“Intuition although seemingly spontaneous, apparently emotional, stems from a form of “information” that has become built-in from past experience. Discipline means choosing what to do unencumbered by the fear of making a mistake. Confidence means trusting our intuition that what we “see” is what we “know.” There’s no escaping to the external, to the objective, and no standing on the shaky ground of emotions. So the question becomes, How do we create within ourselves the heroic condition of confidence wherein risk is not danger but life?

Archives of “February 2019” month

rssBlast from the past circa 1922.

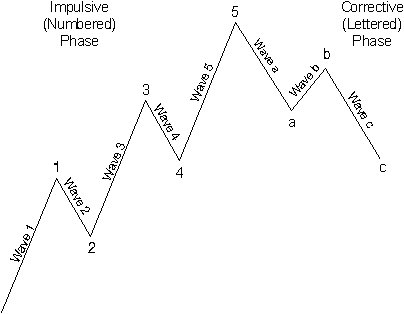

Elliott Wave Patterns

Larry Fink’s $12 Trillion Shadow

Though few Americans know his name, Larry Fink may be the most powerful man in the post-bailout economy. His giant BlackRock money-management firm controls or monitors more than $12 trillion worldwide—including the balance sheets of Fannie Mae and Freddie Mac, and the toxic A.I.G. and Bear Stearns assets taken over by the U.S. government last year. How did Fink rebound from a humiliating failure to become the financial fulcrum of Washington and Wall Street? Through a series of interviews, the author probes his role in the crisis, his unique risk-assessment system, and the growing concern he inspires.

Though few Americans know his name, Larry Fink may be the most powerful man in the post-bailout economy. His giant BlackRock money-management firm controls or monitors more than $12 trillion worldwide—including the balance sheets of Fannie Mae and Freddie Mac, and the toxic A.I.G. and Bear Stearns assets taken over by the U.S. government last year. How did Fink rebound from a humiliating failure to become the financial fulcrum of Washington and Wall Street? Through a series of interviews, the author probes his role in the crisis, his unique risk-assessment system, and the growing concern he inspires.

Worth Reading ,Just click here

7 Things You Must Do to Win at Trading.

| 1. Managing the risk of ruin. Do not risk so much on any one trade that 10 losing trades in a row will destroy your account. risking 1% to 2% of your trading capital per trade is a great baseline for eliminating the risk of ruin. 2. Only trade with a positive risk/reward ratio. Only take trades where your possible reward is at least two or three times the amount of capital you are risking in the trade. 3. Always trade in the direction of the prevailing trend. Always trade in the direction of the flow of capital for your specific time frame. Shorting rockets and catching falling knives is not profitable in the long run. 4. Trade a robust system. Back test and study your trading method, system, or style to ensure it is a winning system historically. The key is that it had bigger winners than losers over the long run in the past. 5. You must have the discipline to take your entries and exits as they are triggered. You must take your entries when they trigger, your losses when they are hit, and your profits when a run is over to be a successful trader. 6. You must persevere through losing periods. All successful traders were able to overcome their losing periods to come back and make the big money. If you quit you will not be around for the opportunity to win big. 7. If you want to be a winning trader you must follow your trading plan not your fear and greed. Emotions will undo a trader more than anything else. Trading too big is due to greed, missing a winning trade due to no entry is a sign of fear, traders must trade the math and probabilities not their own opinions or emotions. |

Warren Buffett's Advice To A Columbia University Investing Class

Investors are constantly looking nuggets of wisdom from the Oracle of Omaha, Warren Buffett, so this tidbit on Omaha.com caught our eye.

It’s just one quote from Buffett. He was at a 165 person Columbia University investing class, and one of the students asked him how to prepare for a career in investing.

From Omaha.com:

…Buffett thought for a few seconds and then reached for the stack of reports, trade publications and other papers he had brought with him. (more…)

Thought For A Day

Six Rules for Traders & Investors

Make all your mistakes early in life. He says the more tough lessons you learn early on, the fewer errors you make later. A common mistake of all young investors is to be too trusting with brokers, analysts, and newsletters who are trying to sell you bad stocks.

Make all your mistakes early in life. He says the more tough lessons you learn early on, the fewer errors you make later. A common mistake of all young investors is to be too trusting with brokers, analysts, and newsletters who are trying to sell you bad stocks.Always make your living doing something you enjoy. This way, you devote your full intensity to it which is required for success over the long-term.

Be intellectually competitive. This involves doing constant research on subjects that make you money. The trick, he says, in plowing through such data is to be able to sense a major change coming in a situation before anyone else.

Make good decisions even with incomplete information. In the real world, he argues, investors never have all the data they need before they put their money at risk. You will never have all the information you need. What matters is what you do with the information you have. Do your homework and focus on the facts that matter most in any investing situation.

Always trust your intuition. For him, intuition is more than just a hunch. He says intuition resembles a hidden supercomputer in the mind that you’re not even aware is there. It can help you do the right thing at the right time if you give it a chance. In fact, over time your own trading experience will help develop your intuition so that major pitfalls can be avoided.

Don’t make small investments. You only have so much time and energy so when you put your money in play. So, if you’re going to put money at risk, make sure the reward is high enough to justify it.

Observation, Experience, Memory and Mathematics

“Observation, experience, memory and mathematics – these are what the successful trader must depend on. He must not only observe but remember at all times what he has observed. He cannot bet on the unreasonable or the unexpected, however strong his personal convictions may be about man’s unreasonableness or however certain he may feel that the unexpected happens very frequently. He must bet always on probabilities – that is, try to anticipate them. Years of practice at the game, of constant study, of always remembering, enable the trader to act on the instant when the unexpected happens as well as when the expected comes to pass. “A man can have great mathematical ability and an unusual power of accurate observation and yet fail in speculation unless he also possesses the experience and the memory. And then, like the physician who keeps up with the advances of science, the wise trader never ceases to study general conditions, to keep track of developments everywhere that are likely to affect or influence the course of the various markets. After years of the game it becomes a habit to keep posted. He acts almost automatically. He acquires the invaluable professional attitude that enables him to beat the game – at times! This difference between the professional and the amateur or occasional trader cannot be overemphasized. I find, for instance, that memory and mathematics help me very much. Wall Street makes its money on a mathematical basis. I mean, it makes its money by dealing with facts and figures.” |

Make all your mistakes early in life. He says the more tough lessons you learn early on, the fewer errors you make later. A common mistake of all young investors is to be too trusting with brokers, analysts, and newsletters who are trying to sell you bad stocks.

Make all your mistakes early in life. He says the more tough lessons you learn early on, the fewer errors you make later. A common mistake of all young investors is to be too trusting with brokers, analysts, and newsletters who are trying to sell you bad stocks.