A BEAUTIFUL STORY

*A little boy went to a telephone booth which was at the cash counter of a store and dialed a number.

The store-owner observed and listened to the conversation:

… …

Boy : “Lady, Can you give me the job of cutting your lawn?

Woman : (at the other end of the phone line) “I already have someone to cut my lawn.” (more…)

Archives of “February 15, 2019” day

rss"Unlearning" A Lifetime Of Lessons

When it comes to market timing, you’ve got to UNLEARN responses that you’ve spent your whole life learning. Market timing isn’t about you. It is just a strategy that works over time. In other fields, probability plays little if any role. You put in effort, make sure you meet the expectations of the people who pay you, and you’re a success. In the traditional workplace, it makes sense to put a little ego and pride into your work. Your effort and talent often have a direct payoff. But with market timing, the odds can go against you, no matter how much work you put in. The perfect trade can go wrong. That’s hard to accept for most people because it means that being a successful (profitable) market timer or trader, to some extent, is just a matter of the odds randomly working in your favor. But there is good logic behind this randomness. And a successful timing or trading strategy uses this logic to profit. A successful timing strategy will exit losses quickly. It will not stay with a bullish or bearish position to sooth the ego of the strategy’s designer. It will also stay with a successful trade and not exit quickly to lock in a profit. That may feel good for a day, but if the profitable trend lasts two, three, five times longer, you have lost out on a huge profit. Recognizing that odds are part of trading takes some of the glory out of it. But on the other hand, understanding odds helps you cope with inevitable drawdowns.

When it comes to market timing, you’ve got to UNLEARN responses that you’ve spent your whole life learning. Market timing isn’t about you. It is just a strategy that works over time. In other fields, probability plays little if any role. You put in effort, make sure you meet the expectations of the people who pay you, and you’re a success. In the traditional workplace, it makes sense to put a little ego and pride into your work. Your effort and talent often have a direct payoff. But with market timing, the odds can go against you, no matter how much work you put in. The perfect trade can go wrong. That’s hard to accept for most people because it means that being a successful (profitable) market timer or trader, to some extent, is just a matter of the odds randomly working in your favor. But there is good logic behind this randomness. And a successful timing or trading strategy uses this logic to profit. A successful timing strategy will exit losses quickly. It will not stay with a bullish or bearish position to sooth the ego of the strategy’s designer. It will also stay with a successful trade and not exit quickly to lock in a profit. That may feel good for a day, but if the profitable trend lasts two, three, five times longer, you have lost out on a huge profit. Recognizing that odds are part of trading takes some of the glory out of it. But on the other hand, understanding odds helps you cope with inevitable drawdowns.

life is speeding up :Don't miss it

And this is year old.

If possible …Just have your comment.

Trust is a combination of character and competence

Marcus Aurelius.

RISK MANAGEMENT

1.Never enter a trade before you know where you will exit if proven wrong.

2. First find the right stop loss level that will show you that you’re wrong about a trade then set your positions size based on that price level.

3. Focus like a laser on how much capital can be lost on any trade first before you enter not on how much profit you could make.

4. Structure your trades through position sizing and stop losses so you never lose more than 1% of your trading capital on one losing trade.

5. Never expose your trading account to more than 5% total risk at any one time.

6. Understand the nature of volatility and adjust your position size for the increased risk with volatility spikes.

7. Never, ever, ever, add to a losing trade. Eventually that will destroy your trading account when you eventually fight the wrong trend.

8. All your trades should end in one of four ways: a small win, a big win, a small loss, or break even, but never a big loss. If you can get rid of big losses you have a great chance of eventually trading success.

9. Be incredibly stubborn in your risk management rules don’t give up an inch. Defense wins championships in sports and profits in trading.

10. Most of the time trailing stops are more profitable than profit targets. We need the big wins to pay for the losing trades. Trends tend to go farther than anyone anticipates.

Wanting change isn't enough. We must be the change we want to see in our world.

