- There is no single true path.

- The universal trait is discipline.

- Trade your personality.

- Failure and perseverance are part of every successful trader’s life.

- Great traders are flexible.

- It takes time to become a successful trader.

- Keep a record of your market observations.

- Develop a trading philosophy.

- What is your edge? Big picture tech, change, on the cusp, understand big trend before others, shifts.

- Confidence is important, and you build it from hard work.

- Hard work.

- Obsessiveness.

- Market wizards are innovators, not followers.

- To be a winner you have to be willing to take a loss!

- Risk control. Stop-loss, or reducing position size, limit initial position size, short selling.

- You can’t be afraid of risk

- Some limit downside by focusing on undervalued stocks. (but still can drop.)

- Value alone is not enough. Need catalysts.

- The importance of catalysts.

- Focus not only on when to get in, but when to get out

Archives of “February 2019” month

rssHow good is your WHY?

I’ve been taking a minor natural break in trading over recent weeks, and in the meantime I’ve been pondering the power of the “WHY” I have when entering trades. You need a good why, no matter what you are doing in life, but especially when you walk into one of the toughest and most volatile markets in the world and put your money on the line.

I’ve been taking a minor natural break in trading over recent weeks, and in the meantime I’ve been pondering the power of the “WHY” I have when entering trades. You need a good why, no matter what you are doing in life, but especially when you walk into one of the toughest and most volatile markets in the world and put your money on the line.

What’s your WHY?

I can see looking back that the vast majority of my trading had a feeble why behind them; no wonder I lost cash hand over fist. Really my reason for entering was that I just wanted to enter, thats all. The second problem most likely is that even when I THOUGHT I had a good reason, the idea behind it was faulty.

So you can have no reason to enter, or you can have a wrong reason to enter.

Also I notice on the forums that the VAST MAJORITY of newbie / semi newbie traders there are trying to formulate their own personal why. Their own UNIQUE system, inventing unique indicators.

They think that the idea of the game is to outsmart everyone else in the market; to be unique. The obsession with system creation or inventing new indicators has being unique and outsmarting everyone else behind it as a hidden motivation. The thing with markets though is that its not about you, its about consensus. If you invent your own amazing oscillator and you are the only person in the world looking at it, then how good a reason is this to enter the market? How much consensus do you have behind you? Who supports your decision? Who agrees with you?

Probably nobody, except a handful by pure chance. (more…)

Federal prosecutors leading criminal investigation into Goldman Sachs

Some breaking news on the WSJ. Federal prosecutors are conducting a criminal investigation into whether GS or employees committed securities fraud. This is more serious than the fairly toothless senate committee.

Updated at 6:08/30th April/Baroda

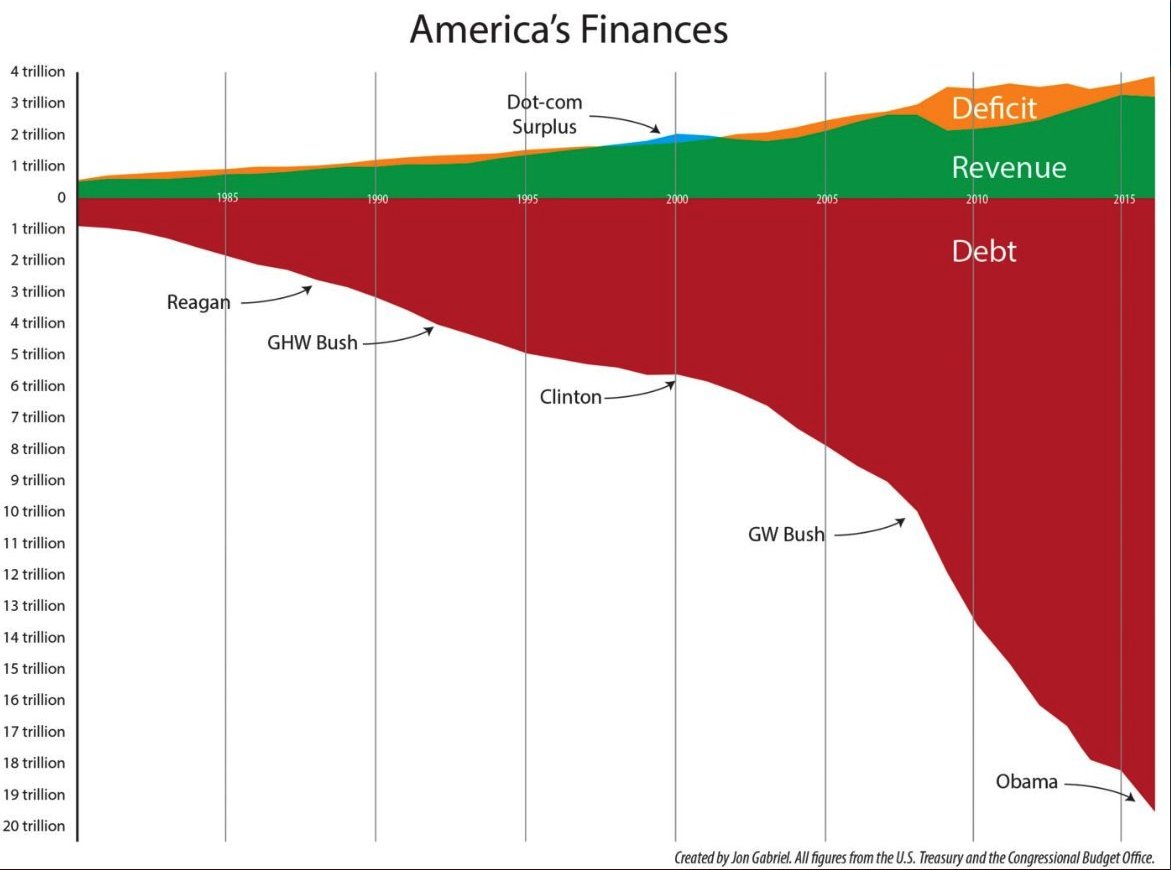

Want to know why the USA will eventually be stripped as the reserve currency of the world?

A brilliant illustration of how much public space we've surrendered to cars

My favorite things in life don't cost any money. The most precious resource we all have is time. —Steve Jobs

Risk Management -Quotes

Thought For A Day

Market Gravitates or We Spot those LEVELS…. Mystery !!

Here in this very space we have written Y’day and updated today intra-day too: @ 9106 wrote to Sell CNX Bank INDEX on any Rise. It would tumble to 8719 level very shortly. Bang on… just in 48 hrs it collapsed to exactly our level, precisely 8715, a whooping fall of 400 points.

In the same breathe you were forewarned that for NF not crossing 5165-68 would weaken it to 4994 – 4970 levels. Exactly from 5168 of y’day it has nosedived uptill 5017.

These are indices: Non-manipulatable, Non-influential. How did it happen, who did it, can there be any attributes at all !!!! Its our ever dependable charts, Analytical skills and wisdom of Insight. Collectively Technical Analysis. Just Pure Intelligence.

Yesterday I written about Bank stocks…Just click here

Read Yesterday’s Guesstimates

Many Traders had asked about MTNL…..and they say I don’t about failure calls.First of all about MTNL….Technically was /still looking hot …But I had written many times never act blindly in market and always consider price as Father of stock/Commodity.

-Now click here and see…the reason ..Why MTNL had crashed in yesterday’s trade.

Now about Failure calls.If I recommend any stock or do analysis then I always write Support/Resistance levels. (more…)

Happening in India :Trickle Down Economics