Archives of “February 2019” month

rssRichard Weissman explains the "psychic trader syndrome"

Wonderful

Lack of Discipline -Killing Your Trading Performance

Global Demographcis

Losers Average Losers

There are so many concepts about the stock market that are taught in the classrooms, promoted throughout the media, and passed along from generation to generation but, unfortunately, most of them are FLAT OUT WRONG!

I decided to write a 5-part series (this is part 2 of 5) on the common misconceptions that really need to stop being promoted. Keep in mind, these are all my humble opinions, but after 16 years of trading and studying market history, one really begins to notice what works and what doesn’t.

Common Misconception #2 – Dollar Cost Averaging

Paul Tudor Jones is one of the greatest traders in market history. Why? Because he’s consistently profitable. The best “anything” in the world are the best because they perform at a consistent, superior level for long periods of time. Michael Jordan isn’t considered the best basketball player ever because he scored 30 points ONCE in a game. It’s because he averaged 30 points per game over his ENTIRE career. (more…)

The Ten Things Profitable Traders Do Differently

The following 10 reasons may be why the 10% of long term profitable traders take the money from the 90% that are unprofitable. I see these differences in real life all the time. There is a big difference between profitable and unprofitable traders that usually comes down to homework, mental discipline, and risk management.

- Winning traders let winning trades get as big as possible before exiting. They have the really big winners to pay for all the losers.

- Winning traders have no patience for losing trades, they keep losses small. They know how not to give back their profits with big losing trades.

- They are focusing on trading actual price action not their own opinions or beliefs.

- They are experts on the trading vehicles that they trade.

- The trade with the trend in their time frame.

- Good traders know that their trailing stops are smarter than they are.

- Profitable traders know that it is their robust methodology that makes them profitable not any one trade.

- Winning traders are great risk managers. Their #1 concern is how much they can lose, their #2 concern is how much they can make.

- Profitable traders have put in the time, usually years and thousands of hours to learn what really makes money in the markets.

Profitably traders have studied historical price data, chart patterns, trends, and price action.

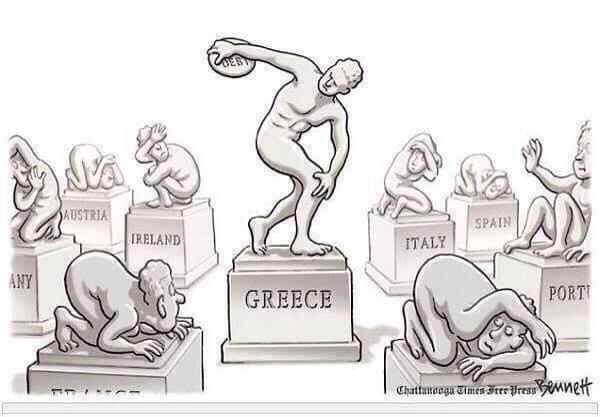

The 2016 Summer Games

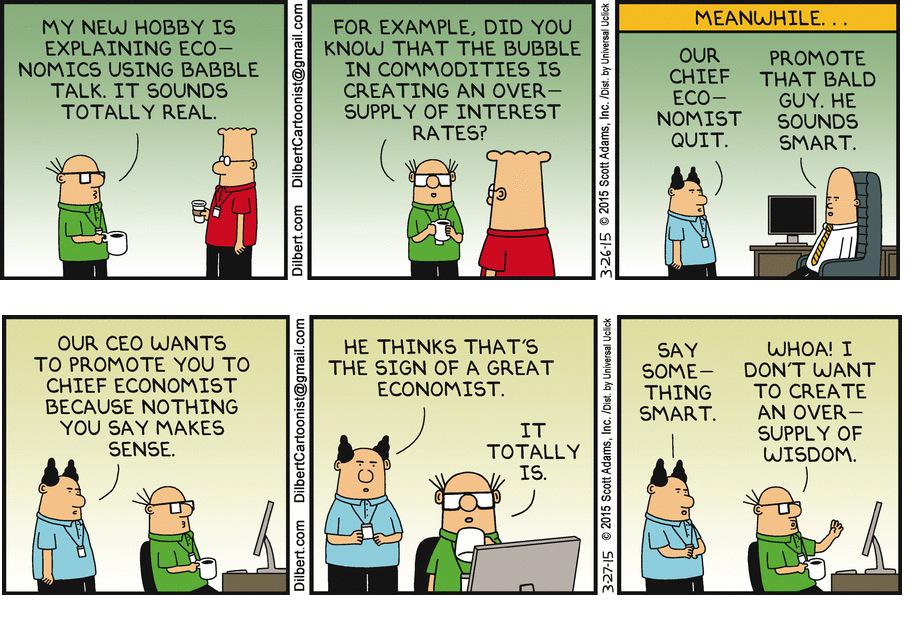

Economists Ha Ha Ha

Seven Sins of Trading

1. Trading an inappropriate position size.

1. Trading an inappropriate position size.

Simply put…if you risk too much, you’ll lose too much. In my eyes, this is the single most important rule of trading. Risking only 1-2% of an acct value is crucial to staying in the game.

2. Not knowing when to take the loss.

If you cannot answer the questions “Where am I taking the loss,” and “Where is my profit target” then stay out of the market. If you leave these decisions for later, then you will make them emotionally, which will be the worst decisions a trader can make.

3. Trading on someone else’s research or recommendation.

We have all heard stock tips thrown our way. Sometimes we might even hear people throw out potential trades that they are watching and become tempted to jump in. Sometimes I throw out stocks that I am trading and I am watching. The problem is that you might not know what this person is watching for, what strategy this stock fits, or what types of efforts are thrown into their research. If you take these stocks into consideration, make sure they are trades you would have likely come across on your own by conducting your own research. (more…)