be too far off now. EUR/USD holds steady near the lows for the day at 1.1130 after hitting a session low of 1.1122 briefly, with anticipation still on the ECB policy decision later today.