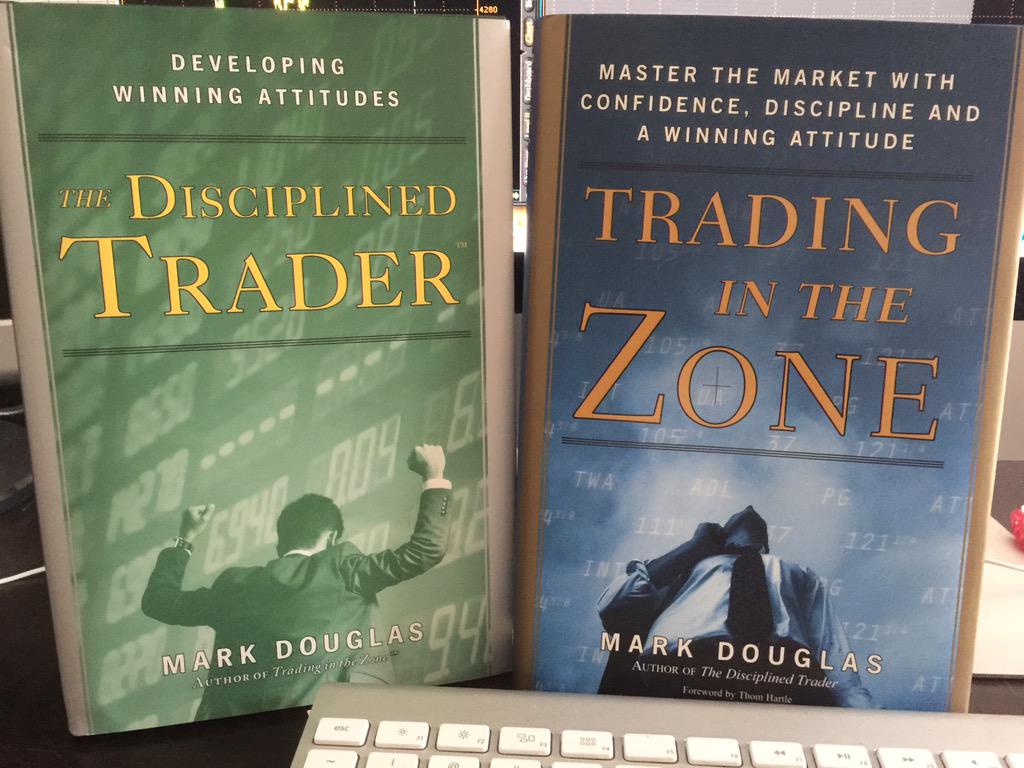

2 Books all traders should have in their library

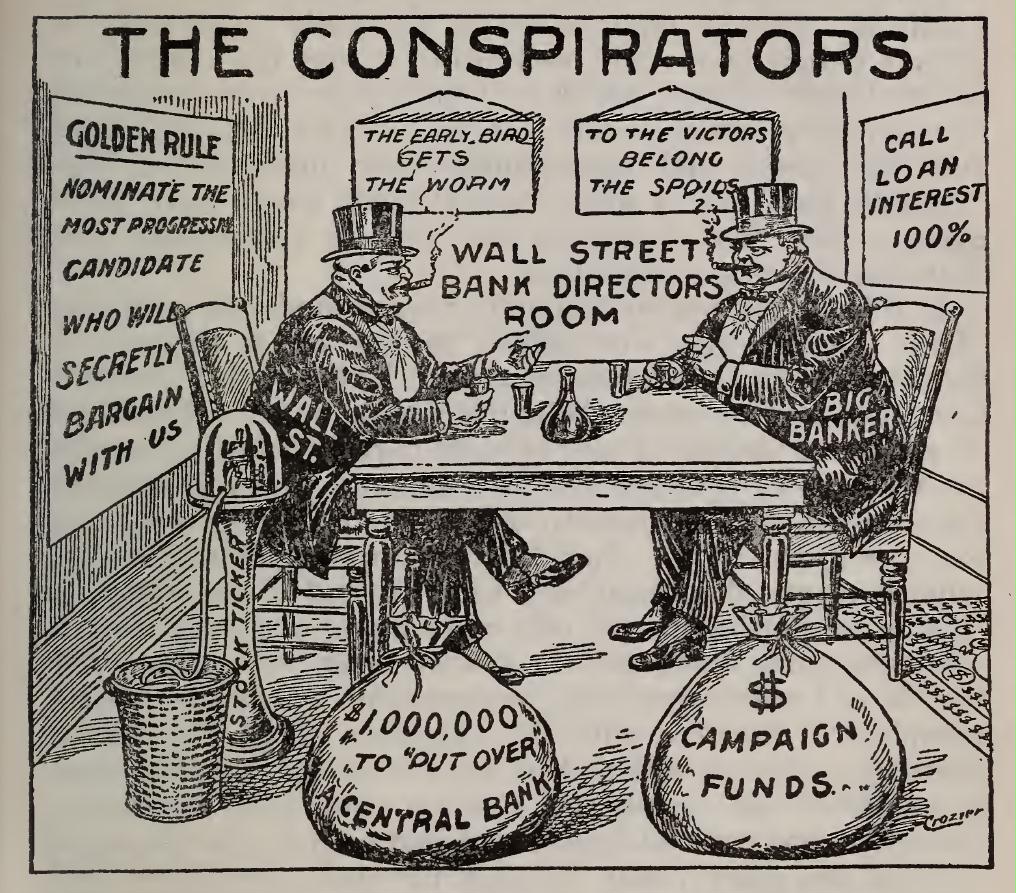

Valid in 1912 & Still in 2017 too

Why Traders Fail ?Read These 20 points

1. Lack of motivation. A talent is irrelevant if a person is not motivated to use it. Motivation may be external (for example, social approval) or internal (satisfaction from a job well-done, for instance). External sources tend to be transient, while internal sources tend to produce more consistent performance.

2. Lack of impulse control. Habitual impulsiveness gets in the way of optimal performance. Some people do not bring their full intellectual resources to bear on a problem but go with the first solution that pops into their heads.

3. Lack of perseverance and perseveration. Some people give up too easily, while others are unable to stop even when the quest will clearly be fruitless.

4. Using the wrong abilities. People may not be using the right abilities for the tasks in which they are engaged.

5. Inability to translate thought into action. Some people seem buried in thought. They have good ideas but rarely seem able to do anything about them.

6. Lack of product orientation. Some people seem more concerned about the process than the result of activity.

7. Inability to complete tasks. For some people nothing ever draws to a close. Perhaps it’s fear of what they would do next or fear of becoming hopelessly enmeshed in detail.

8. Failure to initiate. Still others are unwilling or unable to initiate a project. It may be indecision or fear of commitment. (more…)